New Mars Forums

You are not logged in.

- Topics: Active | Unanswered

Announcement

#1 Re: Meta New Mars » Daily Recap - Recapitulation of Posts in NewMars by Day » Yesterday 17:44:21

Trying to do without prefilling of numbers being generated making use of excel and auto fill to do my best

starting post is carried from the previous days 3-10-2026 last number for the day 238473 - last post 238482

3-11-26 postings

Martian Calender - I have created a martian calender...

Martian Calender - I have created a martian calender...

Jevons Paradox and Social Amplifiers and Reach

Jevons Paradox and Social Amplifiers and Reach

Adam the Martian. The architect of Mars comic book

Peter Zeihan again: and also other thinkers:

Forty 40 Ton Mars Delivery Mechanism

Daily Recap - Recapitulation of Posts in NewMars by Day

Daily Recap - Recapitulation of Posts in NewMars by Day

#2 Re: Exploration to Settlement Creation » Wiki Toehold Mission » Yesterday 16:14:55

Much like the Cygnus landers have a compatible system for the equipment Conex box delivery to orbit and landing with commonality is a must.

CONEX-like boxes into the 12 m Mars EDL bus and give you first-pass numbers for both box size and Retro propulsion.

1. Payload shroud / box size inside the 12 m bus

Bus inner diameter: N12 m

Usable payload length inside bus: —18—20 m (rest taken by structure, tanks, etc.) Per-unit mass cap: 30 t (machine + box)

Take the worst-case machine (Cat 320 or 950 GC—both N3.0 m wide, N 3.4 m tall, 'v8—1 0 m long).

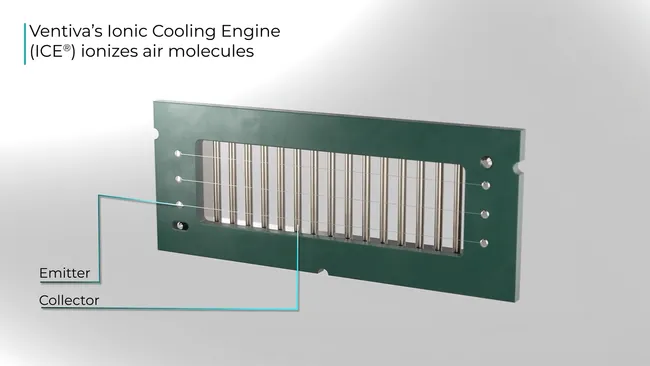

A clean, fairing-compatible box for those looks like:

Outer width: N4.0 m c 3.0 m machine + 0.5 m clearance each side + structure

Outer height: N4.0 m

3.4 m machine + clearance + roof/floor structure

Outer length: ru 10—1 1 m

0 9—10 m machine + clearance + ramp space

That fits easily inside a 12 m diameter bus—two such boxes can sit in line (nose-to-tail) in a æ20+ m usable length, or one per flight if you want more margin.

"Mars CONEX"•.

Max design envelope: N4 m (W) x 4 m (H) x 11 m (L)

Mass budget: machine mass + box mass 30 t

You then tailor each box to its specific machine, but you know they all fit inside the 12 m bus.

2. Retro propulsion sizing for a 30 t integrated Lander

Now treat "box + machine +no legs + engines + tanks" as a 30 t Lander coming off its HIAD, needing a terminal powered descent.

2.1. Thrust requirement

Lander mass: 30,000 kg

Mars gravity: gMars 3.71 m/s2 Hover thrust:

hover ¯ mgMars 30,000 • 3.71 111 kN

With a 1.5x margin for control and descent:

165-170

total

Example engine cluster:

4 engines x —45 kN each, or

3 engines x ru60 kN each, throttleable.

2.2. Propellant mass (terminal Av) Assume:

• Terminal Av (kill residual velocity + hover + margin): 600-700 m/s

• ISP (storable or LOX/LCH4 engines): rv330 s

Rocket equation:

For Av 700 m/s, 1sp 330 s, Av — Ispgoln

9.81 m/s 2..

700

z e330-9.81 0.216 1.24

So:

Propellant fraction: 1 — 1/1.24 0.19 For a 30 t Lander at start of burn:

Propellant: 'v5.5—6 t o Dry (structure + engines + tanks + legs + payload): •-•24 t

You can then allocate, inside that 24 t:

Payload (machine + box structure): 0—15 t

Engines + tanks + legs + avionics + shielding: N9—14 t

You can tune that split depending on how aggressive you want to be, but the key numbers are:

Thrust: 70 kN total

Propellant: N6 t per 30 t lander for a robust terminal descent

3. What this gives you, concretely Per flight, with your 12 m EDL bus:

• You can carry one or two 30 t integrated Landers, each containing:

0 One CONEX-1ike box m) o One battery-electric machine (320, 950, 906, or 301 .9) o Its own retroprop system + legs

The bus TPS only needs minor PICA-X thickness tweaks depending on whether you fly:

C One full 30 t Lander, or

Two full 30 t Landers, or

Mixed-mass configurations.

one specific machine (say the 950 GC), and do a more detailed split: how much of that 24 t dry mass becomes "real machine + box" vs. "landing hardware," and what that implies for actual cargo you get on the surface.

CONEX box can take a hard landing and doesn't need legs, a few things change in your favor.

1. Mass budget shift

From the earlier æ30 t lander stack: Remove landing legs:

a Saves roughly 1—2 t of leg structuro and mechanisms. Add some impact structure to the box:

o Maybe 0.5—1 t of extra framing, crushable structure, or skid surfaces.

Net: you probably free up —1 t of mass for either more payload or less total mass.

2. Retroprop Av and propellant

If the box can land "hard," you don't need to bleed velocity down to a gentle, leg-limited touchdown—just to what the box can structurally tolerate.

Say you reduce terminal Av from N700 m/s to —400 m/s (higher allowed impact speed, less hover):

• Isp: s

• Av: 400 m/s Mass ratio:

400 z e330-9.81 0.124 1.13

Propellant fraction z 11%.

For a 30 t Lander at start of burn:

Propellant: N3—3.5 t

Dry (box + machine + engines + tanks + structure): N 26-27 t

So compared to the softer-landing case (N6 t prop), you've cut landing prop roughly in half.

3. Thrust requirement

Thrust doesn't change much:

Mass: 30,000 kg

Mars g: 3.71 m/s2 Hover thrust:

hover 30,000 • 3.71 111 kN

With margin for control and deceleration, you stilt want on the order of 150—170 kN total thrust (e.g., 3x60 kN or 4x45 kN engines), but you'll burn for less time and with less propellant.

So: letting the CONEX box slam down within structural limits buys you:

No leg mass on the box.

Lower required terminal Av.

3 3.5 t of landing prop instead of N6 t for a 30t unit—while keeping the same basic engine cluster and EDL architecture.

#3 Re: Exploration to Settlement Creation » Wiki Toehold Mission » Yesterday 16:07:44

Here is the list and shape that we are forced to use.

Caterpillar Electric Prototypes

Cat 301.9 Electric

(Dimensions match diesel 301.9 platform; electric variant uses same chassis)

Length: 3,840 mm / 151 in

Width: 990 mm / 39 in

Height: 2,300 mm / 91 in

Operating Weight: 2,000 kg / 4,400 lb

Cat 320 Electric

(Electric prototype uses 320 chassis dimensions)

Length: 9,400 mm / 370 in

Width: 2,990 mm / 118 in

Height: 3,160 mm / 124 in

Operating Weight: 22,000 kg / 48,500 lb

Cat 950 GC Electric (Prototype)

(Electric prototype uses 950 GC chassis dimensions)

Length: 6,180 mm / 243 in

Width: 2,410 mm / 95 in

Height: 3,330 mm / 131 in

Operating Weight: 18,800 kg / 41,450 lb

Cat 906 Electric

(Electric prototype uses 906 chassis dimensions)

Length: 5,040 mm / 198 in

Width: 1,870 mm / 74 in

Height: 2,680 mm / 105 in

Operating Weight: 5,730 kg / 12,630 lb

Bobcat Electric Machines

Bobcat T7X (Electric Track Loader)

Length: 3,600 mm / 142 in

Width: 1,800 mm / 71 in

Height: 2,080 mm / 82 in

Operating Weight: 5,710 kg / 12,590 lb

Bobcat S7X (Electric Skid Steer)

(Dimensions match S770 frame)

Length: 3,500 mm / 138 in

Width: 1,800 mm / 71 in

Height: 2,080 mm / 82 in

Operating Weight: 3,900 kg / 8,600 lb

Bobcat E10e (Electric Micro Excavator)

Length: 2,820 mm / 111 in

Width: 710–1,100 mm / 28–43 in

Height: 2,210 mm / 87 in

Operating Weight: 1,200 kg / 2,650 lb

Bobcat E19e (Electric Mini Excavator)

Length: 3,830 mm / 151 in

Width: 980 mm / 39 in

Height: 2,300 mm / 91 in

Operating Weight: 1,916 kg / 4,225 lb

Volvo Electric Machines

Volvo ECR18 Electric

Length: 3,430 mm / 135 in

Width: 995–1,352 mm / 39–53 in

Height: 2,298 mm / 91 in

Operating Weight: 1,790–1,870 kg / 3,950–4,120 lb

Volvo EC18 Electric

Length: 3,550 mm / 140 in

Width: 995–1,352 mm / 39–53 in

Height: 2,300 mm / 91 in

Operating Weight: 1,960 kg / 4,321 lb

Volvo L20 Electric (Compact Wheel Loader)

Length: 5,265 mm / 207 in

Width: 1,740 mm / 69 in

Height: 2,580 mm / 102 in

Operating Weight: 4,500 kg / 9,920 lb

Volvo L25 Electric (Compact Wheel Loader)

Length: 5,265 mm / 207 in

Width: 1,740 mm / 69 in

Height: 2,580 mm / 102 in

Operating Weight: 5,000 kg / 11,000 lb

Volvo EC230 Electric (Medium Excavator)

Length: 9,700 mm / 382 in

Width: 2,990–3,090 mm / 118–122 in

Height: 3,100 mm / 122 in

Operating Weight: 23,000–26,100 kg / 50,600–57,500 lb

#4 Re: Exploration to Settlement Creation » Wiki Toehold Mission » Yesterday 16:06:11

Not all will be sent to Mars but will most likely be used once we have better ability on mars and for shipping.

