New Mars Forums

You are not logged in.

- Topics: Active | Unanswered

Announcement

#26 2017-12-31 19:41:55

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

It had been low the day before it seemed to have frozen and I had put in 20 dollars of fuel but did not think to treat it then but since the hard start have like you indicated put in a fleet dry gas and octane boost and have let it set to work its way in hopefully the temperatures will break next week.

On another note got a free Monitor 20 karosene fueled heater yesterday to drag around the house into the cellar doorway and spent most of the day plumbing up the exhaust to vent to the out side. Got kerosene into it but it still has not started to run....still looking for what might be its problem....

Temperatures are still near zero or a bit warmer and dropping to about -10 during the night stilll...

Offline

Like button can go here

#27 2018-01-01 17:25:29

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

Worked today on the monitor heater to diagnose why it was not starting, after many hours of reading and l is ato open the key areas I have found no fuel going into the burn chamber with glow plug getting warm. Plenty of fuel is in the tank and pan that it is draw from but from there it is needle valve controlled. Will need to drain the unit before going any further....

Here just another dumb means of the poor and others to escape and its effect is seen with the U.S. life expectancy falls for second straight year — as drug overdoses soar which the entitlements will begin going down....

Minimum wage rising in more than 3 dozen states and cities in 2018 according to a report by the National Employment Law Project. With 4.5 million workers around the country will benefit from 35 cents up to $1 dollar for some.

The federal minimum wage remains unchanged at $7.25 per hour, where it has stayed since 2009.

The 10 states raising the minimum wage as a result of legislation or ballot measures are: Arizona, California, Colorado, Hawaii, Maine, Michigan, New York, Rhode Island, Vermont and Washington, according to EPI.

The eight states increasing their minimum wage through automatic inflation adjustments are: Alaska, Florida, Minnesota, Missouri, Montana, New Jersey, Ohio and South Dakota.

Cities hiking the minimum hourly rate for workers range from several in California to New York City and Washington, D.C.

Sort of means the cost of everything is to high is a city needs to additionally boost the low wages.....

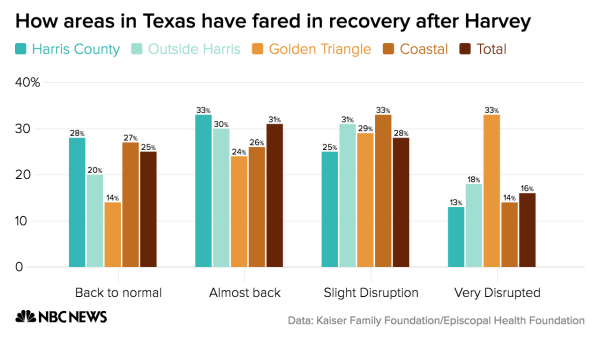

New poverty areas are also on the rise as a result of the huricanes....

Harvey-hit Texans still struggle with recovery amid housing challenges

The deepening cold is affecting 200 million and is stated to be why 5 are reporting to be dead from its grip of near zero temperatures.

Offline

Like button can go here

#28 2018-01-01 22:11:35

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

For homeless people, the cold is life-threatening

New Year’s Day brought to the city of Boston the fifth consecutive day of temperatures below 20 degrees, and fears from officials and homeless people that the sustained frigid weather was taxing the city’s resources and imperiling the lives of people on the streets.

Record cold is being set not only for temperature but also for duration...

Across the city, Greene said, about 1,700 people have filled the shelters -- several hundred more than usual. City shelters and places like the Pine Street Inn have added extra beds, he said, and South Station has opened for overnight emergency shelter-in-place. City and shelter workers have been out 24 hours a day driving outreach vans, handing out food and blankets and trying to get people to come to shelters.

But about 40 people around the city have refused to come inside, said Greene. Many of those people, said Greene and others who work in shelters, have serious mental health issues that keep them from making good decisions. Some of them are struggling with addiction, or become overwhelmed in crowded shelters. Those are the people at the highest risk, officials said.

Which says that the healthcare system is failing them...

Offline

Like button can go here

#29 2018-01-05 11:10:41

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

A poll that I saw had these as income brackets:

Your annual household income?

8% $0-$24,999

34% $25,000-$74,999

31% $75,000-$124,999

15% $125,000-$174,999

12% $175,000 and up

So where is middle income? I guess it would depended on how many brackets are used.....

Offline

Like button can go here

#30 2018-01-05 14:13:21

- Terraformer

- Member

- From: The Fortunate Isles

- Registered: 2007-08-27

- Posts: 4,000

- Website

Re: Why do we have Poverty in America

That second bracket is... quite the range. The upper end is 3x the size of the lower end. That's a big difference.