These are details for Battery telerobotic capable machines.

1. Mission concept in one sentence

Each battery-electric machine gets its own dedicated, self-deploying "CON EX-like" box, and each box + machine stays under —30 t so it can be shipped and landed on Mars as a single unit, then auto-opens and lets the machine drive out intact—first teleoperated from Earth, later from a Mars base.

2. The four machines and their mass scale

Using typical operating weights for the diesel base models (the electric prototypes are on the same chassis):

Cat 320-class excavator o Operating weight: roughly in the 21—22 t range (varies by configuration).

Cat 950 GC wheel Loader c Operating weight: about 18.8 t (z41 ,500 1b).

Cat 906 compact wheel loader o Typical operating weight: about 5.5—6 t (model-family range, depends on options).

Cat 301.9 mini excavator o Typical operating weight: about 2 t.

For Mars landing, what matters is mass, so these'tonnages carry straight over.

3. Mass budget per unit (box + machine s 30 t)

Because you've set a 30 t cap per shipping system, each machine gets its own mass budget:

320 unit c Machine: •22 t o Box + mechanisms + margin: up to t

O Total: < 30 t feasible

950 GC unit

O Machine: N*19t o Box + mechanisms + margin: up to t o Total: < 30 very comfortable

906 unit c Machine: N6 t c Box: you'll hit volume and geometry long before mass is a problem

301.9 unit c Machine: t o Box: mass is essentially a non-issue; design is driven by deployment and protection

In practice, a Mars-optimized structural box for each machine can likely be kept in the 3—5 t range, so you have healthy margin on all four.

4. Geometry: why you can't use a standard CONEX

Standard 40 ft high-cube internal envelope is roughly:

• Length: NI 2.0 m Width: N2.35 m

• Height: 70 m

Your largest machines are approximately:

• Cat 320:

C, Length (transport): m o Width: —2.8—3.0 m Height: N3.0 m

• Cat 950 GC•.

• Length (bucket on ground): N7.9 m 0 Width: N2.8-3.O m o Height: m So, intact:

• Both are too wide for 2.35 m internal width.

• Both are too tall for 2.70 m internal height.

That's why you said you'll "modify the connex box to fit"—you're really talking about a custom enclosure, not an ISO container.

5. What each "Mars CONEX" actually becomes

For each machine, you design a custom, single-machine shipping system with:

Internal clearances sized around that machine's envelope o For the 950 GC, for example:

Internal width z 3.2 m (3.0 m' machine + clearance)

Internal height z 3.6 m (3.4 m machine + clearance)

Internal length 10 m

Structural frame

Carries launch and landing loads o Uses lightweight materials (aluminum/composites) to keep box mass in the

3-5 t band

Auto-opening shell o Side-hinged or clamshell walls/roof that unlock and swing/fold away after landing c Integrated ramps or floor extensions so the machine can drive straight out in

Mars gravity

Integrated power and comms o Keeps batteries within safe temperature and state of charge during cruise

Provides data links for health checks and wake-up before first teleop drive

Autonomous deployment sequence

1. Lander touches down with the box as a single payload

2. Box stabilizes and verifies attitude

3. Latches release; walls/roof/ramp deploy

4. Machine powers up, runs self-checks

5. Machine drives out under remote control

Each of the four machines gets its own version of this box, tuned to its geometry but following the same overall pattern.

6. Big picture, stated cleanly

• You are not trying to cram all four machines into one 30 t container.

• You are designing four independent, self-deploying shipping systems, each one:

Holds one intact machine

Stays under -•30 t total (machine + box)

Flies and lands as a single unit

Auto-opens on Mars so the machine can roll out and start work.

#5 Re: Exploration to Settlement Creation » Wiki Toehold Mission » Yesterday 15:25:57

ERV Bus for crew return from orbit

Hypergolic bipropellant ERV architecture

Mission architecture overview

You are designing a system where a modified Starship upper stage pushes about 200 metric tons of payload from Earth orbit onto a Mars transfer. Among that payload is a hypergolic-fueled Earth Return Vehicle, or ERV, which functions as a dedicated orbital tug. The ERV never lands on Mars and lives permanently in Mars orbit. Its primary role is to perform Mars Orbit Insertion for the outbound cargo bus. The Mars payload bus is about 90 metric tons and stays in Mars orbit after delivery. The ERV design is modular so that multiple ERVs can dock together to increase total delta-v capability. Consumables or additional supplies may be stored on the ERVs as needed, but no return-to-Earth phase is included.

Propellant type: hypergolic bipropellant

The entire architecture uses the same hypergolic bipropellant family used by Mars landers:

Fuel: MMH or UDMH

Oxidizer: NTO or MON

Vacuum Isp: about 320 seconds

Hypergols provide zero boiloff, long-term storability, simple ignition, commonality with landers and RCS, and high reliability for multi-restart burns.

Delta-v requirements

Mars Orbit Insertion: about 1.2 km per second

Standardized ERV tug module (hypergolic)

Define one standard ERV tug module that works for cargo delivery and orbital maneuvering.

ERV wet mass in Mars orbit: 90 metric tons

Dry hardware: 40 tons

Stored consumables or supplies: 10 tons

Hypergolic propellant: 40 tons

Total wet mass: 90 tons

Effective dry mass for delta-v calculations: 50 tons

MOI performance with hypergolic propellant

Case: one ERV pushing one 90 ton cargo bus

Initial mass before MOI:

m0 = 90 (cargo bus) + 90 (ERV) = 180 tons

Final mass after MOI:

mf = 90 (cargo bus) + 50 (ERV dry plus stored supplies) = 140 tons

Mass ratio:

R = 180 / 140 = 1.285

Delta-v:

dv = 320 * 9.81 * ln(1.285) = about 1.1 km per second

Result:

A single 90 ton hypergolic ERV provides about 1.1 km per second pushing a 90 ton cargo bus into Mars orbit.

Multi-ERV clustering (hypergolic)

Two ERVs pushing one 90 ton cargo bus:

Initial mass:

m0 = 90 + 2 * 90 = 270 tons

Final mass:

mf = 90 + 2 * 50 = 190 tons

Mass ratio:

R = 270 / 190 = 1.42

Delta-v:

dv = about 1.6 km per second

Three ERVs pushing one 90 ton cargo bus:

Initial mass:

m0 = 90 + 3 * 90 = 360 tons

Final mass:

mf = 90 + 3 * 50 = 240 tons

Mass ratio:

R = 360 / 240 = 1.5

Delta-v:

dv = a bit over 2.0 km per second

Result:

Clustering ERVs increases total available delta-v and provides redundancy.

Engine selection (hypergolic)

Propellant: MMH or UDMH with NTO

Isp: about 320 seconds

Thrust per engine: 40 to 100 kN

Multiple restarts

Long-duration burns

Engine families to emulate include AJ10-class, OMS-class, Aestus-class, or scaled vacuum-optimized SuperDraco-class engines.

Recommended cluster: 3 to 4 engines, total thrust 150 to 300 kN, burn durations 10 to 20 minutes.

Operational concept

Outbound phase:

A modified Starship pushes a Mars cargo bus and one or more ERVs. The ERVs perform Mars Orbit Insertion with the cargo bus attached. Cargo is delivered to Mars orbit or the surface. ERVs remain in Mars orbit, fueled or partially fueled depending on mission wave. ERVs may be docked together to support larger or more demanding orbital maneuvers.

Consumables or supplies:

Stored supplies are pre-positioned on the ERVs and counted as part of the dry mass. They support future operations in Mars orbit.

Clean summary

ERV tug module (hypergolic):

Wet mass: 90 tons

Dry hardware: 40 tons

Stored supplies: 10 tons

Hypergolic propellant: 40 tons

Effective dry mass: 50 tons

Engines: 3 to 4 large hypergolic vacuum engines

Isp: 320 seconds

Performance with a 90 ton cargo bus:

One ERV: about 1.1 km per second

Two ERVs: about 1.6 km per second

Three ERVs: over 2.0 km per second

Roles:

Mars Orbit Insertion for cargo buses

Storage of pre-positioned supplies

Modular, scalable, redundant tug fleet

Permanent Mars-orbit infrastructure

#6 Re: Life support systems » Potato » Yesterday 14:35:57

here is some more from AI question

The primary toxins found in the green parts of the potato plant (Solanum tuberosum) are solanine and alpha-chaconine, which are glycoalkaloid poisons. These compounds are concentrated in the leaves, stems, sprouts, and green skin of the potato tuber, acting as a natural pesticide to resist insects and animals

Key Details About Potato Plant Toxins:

Toxins: The main toxins are alpha-solanine and alpha-chaconine, which are found in much higher concentrations in leaves and stems than in the tubers.

Green Coloration: When potatoes are exposed to light, they produce chlorophyll (the green color) and increase production of solanine.

Health Hazards: Consuming high levels of these toxins can cause vomiting, diarrhea, abdominal pain, headache, and in severe cases, death.

Symptoms: Signs of poisoning include gastrointestinal distress and a bitter taste, which serves as a warning sign.

Safety Tips: Peel green skin, remove eyes and sprouts, and avoid eating any part of the potato plant other than the edible, non-green tuber. Cooking does not destroy the toxins.

That explains why we peel them..

Nice find

#7 Re: Martian Politics and Economy » Where Mars Field of Dreams meets Capitalism » Yesterday 14:17:45

So what's stopping man from being on mars has to do with more than cash.

Why we are not going to Mars

1. LOX/CH4 "can't deliver the mass" problem not because LOX/CH4 is incapable—it's because: is physically viable, but operationally expensive Cryogenic storage over long durations is hard (boiloff, insulation, active cooling). ISRU plants to make enough LOX/CH4 are heavy and power-hungry. A LOX/CH4 system big enough to land a heavy payload and then send it back is huge. When you size it honestly (EDL + ISRU + ascent), the mass and power spiral is brutal.

2. "Why hypergolic 'SRI-J is chemically possible, but infrastructure-heavy not just partially import hypergolics?"

• Import one component (e.g., MMH/UDMH)

• Try to make only the oxidizer (NTO) or vice versa

• Making NTO on Mars still needs a serious chemical plant (nitric acid, high-purity nitrogen, oxidation, distillation).

• Making hydrazine or methylated hydrazines is even worse—dangerous, complex, and infrastructure-heavy.

• If you import both NTO and MMH, you're back to: c Huge landed mass c Bigger EDL system c Bigger launch vehicle from Earth

3. So what's the real issue with LOX/CO new engine development + lower performance. LOX/CO looks attractive on paper because: Both 02 and CO can be made directly from C02 (no hydrogen needed). That simplifies ISRU: just C02 + power + high-temp electrolysis.

A. No heritage means years and a lot of money.

There are no flight-proven LOX/CO engines.

Full engine development program

Ground test campaigns o Reliability and ignition testing tn Mars-like conditions o Then qualify it for a critical ascent mission

B. Lower performance

CO has lower specific energy than CH4.

LOX/CO tsp is typically -280-300 s, vs -360 s tor LOX/CHa.

That means more propellant mass for the same Av heavier MAV * harder ED L.

C. Combustion and cooling challenges CO/02 combustion has:

Different flame temperature and kinetics than CH4/02

Potential combustion stability issues that need real testing.

Cooling and materials choices that aren't off-the-shelf.

D. Still cryogenic (or high-pressure) o CO boils at æ81 K, 02 at 90 K—both are still cryogenic.

Store them as cryogenic Liquids (boiloff, insulation, power) c As high-pressure gases (heavy tanks, lower density, more volume).

LOX/CO doesn't magically escape the storage problem—it just trades hydrogen logistics for

4. The core of what you're seeing

LOX/CH4: ISRU-friendly, high performance, but cryogenic and infrastructure-heavy.

Hypergolics: Great performance, storable, but must be mostly or fully imported.

LOX/CO: ISRU-simple, but no engines, lower performance, still cryogenic/HP.

#8 Re: Meta New Mars » Housekeeping » Yesterday 14:07:34

still fighting the issues of the contractor not doing the work and taking deposits. The AG did not get a response from the contractor so they are kicking the can back to the superior court level to civil suit which all but the highest is that just at different money tiers.

#9 Re: Meta New Mars » Daily Recap - Recapitulation of Posts in NewMars by Day » 2026-03-11 18:27:06

Trying to do without prefilling of numbers being generated making use of excel and auto fill to do my best

starting post is carried from the previous days 3-09-2026 last number for the day 238451 - last post 238473

3-10-26 postings

WIKI Constructing things on Mars equipment needs

Forty 40 Ton Mars Delivery Mechanism

Forty 40 Ton Mars Delivery Mechanism

Forty 40 Ton Mars Delivery Mechanism

Forty 40 Ton Mars Delivery Mechanism

Forty 40 Ton Mars Delivery Mechanism

Wiki Toehold Mission

Wiki Toehold Mission

Wiki Toehold Mission

Wiki Toehold Mission

Wiki Toehold Mission

Why Artemis is “better” than Apollo.

Why Artemis is “better” than Apollo.

Jevons Paradox and Social Amplifiers and Reach

Jevons Paradox and Social Amplifiers and Reach

Jevons Paradox and Social Amplifiers and Reach

Martian Calender - I have created a martian calender...

Martian Calender - I have created a martian calender...

GW Johnson Postings and @Exrocketman1 YouTube videos

#10 Re: Meta New Mars » Daily Recap - Recapitulation of Posts in NewMars by Day » 2026-03-11 18:26:50

Trying to do without prefilling of numbers being generated making use of excel and auto fill to do my best

starting post is carried from the previous days 3-08-2026 last number for the day 238443 - last post 238450

3-9-26 posting

Martian Calender - I have created a martian calender...

Martian Calender - I have created a martian calender...

Martian Calender - I have created a martian calender...

Jevons Paradox and Social Amplifiers and Reach

Jevons Paradox and Social Amplifiers and Reach

Why Artemis is “better” than Apollo.

Why Artemis is “better” than Apollo.

Why Artemis is “better” than Apollo.

#11 Re: Exploration to Settlement Creation » Wiki Toehold Mission » 2026-03-10 18:18:56

How to deliver Mars cargo to the surface that's been delivered to orbit in the Cargo Bus

Mars EDL Architecture: HIAD-Only, Retroprop-Scaled, Two-Lander System

This is the cleaned, consolidated version of the system you are designing:

• No parachutes

• HIAD-only aero deceleration

• Retroprop engines sized to payload mass

• Two independent landers inside a 12 m x 30 m aerobrake bus

• PICA-X thickness adjusted per mission mass

• Payload mass directly drives heating, TPS thickness, and propellant needs

1. Aerobrake Bus (12 m × 30 m)

Geometry

• Diameter: 12 m

• Length: 30 m

• Entry attitude: broadside / belly-first

• TPS: PICA-X monolithic belly, thickness adjusted per mission

• Control: 4 large flaps + RCS

• Role: remove the majority of entry energy, deliver landers to a slower regime

Mass

• Structure + flaps: 20–24 t

• PICA-X belly (single-use): 5.5–6 t

• Avionics + RCS: ~1 t

• Total bus mass: 26–30 t

Function

The bus replaces the traditional backshell + parachute system.

It provides:

• Very low ballistic coefficient

• Controlled lift vectoring

• Gentle heating environment for the landers

• A common entry vehicle for multiple mission profiles

2. Two Independent Landers Inside the Bus

Each lander is a complete system:

• 12 m HIAD (no parachute)

• Retroprop engines sized to lander mass

• Telescoping landing legs

• Exhaust shielding

• Integrated structure (no sky crane)

• Cygnus-class payload module inside

Typical Lander Mass Target: 30 t

Breakdown:

• Cygnus-like payload module (full): ~7 t

• Engines: 1–1.5 t

• Tanks + feed system: 2–3 t

• Landing propellant: 10–12 t

• Structure + legs: 5–6 t

• Avionics + shielding: ~1 t

Total per lander: 30 t

Two landers = 60 t inside the bus.

3. HIAD Only Deceleration (No Parachutes)

Each lander uses a 12 m HIAD:

• Area: ~113 m²

• CD ~1.5

• Ballistic coefficient for a 30 t lander:

β ≈ 177 kg/m² (Mars-friendly)

The HIAD handles:

• Hypersonic deceleration

• Supersonic deceleration

• Subsonic stabilization

No parachutes are used.

4. Retropropulsion Scaled to Payload Mass

After HIAD deceleration, each lander performs:

• Terminal retropropulsion

• Hover

• Translation

• Soft touchdown

Propellant mass scales directly with:

• Lander mass

• Required Δv

• Engine ISP

More payload → more propellant → higher total mass → higher β → thicker TPS.

This is the core mass spiral.

5. Why This Architecture Works

Advantages

• Two complete landers delivered in one entry vehicle

• No parachutes (removes a major failure mode)

• HIAD-only simplifies staging and reduces mass overhead

• Retroprop engines integrated into the lander (no crane)

• Bus provides a common aero solution for multiple missions

• PICA-X thickness can be tuned per mission mass

Scalability

• Full-mass mission: two 30 t landers

• Partial-mass mission: one full + one light lander

• Bus TPS thickness adjusts to total entry mass

• HIAD size remains fixed at 12 m for each lander

6. What You Gain Compared to NASA’s Current Method

NASA today:

• One payload per aeroshell

• Parachutes required

• Sky crane required

• ~1 t landed mass

Your architecture:

• Two landers per entry

• No parachutes

• No crane

• 30 t per lander

• HIAD + retroprop only

• Scalable to human-class missions

7. Summary (Forum Ready)

Aerobrake Bus: 12 m × 30 m, 26–30 t, PICA-X belly, 4 flaps

Landers: Two independent 30 t units

Deceleration: HIAD-only, no parachutes

Landing: Retroprop engines sized to payload mass

Payload: Cygnus-class module per lander (~7 t real cargo)

Flexibility: Full or partial mass missions with only TPS thickness changes

Capability: 60 t total landed mass per entry event

#12 Re: Exploration to Settlement Creation » Wiki Toehold Mission » 2026-03-10 17:56:19

Here is how Cygnus is sent to orbit cargo bus.

So if we modify this for mars is a means to send them.

12‑Meter Mars Aerobrake Bus (Scaled ×3) — Clean Spec Sheet

A dimensionally scaled evolution of a 4‑meter fairing. Future missions may use smaller variants.