The median income in America, the last time I checked, was $56k/year. So middle income would be that, plus-minus some number. If income is approximately normally distributed, we can call the middle 50% middle income.

Use what is abundant and build to last

Offline

Like button can go here

#31 2018-01-05 18:45:10

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

To which a household implies 2 wage earners...so at middle income neither are making enough to live on.

I think the other table refers to the number of children in the household for the state % but still not sure...

Offline

Like button can go here

#32 2018-01-06 16:59:59

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

The poor and homeless will live in just about anything from carboard refrigerator boxes, tents, dumpsters, cargo containers, run down trailers ect.. to which these are shelter from the elements such that they are and what can be afforded due to the individuals ability. So whats a little from others that will claim they know best when most of our grand parents can remember no running water, indoors toilets and a few dirt floors to name just a few things. So why should some one be forced to give up there own paridise to which they have come to know as home.

Told their treehouse must go, owners appeal to Supreme Court

Lynn Tran and Richard Hazen built a Florida beachfront treehouse that would be the envy of any child. It's got two levels, hammocks and windows looking out on the Gulf of Mexico.

But the hangout has cost the couple a handsome sum: about $30,000 to construct and probably five times that in legal fees as they've fought local authorities over it, Tran said. Now, they're at their last stop, the Supreme Court. Unless the high court intervenes, the treehouse must be torn down.

Treehouse owners U.S. Supreme Court plea: Give us a chance

Offline

Like button can go here

#33 2018-01-07 02:50:28

- RobertDyck

- Moderator

- From: Winnipeg, Canada

- Registered: 2002-08-20

- Posts: 8,394

- Website

Re: Why do we have Poverty in America

I realize a lot of people criticize Donald Trump. And he did a lot of things that I disagree with. But one major reason he was elected was to reduce the excessive unreasonable overbearing regulation that exists within the United States today. That problem exists in every developed country of the world, but Donald Trump is POTUS. This is an example. WTF! This couple built a treehouse on their own property, but have been ordered to demolish it. It's their property! Furthermore, they did inquire about permits before they built it, were told that permits were not required, but now some (expletive) civil servant demands they destroy it.

Offline

Like button can go here

#34 2018-01-07 10:37:12

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

If the permit conversation was in writting it would have been better and the structure would have been grand-fathered. Even the anonymous needs to be documented.

Offline

Like button can go here

#35 2018-01-07 12:54:41

- GW Johnson

- Member

- From: McGregor, Texas USA

- Registered: 2011-12-04

- Posts: 6,178

- Website

Re: Why do we have Poverty in America

There's something fundamentally flawed about a society that relies on bureaucracies in order to function. They all inevitably tend toward the infamously brain-dead way India operates its civil society today. We haven't invented but one countering pressure for this creep so far: the tools for good government that my grandfather told me about before he died back in 1965.

He said they were tar, feathers, guns, and ropes! I believe he was right.

In his day, government worked without being very brain-dead bureaucratic at all. In my father's day, we let the lawyers and judges talk us out of using them. Now in our day, look at the travesty we live under.

Compared to that, brain-dead stupid politics and politicians (of either side) are small change, as devastating as they are.

Keep your powder dry and your weapons unregistered. We're going to need them.

GW

Last edited by GW Johnson (2018-01-07 12:57:00)

GW Johnson

McGregor, Texas

"There is nothing as expensive as a dead crew, especially one dead from a bad management decision"

Offline

Like button can go here

#36 2018-01-07 17:29:59

- RobertDyck

- Moderator

- From: Winnipeg, Canada

- Registered: 2002-08-20

- Posts: 8,394

- Website

Re: Why do we have Poverty in America

In this post in the Politics thread, I posted what I actually received in Canada for welfare. In post #24 of this thread, SpaceNut posted how much is paid in the state with the highest welfare budget. Pennsylvania website for welfare here states an single adult will receive an amount that varies by county: from $215 to $174/month. Any earned income is deducted from that. There is also medical assistance and SNAP (Supplemental Nutrition Assistance Program). There's a clothing allowance for individuals in a rehabilitation center or residential school, not for a single adult living on his own. There's a budget for emergency shelter, but not for regular shelter. So using the case of a single adult who has a home, just no income, assistance is a lot lower than claimed. In fact, section 138.1 of this document states "The Family Size Allowance (FSA) which is granted to eligible persons or families to meet basic living expenses for food, clothing, shelter, utilities and incidentals."