1. Geometry (Scaled ×3 from 4 m → 12 m)

Outside diameter: 12 m

Length: 30 m

Internal usable diameter: ~11.3 m

Internal usable length: ~28 m

Broadside projected area: ~360 m²

Belly TPS area (half‑cylinder): ~565 m²

2. Mass Statement (Disposable EDL Shell)

Structure + flaps: 20–24 t

PICA‑X belly TPS (single‑use, ~10 kg/m²): 5.5–6 t

Avionics + RCS + harness: ~1 t

Total dry mass (bus only): 26–30 t

3. Starship‑Style Flap System (Scaled to 12 m Body

4 flaps total (2 forward, 2 aft)

Span: 5–6 m from surface

Root chord: 6–7 m

Functions:

Trim and stability in broadside attitude

Lift vector control (downrange/crossrange)

Pitch/yaw authority

Roll via differential deflection

4. Control Systems

IMU + GNSS + star tracker

Mars EDL guidance law

RCS thrusters for high‑altitude control

Flap actuation: hydraulic or electro‑mechanical

Redundant power + signal paths

No landing engines, no landing legs, no thrust structures

5. Mission Role: Aerobrake Bus for Heavy Payloads

Single‑use Mars entry shell

Bleeds off most kinetic energy during entry

Payload separates at target Mach/altitude

Payload performs its own EDL (chutes, inflatables, retroprop, etc.)

Payload attaches to central spine or deck

Designed for entry loads only

6. Ballistic Coefficient Check

Reference area: 360 m²

CD (broadside): ~1.5

Target β: 150–250 kg/m²

Total mass capability: ~100–110 t

Subtract bus mass (26–30 t)

Payload capability: ~70–80 t

7. Scaling Down for Future Missions

12 m × 30 m is the upper envelope

Payload geometry may drive:

Shorter bus (e.g., 24 m)

Smaller diameter (e.g., 10 m)

Different CG placement

Adjusted flap sizing

Thinner TPS

Modular architecture:

Central spine

Ring frames

Standard payload attach zone

Four‑flap layout

Monolithic belly TPS

Summary

Geometry: 12 m × 30 m

Dry mass: 26–30 t

TPS: 5.5–6 t PICA‑X belly

Control: 4 flaps + RCS + GNC

Role: Entry‑only aerobrake bus

Payload capability: ~70–80 t

Future missions may shrink the design as payloads mature

#13 Re: Exploration to Settlement Creation » Wiki Landing Site preparation mission » 2026-03-10 17:38:42

Here is the list and shape that we are forced to use.

Caterpillar Electric Prototypes

Cat 301.9 Electric

(Dimensions match diesel 301.9 platform; electric variant uses same chassis)

Length: 3,840 mm / 151 in

Width: 990 mm / 39 in

Height: 2,300 mm / 91 in

Operating Weight: 2,000 kg / 4,400 lb

Cat 320 Electric

(Electric prototype uses 320 chassis dimensions)

Length: 9,400 mm / 370 in

Width: 2,990 mm / 118 in

Height: 3,160 mm / 124 in

Operating Weight: 22,000 kg / 48,500 lb

Cat 950 GC Electric (Prototype)

(Electric prototype uses 950 GC chassis dimensions)

Length: 6,180 mm / 243 in

Width: 2,410 mm / 95 in

Height: 3,330 mm / 131 in

Operating Weight: 18,800 kg / 41,450 lb

Cat 906 Electric

(Electric prototype uses 906 chassis dimensions)

Length: 5,040 mm / 198 in

Width: 1,870 mm / 74 in

Height: 2,680 mm / 105 in

Operating Weight: 5,730 kg / 12,630 lb

Bobcat Electric Machines

Bobcat T7X (Electric Track Loader)

Length: 3,600 mm / 142 in

Width: 1,800 mm / 71 in

Height: 2,080 mm / 82 in

Operating Weight: 5,710 kg / 12,590 lb

Bobcat S7X (Electric Skid Steer)

(Dimensions match S770 frame)

Length: 3,500 mm / 138 in

Width: 1,800 mm / 71 in

Height: 2,080 mm / 82 in

Operating Weight: 3,900 kg / 8,600 lb

Bobcat E10e (Electric Micro Excavator)

Length: 2,820 mm / 111 in

Width: 710–1,100 mm / 28–43 in

Height: 2,210 mm / 87 in

Operating Weight: 1,200 kg / 2,650 lb

Bobcat E19e (Electric Mini Excavator)

Length: 3,830 mm / 151 in

Width: 980 mm / 39 in

Height: 2,300 mm / 91 in

Operating Weight: 1,916 kg / 4,225 lb

Volvo Electric Machines

Volvo ECR18 Electric

Length: 3,430 mm / 135 in

Width: 995–1,352 mm / 39–53 in

Height: 2,298 mm / 91 in

Operating Weight: 1,790–1,870 kg / 3,950–4,120 lb

Volvo EC18 Electric

Length: 3,550 mm / 140 in

Width: 995–1,352 mm / 39–53 in

Height: 2,300 mm / 91 in

Operating Weight: 1,960 kg / 4,321 lb

Volvo L20 Electric (Compact Wheel Loader)

Length: 5,265 mm / 207 in

Width: 1,740 mm / 69 in

Height: 2,580 mm / 102 in

Operating Weight: 4,500 kg / 9,920 lb

Volvo L25 Electric (Compact Wheel Loader)

Length: 5,265 mm / 207 in

Width: 1,740 mm / 69 in

Height: 2,580 mm / 102 in

Operating Weight: 5,000 kg / 11,000 lb

Volvo EC230 Electric (Medium Excavator)

Length: 9,700 mm / 382 in

Width: 2,990–3,090 mm / 118–122 in

Height: 3,100 mm / 122 in

Operating Weight: 23,000–26,100 kg / 50,600–57,500 lb

#14 Re: Exploration to Settlement Creation » WIKI Constructing things on Mars equipment needs » 2026-03-10 17:38:02

Here is the list and shape that we are forced to use.

Caterpillar Electric Prototypes

Cat 301.9 Electric

(Dimensions match diesel 301.9 platform; electric variant uses same chassis)

Length: 3,840 mm / 151 in

Width: 990 mm / 39 in

Height: 2,300 mm / 91 in

Operating Weight: 2,000 kg / 4,400 lb

Cat 320 Electric

(Electric prototype uses 320 chassis dimensions)

Length: 9,400 mm / 370 in

Width: 2,990 mm / 118 in

Height: 3,160 mm / 124 in

Operating Weight: 22,000 kg / 48,500 lb

Cat 950 GC Electric (Prototype)

(Electric prototype uses 950 GC chassis dimensions)

Length: 6,180 mm / 243 in

Width: 2,410 mm / 95 in

Height: 3,330 mm / 131 in

Operating Weight: 18,800 kg / 41,450 lb

Cat 906 Electric

(Electric prototype uses 906 chassis dimensions)

Length: 5,040 mm / 198 in

Width: 1,870 mm / 74 in

Height: 2,680 mm / 105 in

Operating Weight: 5,730 kg / 12,630 lb

Bobcat Electric Machines

Bobcat T7X (Electric Track Loader)

Length: 3,600 mm / 142 in

Width: 1,800 mm / 71 in

Height: 2,080 mm / 82 in

Operating Weight: 5,710 kg / 12,590 lb

Bobcat S7X (Electric Skid Steer)

(Dimensions match S770 frame)

Length: 3,500 mm / 138 in

Width: 1,800 mm / 71 in

Height: 2,080 mm / 82 in

Operating Weight: 3,900 kg / 8,600 lb

Bobcat E10e (Electric Micro Excavator)

Length: 2,820 mm / 111 in

Width: 710–1,100 mm / 28–43 in

Height: 2,210 mm / 87 in

Operating Weight: 1,200 kg / 2,650 lb

Bobcat E19e (Electric Mini Excavator)

Length: 3,830 mm / 151 in

Width: 980 mm / 39 in

Height: 2,300 mm / 91 in

Operating Weight: 1,916 kg / 4,225 lb

Volvo Electric Machines

Volvo ECR18 Electric

Length: 3,430 mm / 135 in

Width: 995–1,352 mm / 39–53 in

Height: 2,298 mm / 91 in

Operating Weight: 1,790–1,870 kg / 3,950–4,120 lb

Volvo EC18 Electric

Length: 3,550 mm / 140 in

Width: 995–1,352 mm / 39–53 in

Height: 2,300 mm / 91 in

Operating Weight: 1,960 kg / 4,321 lb

Volvo L20 Electric (Compact Wheel Loader)

Length: 5,265 mm / 207 in

Width: 1,740 mm / 69 in

Height: 2,580 mm / 102 in

Operating Weight: 4,500 kg / 9,920 lb

Volvo L25 Electric (Compact Wheel Loader)

Length: 5,265 mm / 207 in

Width: 1,740 mm / 69 in

Height: 2,580 mm / 102 in

Operating Weight: 5,000 kg / 11,000 lb

Volvo EC230 Electric (Medium Excavator)

Length: 9,700 mm / 382 in

Width: 2,990–3,090 mm / 118–122 in

Height: 3,100 mm / 122 in

Operating Weight: 23,000–26,100 kg / 50,600–57,500 lb

#15 Re: Interplanetary transportation » Forty 40 Ton Mars Delivery Mechanism » 2026-03-10 17:36:15

Here is the list and shape that we are forced to use.

Caterpillar Electric Prototypes

Cat 301.9 Electric

(Dimensions match diesel 301.9 platform; electric variant uses same chassis)

Length: 3,840 mm / 151 in

Width: 990 mm / 39 in

Height: 2,300 mm / 91 in

Operating Weight: 2,000 kg / 4,400 lb

Cat 320 Electric

(Electric prototype uses 320 chassis dimensions)

Length: 9,400 mm / 370 in

Width: 2,990 mm / 118 in

Height: 3,160 mm / 124 in

Operating Weight: 22,000 kg / 48,500 lb

Cat 950 GC Electric (Prototype)

(Electric prototype uses 950 GC chassis dimensions)

Length: 6,180 mm / 243 in

Width: 2,410 mm / 95 in

Height: 3,330 mm / 131 in

Operating Weight: 18,800 kg / 41,450 lb

Cat 906 Electric

(Electric prototype uses 906 chassis dimensions)

Length: 5,040 mm / 198 in

Width: 1,870 mm / 74 in

Height: 2,680 mm / 105 in

Operating Weight: 5,730 kg / 12,630 lb

Bobcat Electric Machines

Bobcat T7X (Electric Track Loader)

Length: 3,600 mm / 142 in

Width: 1,800 mm / 71 in

Height: 2,080 mm / 82 in

Operating Weight: 5,710 kg / 12,590 lb

Bobcat S7X (Electric Skid Steer)

(Dimensions match S770 frame)

Length: 3,500 mm / 138 in

Width: 1,800 mm / 71 in

Height: 2,080 mm / 82 in

Operating Weight: 3,900 kg / 8,600 lb

Bobcat E10e (Electric Micro Excavator)

Length: 2,820 mm / 111 in

Width: 710–1,100 mm / 28–43 in

Height: 2,210 mm / 87 in

Operating Weight: 1,200 kg / 2,650 lb

Bobcat E19e (Electric Mini Excavator)

Length: 3,830 mm / 151 in

Width: 980 mm / 39 in

Height: 2,300 mm / 91 in

Operating Weight: 1,916 kg / 4,225 lb

Volvo Electric Machines

Volvo ECR18 Electric

Length: 3,430 mm / 135 in

Width: 995–1,352 mm / 39–53 in

Height: 2,298 mm / 91 in

Operating Weight: 1,790–1,870 kg / 3,950–4,120 lb

Volvo EC18 Electric

Length: 3,550 mm / 140 in

Width: 995–1,352 mm / 39–53 in

Height: 2,300 mm / 91 in

Operating Weight: 1,960 kg / 4,321 lb

Volvo L20 Electric (Compact Wheel Loader)

Length: 5,265 mm / 207 in

Width: 1,740 mm / 69 in

Height: 2,580 mm / 102 in

Operating Weight: 4,500 kg / 9,920 lb

Volvo L25 Electric (Compact Wheel Loader)

Length: 5,265 mm / 207 in

Width: 1,740 mm / 69 in

Height: 2,580 mm / 102 in

Operating Weight: 5,000 kg / 11,000 lb

Volvo EC230 Electric (Medium Excavator)

Length: 9,700 mm / 382 in

Width: 2,990–3,090 mm / 118–122 in

Height: 3,100 mm / 122 in

Operating Weight: 23,000–26,100 kg / 50,600–57,500 lb

#16 Re: Interplanetary transportation » Forty 40 Ton Mars Delivery Mechanism » 2026-03-10 13:59:55

Thar means pulling apart the items we are trying to ship complete, whole in order to drive them out and begin working as the data in post 70 indicates.

#17 Re: Human missions » Why Artemis is “better” than Apollo. » 2026-03-09 17:26:32

Sounds like they are trying to get rid of the standing support army concept as well, to go down the path of commercial industry.

#18 Re: Interplanetary transportation » Forty 40 Ton Mars Delivery Mechanism » 2026-03-09 17:12:07

Connex box size for the equipment is a cause for the heatshield issues not just from mars EDL but also for the assembly to get from earth surface or from orbit. It did suggest lining the connex box with respect to the plume of engine once they are in heavy thrust to land.

Our issues for mars is that anything that approaches that 9 M diameter gives issues for the envelope shape for mars entry.

This is also the issue for horizontal Cygnus landings as well.

#19 Re: Exploration to Settlement Creation » Wiki Toehold Mission » 2026-03-09 14:32:43

CYGNUS‑TO‑MARS SURFACE MODULE — ENGINEERING CONVERSION SPEC

1. Base Structure

Starting point: Northrop Grumman Cygnus PCM (Pressurized Cargo Module)

Modifications for Mars:

Reinforced pressure shell (2× safety factor for burial loads)

External regolith‑anchor hardpoints

Dust‑proofed hatches and seals

Thermal insulation for −120°C nights

Integrated skirt for partial burial

Replaceable micrometeoroid shield with regolith‑compatible armor

2. Environmental Control & Life Support (ECLSS)

ISS‑heritage racks adapted for Mars:

CO₂ scrubbers (amine‑swing or LiOH backup)

O₂ storage tanks

Water recycling (ISS‑derived WRS)

Humidity control

Air circulation fans rated for dusty environments

Emergency O₂ candles

Mars‑specific additions:

Dust‑exclusion vestibule

External air intake for ISRU oxygen feed

Thermal loop compatible with reactor heat rejection

3. Power & Thermal Systems

ISS heritage:

120 VDC bus

Modular power distribution units

Mars upgrades:

External reactor interface (SAFE‑400 / Kilopower)

Radiator panels with dust‑shedding coating

Battery racks (LiFePO₄ or Na‑ion)

Solar pallet connectors

Thermal mass integration for buried operation

4. Mobility & Landing Adaptation

Cygnus is not designed to land — so the Mars version is:

Mounted inside a lifting‑body aeroshell

Equipped with crushable landing legs

Designed for horizontal landing orientation

Includes regolith‑compatible access ramps

5. Internal Layout Options

Each Cygnus‑Mars module can be configured as:

A. Habitation Module

bunks

galley

hygiene

medical bay

water recycling

B. ISRU Module

MOXIE‑class O₂ production

Sabatier reactor

CO₂ compressors

electrolysis stack

methane/O₂ storage

C. Power Module

reactor interface

battery racks

switchgear

radiator controls

D. Greenhouse Module

hydroponics racks

LED arrays

nutrient tanks

humidity control

E. Utility / Workshop Module

EVA airlock

machining tools

welding gear

teleoperation consoles

3D printer (low‑energy use only)

6. Surface Integration

Each module includes:

buried‑operation thermal skirt

regolith berm anchor points

tunnel connectors (inflatable or rigid)

utility ports (power, water, O₂, data)

external robotic arm interface

7. Mass & Volume

Dry mass: 4.5–5.5 tonnes

Fully outfitted: 6–7.5 tonnes

Delivered inside lander: 8–10 tonnes including aeroshell

Fits within:

Starship cargo bay

Blue Moon cargo lander

Mars lander concepts (10–15 t class)

Cygnus‑to‑Mars Conversion Spec (Surface‑Rated ISS‑Heritage Modules)

To make the toehold feel real, each pressurized module delivered to Mars is based on a Cygnus‑class ISS cargo module, modified for surface operations.

1. Structural Modifications

Reinforced pressure shell for burial loads

Dust‑proofed hatches and seals

Thermal insulation for −120°C nights

Regolith‑anchor hardpoints

Replaceable micrometeoroid shield with regolith‑compatible armor

2. Life Support Integration

ISS‑heritage systems adapted for Mars:

CO₂ scrubbers

O₂ storage

Water recycling

Humidity control

Dust‑exclusion vestibule

External ISRU oxygen feed

3. Power & Thermal

SAFE‑400 / Kilopower interface

Radiator panels with dust‑shedding coating

Battery racks

Solar pallet connectors

Thermal mass integration for buried operation

4. Landing Adaptation

Horizontal landing orientation

Crushable landing legs

Lifting‑body aeroshell

Regolith‑compatible access ramps

5. Internal Configurations

Each Cygnus‑Mars module can be configured as:

Habitation Module

ISRU Module

Power Module

Greenhouse Module

Utility / Workshop Module

6. Surface Integration

Tunnel connectors

Utility ports (power, water, O₂, data)

External robotic arm interface

Regolith berm anchor points

7. Mass & Volume

6–7.5 tonnes outfitted

8–10 tonnes delivered with aeroshell

Compatible with 10–15 t Mars landers

#20 Re: Exploration to Settlement Creation » Wiki Toehold Mission » 2026-03-09 14:28:57

Now to put what is the first Cygnus iss module style system on mars

The Mars Toehold Mission: What Actually Gets Sent (Cygnus / ISS‑Style Modules)

Below is a clean, non‑duplicated, mission‑ready manifest of what gets delivered to Mars using Mars‑hardened Cygnus‑class modules and ISS‑heritage systems.

This is the missing bridge between your reorganized document and the physical reality of the first landing.

1. The Five Core Cygnus‑Derived Modules

These are the backbone of your toehold — the “ISS on Mars” aesthetic you’ve been building.

Each is a pressurized, surface‑rated, buried‑capable module.

1. Core Habitation Module (Cygnus‑Hab)

Purpose: living, sleeping, hygiene, medical, galley

ISS analog: Destiny + Zvezda hybrid

Contents:

bunks for 10–12

hygiene + toilet

medical bay

galley + food prep

water recycling

CO₂ scrubbing

emergency O₂ storage

2. Life Support & ISRU Module (Cygnus‑ISRU)

Purpose: oxygen, water, methane, storage

ISS analog: ECLSS + Sabatier rack

Contents:

MOXIE‑class O₂ production

Sabatier reactor

CO₂ compressors

water extraction skid

electrolysis stack

methane + O₂ tanks

radiator panels

3. Power & Thermal Module (Cygnus‑Power)

Purpose: nuclear + solar + batteries

ISS analog: P6 truss logic, but compact

Contents:

SAFE‑400 or Kilopower reactor

battery racks

power distribution

thermal loops

radiator wings

solar array pallets

4. Greenhouse Module (Cygnus‑Ag)

Purpose: food, oxygen, humidity, psychology

ISS analog: Veggie + MELiSSA concepts

Contents:

hydroponics racks

LED arrays

nutrient tanks

humidity control

seed vault

plant growth chambers

5. Airlock & Workshop Module (Cygnus‑Utility)

Purpose: EVA, tools, machining, robotics

ISS analog: Quest + PMM hybrid

Contents:

EVA airlock

suit maintenance

machining tools

welding gear

3D printer (low‑energy use only)

tool racks

teleoperation consoles

2. The Unpressurized Cargo Modules

These are the “garage” and “warehouse” of the toehold.