The budget that I received in Manitoba was a "basic assistance" for food, clothing, incidentals, but didn't include shelter or utilities. As I said, they took my actual bills for shelter and utilities, averaged over the year to calculate the monthly amount. It added up to more than Pennsylvania pays per month, however, the Manitoba rate does not include medical or SNAP. The Canadian universal healthcare system means welfare doesn't have to pay most medical bills. There is some welfare coverage for dental, although very limited, but I had received welfare for a few years before I learned it existed. I had been told you have to be on welfare continuously for a year to qualify, and they kept kicking me off when I got income from temporary or casual employment. I later learned that the one year qualification period was rumour, it wasn't true. But it meant it was years before I saw a dentist.

So the amount claimed in that news article is highly questionable.

Last edited by RobertDyck (2018-01-08 01:56:42)

Offline

Like button can go here

#37 2018-01-07 17:31:14

- RobertDyck

- Moderator

- From: Winnipeg, Canada

- Registered: 2002-08-20

- Posts: 8,394

- Website

Re: Why do we have Poverty in America

The reason this came up again is this appeared on Facebook.

Offline

Like button can go here

#38 2018-01-07 18:37:37

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

When I was in need of help I had to tell them what type of help that I wished to recieve as they were bound by there procedures to be not able to tell me what they could offer for help. This was also true for the unemployment office as well.

They seem to use lots of fuzzy numbers for what you actually pay when they go about calculating the amounts of benefits that you will recieve.

Offline

Like button can go here

#39 2018-01-12 19:38:49

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

So walmart is to pay $11 for its wages but its still neaar poverty levels and worse as you add in family members and not a second source of income.

https://www.cbo.gov/sites/default/files … umWage.pdf

Each state has tables with the cost of living in there state adjusted...

Offline

Like button can go here

#40 2018-01-16 20:49:51

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

After shelter, food, water the next is energy in any form or type to make use of. The applications of this energy makes mans life richer but his wallet takes a hit for this comfort. The use of buses do help transportation and some areas they are a means to get to work and other places at minimal expenses if you have the time between bus rus. Bicycles can fill some of the gaps but not always so why not create a small light weight hybrid auto that uses supplemental pedaling, batteries, solar and any other means to keep costs dwn. If you only travel and hour at 30 mph travel speed then this could be very practicle in the cities.

The use of low speed windmill generators can create 30 kws which would over the course of pedalling would refill the batteries for extended use, with solar possibly finish that job on a good days light. Now to learn about flywheels and how to store for the generator to use that pedaling power from. A weighted flywheel provides extra power and smoothes out the pedal fatigue.

Just a few things that APPLICATIONS OF HUMAN POWERED MACHINES.

1. Domestic Use: A bicycle - powered soap - making machine, Pedal - powered and hand - cranked grain mills, Coffee mills or Coffee pulpers, Food mills, Strainers and Juicers, Ice cream makers, Washing Machine, Sewing Machine, Water Pump, etc.

2. Commercial and Industrial Use: Hand - Cranked tool Sharpeners, Pedal Power Grinders and Tool Sharpeners, Foot Powered Scroll Saws, A Stationary Bicycle and Dual Wheel Bench Grinders, A Treadle Powered Lathe, Potter‘s Wheel, Tire Pumps, etc.

3. Agricultural Use: Pedal Operated Chaff Cutters, Hand Operated Threshers, Pedal Operated Threshers, Treadle Powered Threshers, Hand Operated Winnowers, Pedal Operated Winnowers, Pedal Operated Irrigation Pumps, Cultivators, Seeders, etc.

4. Transportation: Bicycle, Bicycle Trailers, Cycle Rickshaw, Hand Cranked Tri-cycle, etc.

5. Electrical Generator: A Pedal Operated AC/DC Electrical Generator Unit.

6. Physical Fitness: A Bicycle Unit for Physical Fitness.

Offline

Like button can go here

#41 2018-01-16 21:05:59

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

Then again convert the energy to hydraulics and do even this:

Offline

Like button can go here

#42 2018-01-16 22:37:48

- RobertDyck

- Moderator

- From: Winnipeg, Canada

- Registered: 2002-08-20

- Posts: 8,394

- Website

Re: Why do we have Poverty in America

Then again convert the energy to hydraulics and do even this:

You have to put [ img ] tags around the URL for the image. I fixed it in the quote. Look at below the Message box where it says BBCode. Click that, it gives you all the tags you can use, with examples.

Offline

Like button can go here

#43 2018-01-17 04:11:10

- elderflower

- Member

- Registered: 2016-06-19

- Posts: 1,262

Re: Why do we have Poverty in America

Or you could put wedges in the end of your log and hit them with a big hammer...

Offline

Like button can go here

#44 2018-01-17 13:23:24

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

True but who would be more tired at the end of spliting that cord of wood? I am reminded of all the Giligan Island episodes by doing the research to see just how many ways that kenetic energy can be converted via the use of a bike pedaling....it also shows just how much energy from the powerlines have changed our world....