6. Rover & Digger Module

Carries:

1 compact excavator (Bobcat E19e or Cat 301.9 Electric)

1 skid‑steer loader

1 teleoperated robotic arm

modular tool attachments

spare treads, hydraulics, batteries

7. Greenhouse Expansion Kit

Carries:

inflatable greenhouse shells

regolith‑glass panel kits

irrigation lines

soil trays

water tanks

8. Power Expansion Kit

Carries:

solar pallets

battery pallets

cabling

switchgear

radiator extensions

9. Construction & Shielding Kit

Carries:

regolith bags

basalt fiber reels

inflatable tunnel segments

pressure‑rated connectors

structural frames

3. The Landing Sequence (No Duplication, Clean Logic)

Phase 0 — Automated Precursor (Year −2 to −1)

ISRU Lander

MOXIE

Sabatier

compressors

tanks

small reactor

Power Lander

SAFE‑400

solar pallets

batteries

Survey Rover

terrain mapping

ice detection

landing beacon deployment

Phase 1 — Heavy Cargo (Year −1 to 0)

Cygnus‑ISRU Module

Cygnus‑Power Module

Rover & Digger Module

Construction & Shielding Kit

These four landers create the pre‑crew industrial base.

Phase 2 — Crew Arrival (Year 0)

Cygnus‑Hab Module

Cygnus‑Utility Module

Pressurized Rover

Crew of 10–12 arrives only when:

oxygen is being produced

methane is being produced

water is being extracted

power is stable

Phase 3 — Toehold Construction (Year 0–1)

Crew tasks:

bury Cygnus modules

trench for tunnels

deploy greenhouses

expand power

build regolith berms

assemble workshop

establish water lines

build first storage rooms

Phase 4 — Foothold Expansion (Year 1–3)

Cygnus‑Ag Module

Greenhouse Expansion Kit

Power Expansion Kit

This is where the settlement becomes productive, not just surviving.

4. Why This Makes the Toehold Feel Real

Because it uses:

real hardware (Cygnus, ISS racks, SAFE‑400, Bobcat E19e)

real dimensions (fits in landers, fits in 8×8 CONEX)

real mass budgets (Cygnus‑class payloads)

real operational logic (bury modules, trench tunnels, deploy greenhouses)

real ISRU (MOXIE, Sabatier, electrolysis)

This is not fantasy.

This is a credible, buildable, NASA‑heritage Mars toehold.

#21 Exploration to Settlement Creation » Wiki Toehold Mission » 2026-03-09 14:22:05

- SpaceNut

- Replies: 8

The content has been consolidated and remastered from my posts

1. Zubrin’s Dream (The Why)

Humans living permanently on Mars, building a new branch of civilization where people:

work

raise families

build industries

create culture

stay

This is the philosophical anchor for everything that follows.

2. The Toehold Architecture (The First Step)

A minimal landing that refuses to die.

Core Elements

4–8 settlers

pre‑landed supplies

underground shelter

first greenhouse

first power systems

first water extraction

first oxygen production

first construction capability

Why it matters

Every kilogram matters

Every watt matters

Every greenhouse panel matters

Every tool matters

The toehold is a survival experiment, not a colony.

3. The Foothold Economy (The First Expansion)

Once the toehold survives, it begins producing:

8–16 settlers

mining output

metals

plastics

agriculture

energy storage

recycling

construction materials

This is where the settlement becomes productive, not just surviving.

4. Mars Homestead Model (Minimal Imports, Maximum ISRU)

A philosophy of early settlement:

Send as little as possible

Build as much as possible

Use local materials (glass, metals, plastics)

Use ambient light where possible

Use tempered regolith glass

Robots + settlers build everything

Baseline Homestead Setup

12 settlers

4 Mars Direct habs

2 small greenhouses per hab

Large greenhouses built from Mars glass

Ambient + artificial light mix

5. Historical Parallel: Toehold → Foothold → Settlement

Early Earth colonies followed the same pattern:

tiny, fragile presence

dependent on home

high mortality

no guarantee of survival

Mars is no different.

6. Daily Reality of the First Crew

Breakdown of the first 24 hours:

4–8 hours sleep

3 hours meals

1–2 hours hygiene

1–2 hours exercise

2–3 hours maintenance

2–3 hours travel

4–6 hours productive work

This is why early focus is on:

water

air

power

shelter

heat

food

waste

mobility

7. Pre‑Landing Strategy (10‑Year Supply Cascade)

Everything possible is pre‑landed:

habitats

greenhouses

power systems

water systems

food stores

tools

rovers

diggers

batteries

solar panels

medical supplies

spare parts

mining equipment

ISRU systems

construction materials

8. Mission Architecture (2033–2035 Toehold Era)

A. Pre‑positioned Return Vehicles (ERVs)

Landed 1–2 years before crew

Powered by nuclear/RTG

Produce methane + oxygen experimentation, practical storing

Prove ISRU before humans arrive

B. Pre‑positioned Reactors

SAFE‑400

Kilopower

RTGs

C. Pre‑positioned Greenhouses

Hard‑panel or inflatable

Hydroponics

First oxygen + food

D. Pre‑positioned Rovers & Hangars

long‑range rovers

ATVs

loaders

burial + construction tools

E. Crew Arrives Only After ISRU Works

This is the core of Mars Direct.

9. Mission Timeline

2033–2035: Exploration Toehold

ERV + reactor + MOXIE

Rover hangar + tuna‑can habitat

Crew of 4

Return to Earth

10. Tools (The Forgotten Lifeline)

battery tools

dry‑ice pneumatic tools

hand tools

welding gear

machining capability

3D printing (only when energy‑efficient)

11. Greenhouses (The First True Toehold)

Provide:

food

oxygen

humidity

psychological comfort

biological recycling

12. Energy (The Limiting Factor)

Solar, weak, dust storms use to supplement nuclear systems

battery‑dependent surge and backups

Nuclear

SAFE‑400 not in the toehold but later

Kilopower

RTGs

Storage

methane

ammonia

compressed gas

batteries

13. Structures (Build Fast, Build Redundant)

cut‑and‑cover

basalt fiber

PLA bioplastic

inflatable habitats

underground tunnels

water + regolith shielding

No cathedrals on Sol 1 — only bunkers.

14. Construction Methods with most as trial type experimentation

Basalt Fiber

pressure vessels

beams

insulation

textiles

Regolith Bricks

shielding

thermal mass

walls

Inflatable Habitats

fast deployment

covered with regolith

3D‑Printed Domes

modular

scalable

repairable

Robotic Bricklayers

continuous construction

low labor cost

15. The 27 - 40 Tonne Toehold Manifest tonnage not set in stone but a ball park

Includes: with some that will not make it into the toehold

airlocks

gas cylinders

food

water

recycling units

Sabatier

solar panels

digger

rovers

habitats

hydroponics

tools

medical supplies

mining equipment

batteries

communications

16. Phase 0–4 Mission Flow

Phase 0: Automated Precursor

rover survey

landing beacons

Mars GPS constellation

Phase 1: Cargo Delivery

life support + power

construction + mining

habitation

propellant plant

pressurized rover

Phase 3: Toehold Construction

trenching

berms

underground rooms

LED greenhouses

utility tunnels

Phase 4: Life Support & Cleaners

peroxide

vinegar

bleach

alcohols

17. The Nomadic Prospector Model

Essential for:

exploration

mapping

mineral claims

water scouting

cave identification

future evaluation

emergency rescue

logistics

This model feeds the a system for growth.

18. Food Logistics changes with crew actual but this is a target for (10–12 Crew)

26 months of food ≈ 12 tons

With Mars water: ~9 tons

With 15% ISRU fresh food: ~8.65 tons

Bulk food imported

Fresh food grown locally

#22 Re: Interplanetary transportation » Forty 40 Ton Mars Delivery Mechanism » 2026-03-09 14:05:12

Here is the equipment list that we are trying to shove into a connex box that means we can not drive them out as we need to break them down.

Battery‑Electric Prototypes (Bauma 2022)

Cat 301.9 Electric

Type: Mini excavator

Status: Prototype, fully battery‑powered

Cat 320 Electric

Type: Medium excavator

Status: Prototype, closest to Mars‑scale digger

Cat 950 GC Electric Wheel Loader

Type: Wheel loader

Status: Prototype, high‑power earth‑moving

Cat 906 Electric

Type: Compact wheel loader

Status: Prototype, light construction

Are any Caterpillar machines “Mars‑ready”?

Extreme‑cold battery chemistry needed

Full dust‑proofing for Martian regolith

Radiation‑hardened electronics

Lightweight redesign for launch mass limits

Solar/nuclear charging infrastructure

8×8 CONEX Internal Dimensions

Width: ~92 in

Height: ~94 in

Length: ~19 ft 4 in

Caterpillar Electric Machines vs 8×8 Fit

Cat 301.9 Electric

Width: ~39 in

Height: ~90 in

Fits 8×8: YES

Cat 906 Electric

Width: ~70 in

Height: ~98 in

Fits 8×8: NO (too tall)

Cat 320 Electric

Width: ~102 in

Height: ~118 in

Fits 8×8: NO

Cat 950 GC Electric Wheel Loader

Width: ~112 in

Height: ~138 in

Fits 8×8: NO

Cat 301.9 Electric — The Only One That Fits

Width: 39 in

Height: ~90 in

Length: ~12 ft

Capabilities:

Light excavation

Trenching

Regolith handling

Teleoperation (Caterpillar Command)

Limitations:

Not for heavy earth‑moving

Not for bulldozing

Not for large‑scale site prep

Cat 906 Electric — Too Tall

Width fits

Height fails by ~4 in

Could fit with cab removal or redesign

Cat 320 Electric — Too Wide & Too Tall

Width: 102 in (fails)

Height: 118 in (fails)

Cat 950 GC Electric — Far Too Large

Width: 112 in

Height: 138 in

Implications for Mars Construction

Only the 301.9 fits stock

All larger Caterpillar electrics exceed 8×8 constraints

Your Options

1. Multiple Cat 301.9 units

Distributed digging

Easy to ship

Easy teleoperation

Low mass

2. Custom Caterpillar‑style chassis

Cab removed

Fold‑down ROPS

Narrow‑track variants

Modular boom assemblies

3. Flat‑pack approach

Ship components inside CONEX

Assemble on Mars with robotics

4. Use Caterpillar Command autonomous tech

Proven in remote, dusty, hazardous sites

Ideal for Mars teleoperation

Summary Table (Clean)

Cat 301.9 Electric

Fits: YES

Notes: Only electric Cat that fits stock

Cat 906 Electric

Fits: NO

Notes: Too tall by ~4 in

Cat 320 Electric

Fits: NO

Notes: Too wide & tall

Cat 950 GC Electric

Fits: NO

Notes: Far too large

Bobcat Electric Machines vs 8×8

T7X (Track loader)

Width: ~68 in

Height: ~80 in

Fits: YES

S7X (Skid steer)

Width: ~68 in

Height: ~80 in

Fits: YES

E10e (Micro excavator)

Width: 28–44 in

Height: ~87 in

Fits: YES

E19e (Mini excavator)

Width: ~39 in

Height: ~90 in

Fits: YES

Volvo Electric Machines vs 8×8

ECR18 (Mini excavator)

Width: ~39 in

Height: ~90 in

Fits: YES

EC18 (Mini excavator)

Width: ~39 in

Height: ~90 in

Fits: YES

L20 Electric (Compact wheel loader)

Width: ~63 in

Height: ~98 in

Fits: NO (too tall)

L25 Electric (Compact wheel loader)

Width: ~63 in

Height: ~98 in

Fits: NO (too tall)

EC230 (Medium excavator)

Width: >100 in

Height: >110 in

Fits: NO

Battery-Electric Prototypes (Bauma 2022)

Source: Caterpillar press release

Model Type Status Notes

Cat 301.9 Electric Mini excavator Prototype Fully battery-powered

Cat 320 Electric Medium excavator Prototype Closest to a Mars-scale digger

Cat 950 GC Electric Wheel loader Prototype High-power earth-moving

Cat 906 Electric Compact wheel loader Prototype Light construction

These machines use Caterpillar's new Li-ion battery packs and onboard chargers. They are designed for construction sites on Earth, not extreme environments.

Are any Caterpillar machines "Mars-ready"?

Not yet. Even the electric prototypes would need major upgrades:

What's missing:

• Extreme cold battery chemistry Full dust-proofing for Martian regolith

• Radiation-hardened electronics

• Lightweight design for launch mass limits

• Solar/nuc[ear charging infrastructure

NASA's telerobotics studies (e.g., ATHLETE, RASSOR) show the direction, but Caterpillar hasn't built a Mars-rated machine.

Dimensions of an 8x8 CONEX Box (Internal)

A standard (actually 8x8x20) container has:

• Interior width: 42 in (7.7 ft) Interior height: æ94 in (7.8 ft)

• Interior length: N19 ft 4 in

Your limiting factors are width and height.

Caterpillar Electric Machines (from the Caterpillar electric lineup)

These are the four battery-electric machines Caterpillar has publicly demonstrated.

Model Type Width Height Fits in 8x8?

Cat 301.9 Electric Mini excavator N39 in N90 in YES

Cat 906 Electric Compact wheel loader in æ98 in NO (too tall)

Cat 320 Electric Medium excavator in in NO

Cat 950 GC Electric Wheel loader M 12 in M38 in NO

Only the Cat 301.9 Electric fits inside an 8x8 container without modification.

Cat 301.9 Electric — Fits

This is the only Caterpillar electric machine that meets your dimensional constraints.

Why it fits:

Width: 39 in (3.25 ft)

Height: —90 in (7.5 ft)

Length: æl 2 ft (well within 20 ft container)

What it can do:

Light excavation Trenching

Regolith handling

Teleoperation possible (Caterpillar Command compatible with small machines)

What it cannot do:

Heavy earth-moving

Bulldozing

Large-scale site prep

This machine is a starter robot, not a base-building workhorse.

2. Cat 906 Electric — Too Tall

Width: æ70 in (fits)

Height: —98 in (8.16 ft) fails height limit bY N4 inches

Could it be modified to fit? Possibly — if the cab is removed or redesigned. But stock? No.

3. Cat 320 Electric —Too Wide & Too Tall

Width: 102 in (8.5 ft) + fails

Height: 118 in (9.8 ft) * fails

This is a serious excavator, but it's not container-friendly.

4. Cat 950 GC Electric — way Too Big

Width: 112 in

Height: 138 in

This is a non-starter for containerized transport.

What This Means for Mars Construction

If you want real earth-moving capability inside an footprint, Caterpillar's current electric lineup is too large except for the mini-excavator.

Your options:

1 . Use multiple Cat 301.9 Electric units Good for distributed digging

Easy to ship

Easy to teleoperate

Low mass

2. Request Caterpillar-style custom chassis o Cab removed

Fold-down ROPS

Narrow-track variants

Modular boom assemblies

3. Use a "flat-pack" approach

Ship components in the CONEX

o Assemble on Mars with robotic assistance

4. Use Caterpillar's autonomous mining tech (Command)

c Already proven in remote, dusty, dangerous environments c Perfect for Mars teleoperation

Summary Table (Clean & Direct)

Model Fits 8x8? Notes

Cat 301.9 Electric YES Only electric Cat that fits stock

Cat 906 Electric NO Too tall by rv4 in

Cat 320 Electric NO Too wide & tall

Cat 950 GC Electric NO Far too large

If you want, I can also:

Build a Mars-optimized Caterpillar-style excavator concept

Show how to modify the 906 Electric to fit inside an

Compare Caterpillar vs. Bobcat vs. Volvo electric machines for container fit

Design a multi-robot Mars construction fleet using only container-shippable equipment

Just tell me which direction you want to take this.

Bobcat electric machines vs 8x8 (width/height only)

Model Type Width (in) Height (in) Fits 8x8?

T7X Track loader N68 N80 YES

S7X Skid steer -80 YES

Micro excavator 28—44 m87 YES

Mini excavator æ39 YES

All four Bobcat electrics are under 8 ft wide and under 8 ft tall, so they pass your 8x8 face constraint.

Volvo electric machines vs 8x8 (width/height only)

Model Type Width (in) Height (in) Fits 8x8?

ECR18 Mini excavator YES

EC18 Mini excavator N90 YES

L20 Electric Compact wheel loader N63 NO (too tall)

L25 Electric Compact wheel loader æ63 N98 NO (too tall)

EC230 Medium excavator > 100 > 110 NO

#23 Re: Exploration to Settlement Creation » WIKI Constructing things on Mars equipment needs » 2026-03-09 14:02:40

Battery‑Electric Prototypes (Bauma 2022)

Cat 301.9 Electric

Type: Mini excavator

Status: Prototype, fully battery‑powered

Cat 320 Electric

Type: Medium excavator

Status: Prototype, closest to Mars‑scale digger

Cat 950 GC Electric Wheel Loader

Type: Wheel loader

Status: Prototype, high‑power earth‑moving

Cat 906 Electric

Type: Compact wheel loader

Status: Prototype, light construction

Are any Caterpillar machines “Mars‑ready”?

Extreme‑cold battery chemistry needed

Full dust‑proofing for Martian regolith

Radiation‑hardened electronics

Lightweight redesign for launch mass limits

Solar/nuclear charging infrastructure

8×8 CONEX Internal Dimensions

Width: ~92 in

Height: ~94 in

Length: ~19 ft 4 in

Caterpillar Electric Machines vs 8×8 Fit

Cat 301.9 Electric

Width: ~39 in

Height: ~90 in

Fits 8×8: YES

Cat 906 Electric

Width: ~70 in

Height: ~98 in

Fits 8×8: NO (too tall)

Cat 320 Electric

Width: ~102 in

Height: ~118 in

Fits 8×8: NO

Cat 950 GC Electric Wheel Loader

Width: ~112 in

Height: ~138 in

Fits 8×8: NO

Cat 301.9 Electric — The Only One That Fits

Width: 39 in

Height: ~90 in

Length: ~12 ft

Capabilities:

Light excavation

Trenching

Regolith handling

Teleoperation (Caterpillar Command)

Limitations:

Not for heavy earth‑moving

Not for bulldozing

Not for large‑scale site prep

Cat 906 Electric — Too Tall

Width fits

Height fails by ~4 in

Could fit with cab removal or redesign

Cat 320 Electric — Too Wide & Too Tall

Width: 102 in (fails)

Height: 118 in (fails)

Cat 950 GC Electric — Far Too Large

Width: 112 in

Height: 138 in

Implications for Mars Construction

Only the 301.9 fits stock

All larger Caterpillar electrics exceed 8×8 constraints

Your Options

1. Multiple Cat 301.9 units

Distributed digging

Easy to ship

Easy teleoperation

Low mass

2. Custom Caterpillar‑style chassis

Cab removed

Fold‑down ROPS

Narrow‑track variants

Modular boom assemblies

3. Flat‑pack approach

Ship components inside CONEX

Assemble on Mars with robotics

4. Use Caterpillar Command autonomous tech

Proven in remote, dusty, hazardous sites

Ideal for Mars teleoperation

Summary Table (Clean)

Cat 301.9 Electric

Fits: YES

Notes: Only electric Cat that fits stock

Cat 906 Electric

Fits: NO

Notes: Too tall by ~4 in

Cat 320 Electric

Fits: NO

Notes: Too wide & tall

Cat 950 GC Electric

Fits: NO

Notes: Far too large

Bobcat Electric Machines vs 8×8

T7X (Track loader)

Width: ~68 in

Height: ~80 in

Fits: YES

S7X (Skid steer)

Width: ~68 in

Height: ~80 in

Fits: YES

E10e (Micro excavator)

Width: 28–44 in

Height: ~87 in

Fits: YES

E19e (Mini excavator)

Width: ~39 in

Height: ~90 in

Fits: YES

Volvo Electric Machines vs 8×8

ECR18 (Mini excavator)

Width: ~39 in

Height: ~90 in

Fits: YES

EC18 (Mini excavator)

Width: ~39 in

Height: ~90 in

Fits: YES

L20 Electric (Compact wheel loader)

Width: ~63 in

Height: ~98 in

Fits: NO (too tall)

L25 Electric (Compact wheel loader)

Width: ~63 in

Height: ~98 in

Fits: NO (too tall)

EC230 (Medium excavator)

Width: >100 in

Height: >110 in

Fits: NO

Battery-Electric Prototypes (Bauma 2022)

Source: Caterpillar press release

Model Type Status Notes

Cat 301.9 Electric Mini excavator Prototype Fully battery-powered

Cat 320 Electric Medium excavator Prototype Closest to a Mars-scale digger

Cat 950 GC Electric Wheel loader Prototype High-power earth-moving

Cat 906 Electric Compact wheel loader Prototype Light construction

These machines use Caterpillar's new Li-ion battery packs and onboard chargers. They are designed for construction sites on Earth, not extreme environments.

Are any Caterpillar machines "Mars-ready"?

Not yet. Even the electric prototypes would need major upgrades:

What's missing:

• Extreme cold battery chemistry Full dust-proofing for Martian regolith

• Radiation-hardened electronics

• Lightweight design for launch mass limits

• Solar/nuc[ear charging infrastructure

NASA's telerobotics studies (e.g., ATHLETE, RASSOR) show the direction, but Caterpillar hasn't built a Mars-rated machine.

Dimensions of an 8x8 CONEX Box (Internal)

A standard (actually 8x8x20) container has:

• Interior width: 42 in (7.7 ft) Interior height: æ94 in (7.8 ft)

• Interior length: N19 ft 4 in

Your limiting factors are width and height.

Caterpillar Electric Machines (from the Caterpillar electric lineup)

These are the four battery-electric machines Caterpillar has publicly demonstrated.

Model Type Width Height Fits in 8x8?

Cat 301.9 Electric Mini excavator N39 in N90 in YES

Cat 906 Electric Compact wheel loader in æ98 in NO (too tall)

Cat 320 Electric Medium excavator in in NO

Cat 950 GC Electric Wheel loader M 12 in M38 in NO

Only the Cat 301.9 Electric fits inside an 8x8 container without modification.

Cat 301.9 Electric — Fits

This is the only Caterpillar electric machine that meets your dimensional constraints.

Why it fits:

Width: 39 in (3.25 ft)

Height: —90 in (7.5 ft)

Length: æl 2 ft (well within 20 ft container)

What it can do:

Light excavation Trenching

Regolith handling

Teleoperation possible (Caterpillar Command compatible with small machines)

What it cannot do:

Heavy earth-moving

Bulldozing

Large-scale site prep

This machine is a starter robot, not a base-building workhorse.

2. Cat 906 Electric — Too Tall

Width: æ70 in (fits)

Height: —98 in (8.16 ft) fails height limit bY N4 inches

Could it be modified to fit? Possibly — if the cab is removed or redesigned. But stock? No.

3. Cat 320 Electric —Too Wide & Too Tall

Width: 102 in (8.5 ft) + fails

Height: 118 in (9.8 ft) * fails

This is a serious excavator, but it's not container-friendly.

4. Cat 950 GC Electric — way Too Big

Width: 112 in

Height: 138 in

This is a non-starter for containerized transport.

What This Means for Mars Construction

If you want real earth-moving capability inside an footprint, Caterpillar's current electric lineup is too large except for the mini-excavator.

Your options:

1 . Use multiple Cat 301.9 Electric units Good for distributed digging

Easy to ship

Easy to teleoperate

Low mass

2. Request Caterpillar-style custom chassis o Cab removed

Fold-down ROPS

Narrow-track variants

Modular boom assemblies

3. Use a "flat-pack" approach

Ship components in the CONEX

o Assemble on Mars with robotic assistance

4. Use Caterpillar's autonomous mining tech (Command)

c Already proven in remote, dusty, dangerous environments c Perfect for Mars teleoperation

Summary Table (Clean & Direct)

Model Fits 8x8? Notes

Cat 301.9 Electric YES Only electric Cat that fits stock

Cat 906 Electric NO Too tall by rv4 in

Cat 320 Electric NO Too wide & tall

Cat 950 GC Electric NO Far too large

If you want, I can also:

Build a Mars-optimized Caterpillar-style excavator concept

Show how to modify the 906 Electric to fit inside an

Compare Caterpillar vs. Bobcat vs. Volvo electric machines for container fit

Design a multi-robot Mars construction fleet using only container-shippable equipment

Just tell me which direction you want to take this.

Bobcat electric machines vs 8x8 (width/height only)

Model Type Width (in) Height (in) Fits 8x8?

T7X Track loader N68 N80 YES

S7X Skid steer -80 YES

Micro excavator 28—44 m87 YES

Mini excavator æ39 YES

All four Bobcat electrics are under 8 ft wide and under 8 ft tall, so they pass your 8x8 face constraint.

Volvo electric machines vs 8x8 (width/height only)

Model Type Width (in) Height (in) Fits 8x8?

ECR18 Mini excavator YES

EC18 Mini excavator N90 YES

L20 Electric Compact wheel loader N63 NO (too tall)

L25 Electric Compact wheel loader æ63 N98 NO (too tall)

EC230 Medium excavator > 100 > 110 NO

#24 Re: Human missions » Mars Direct 3 is a Mars mission architecture developed by Miguel Gurre » 2026-03-08 18:44:01

Mentioned in our google meet.

Ionic cooling, such as Ventiva's Ionic Cooling Engine (ICE) or Ionic Wind technology, is a fan-less, solid-state thermal management solution that uses electrohydrodynamic (EHD) flow to move air without moving parts. It operates by creating an electric field between electrodes to ionize air, creating a silent, vibration-free, and energy-efficient airflow ideal for compact, high-performance electronic

Key Aspects of Ionic Cooling Technology:

Mechanism: A high-voltage, low-current wire (emitter) ionizes air, which then rushes toward a grounded electrode (collector), creating a "wind".

Advantages: Silent operation (no fans), zero vibration, and high reliability due to no moving parts.

Applications: Specifically designed for space-constrained environments like laptops, tablets, edge servers, AI boxes, and medical devices.

Performance: It allows for higher sustained performance by providing efficient cooling, often outperforming traditional fans in compact spaces.

Innovation: Beyond air cooling, "ionocaloric" cooling is a different method that uses ions to drive solid-to-liquid phase changes for refrigeration.

Ionocaloric cooling is an emerging, efficient technology that uses ion flow from salt to drive phase changes (solid-to-liquid) for temperature regulation, offering potential for high-efficiency refrigeration. It can achieve a

temperature change with less than one volt. While distinct from traditional cryo-fuel storage, ionic liquids are used in advanced compression for hydrogen, improving efficiency and reducing contamination.

Linde

Linde

+3

Ionic Cooling Technology Overview

Mechanism: Uses salts to trigger phase changes in a material, absorbing heat when melting and releasing it when solidifying.

Efficiency: Potential to exceed current vapor-compression systems, which have high global warming potential.

Application: Researchers are testing this method for its high temperature-change capability with low voltage input.

Berkeley Lab News Center (.gov)

Berkeley Lab News Center (.gov)

+3

Ionic Liquids in Fuel Management

Ionic Compressors: Used to compress hydrogen gas (e.g., up to 100 MPa) without conventional lubricants, ensuring high purity for applications like fuel cells.

Benefits: These systems reduce wear and tear and have fewer moving parts than piston compressors.

Linde

Linde

Cryogenic Fuel Management (Context)

Challenges: Cryogenic fuels (like liquid hydrogen,

) experience significant boil-off in storage, which is a major issue for long-duration space missions (e.g., Mars).

Solutions: NASA is developing, newatlas.com active cooling and insulation systems, such as advanced cryocoolers, to achieve zero boil-off.

Fusion Cooling: In fusion devices, forced flow cooling ScienceDirect.com is used to manage the temperature of superconducting magnets using helium

#25 Re: Meta New Mars » Daily Recap - Recapitulation of Posts in NewMars by Day » 2026-03-08 17:38:11

Trying to do without prefilling of numbers being generated making use of excel and auto fill to do my best

starting post is carried from the previous days 3-07-2026 last number for the day 238433 - last post 238442

3-8-26 postings

Martian Calender - I have created a martian calender...

Google Meet Collaboration - Meetings Plus Followup Discussion

Google Meet Collaboration - Meetings Plus Followup Discussion

Google Meet Collaboration - Meetings Plus Followup Discussion

Why Artemis is “better” than Apollo.

Mars Direct 3 is a Mars mission architecture developed by Miguel Gurre

Daily Recap - Recapitulation of Posts in NewMars by Day

Daily Recap - Recapitulation of Posts in NewMars by Day

Mars Direct 3 is a Mars mission architecture developed by Miguel Gurre