There are several homeless in the area that have bicyles as a vehicle of not only choice but as the means to get from one place to another with the belongings that they have. So a means to get there in an even more assisted way makes sense. One thing that can make life easier — an electric bike.

Electric bikes can help immigrant workers. But in New York, they're banned.

The age groups 40s, 50s and even 60s, an electric bike allows for them to traverse greater distances in less time. So if these are banned them make an small EV car that is a hybrid pedal power to beat them at the game....

Offline

Like button can go here

#45 2018-01-18 16:23:13

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

I know this feeling all to well as Most Americans can't cover a $1,000 emergency

Life happens: A broken-down car. A leaky roof. A broken bone.

Thats a very short list....

Only 39% of Americans say they would be able to pay for a $1,000 unplanned expense, according to new report from Bankrate. More than one-third of households had a major unplanned expense last year, the survey showed, with half of those costing at least $2,500.

Not good...

"In the last recession we had nearly 7 million people who were out of work longer than six months," noted McBride. "To someone who doesn't have any or very little extra funds, accumulating six months of expenses sounds like climbing Mount Everest, but that is the destination."

Been there too....

Here are fourtips to help bulk up your savings:

Save first, then spend

Have a portion of your paycheck go directly into a savings account, McBride recommended.

"Too many people try to save what is left over at the end of the month only to find out there is nothing left over. You have to flip the equation around: save first, then spend what is left over."

Start early

The best way to make saving a habit is to start early.

"The sooner you can get in that habit the better," McBride said. "If you can do it when you are young and not making much that, the habit will stick with you as your age and income grows."

Separate the money

Remove all temptation to spend your emergency savings by keeping the funds separate from your checking account.

Keep your emergency savings stash away from your checking account. "It has to be a dedicated savings account," suggested McBride.

Find the best savings account

Interest rates on savings accounts are still recovering from their tumble in the wake of the financial crisis, so it's a good idea to shop around to find the highest rates.

Currently, your best bet is likely an online bank account.

Some what easier said then done for some of these when there is no extra money....

Offline

Like button can go here

#46 2018-01-19 05:34:45

- Terraformer

- Member

- From: The Fortunate Isles

- Registered: 2007-08-27

- Posts: 4,000

- Website

Re: Why do we have Poverty in America

The median income in America is quite high, relative to other 1st world, western countries. If that many people (a majority!) can't cover a $1000 unplanned expense, then it's not a (material) poverty issue, it's people having screwed up priorities. Poverty, but poverty of virtue, not poverty of wealth.

Use what is abundant and build to last

Offline

Like button can go here

#47 2018-01-19 15:28:43

- kbd512

- Administrator

- Registered: 2015-01-02

- Posts: 8,518

Re: Why do we have Poverty in America

The median income in America is quite high, relative to other 1st world, western countries. If that many people (a majority!) can't cover a $1000 unplanned expense, then it's not a (material) poverty issue, it's people having screwed up priorities. Poverty, but poverty of virtue, not poverty of wealth.

Terraformer,

Exactly. People need to learn how to manage their money. Failing to plan is tantamount to planning to fail. Maybe everything just "works" without any plan whatsoever. My life experiences are that planning failures rarely, if ever, work well. If you're living on food stamps, you don't need to drive a Cadillac or Mercedes Benz. A Ford or Chevy will work just fine. Heck, a bicycle and bus pass can be made to work. When I had less money than I do now, I did a lot of walking and riding buses.

Offline

Like button can go here

#48 2018-01-25 20:00:06

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

Now that you know how much you can expect to bring home, you can divvy up your paycheck. Here's a general guide to help you budget your money to make sure your expenses are covered. You may have to make some adjustments for your situation. If you spend less on housing, for example, you can put the extra money from that category toward paying down debt. The dollar figures in parentheses are based on our above example of a $35,000 gross salary with a monthly take-home pay of $2,110 per month after taxes and other deductions.

.30% ($634) Housing

Budgeting for your housing expenses includes your rent or mortgage, utilities and other fees associated with managing your home. For example, your housing budget should include miscellaneous fees, such as monthly pet fees, if you rent. The total amount for housing should not exceed 30 percent of your after-tax income. If you earn $40,000 annually, then $1,000 per month is your limit. You can budget your housing costs further by setting a monthly spending goal for utilities and other payments. For example, you can set your housing payment to $700 per month and apply the remaining $300 to utilities, cable and other fees.

.10% ($211) Utilities and other housing expenditures (including renters insurance)

We start with utilities, such as gas and electric. Your actual cost will vary by your location, season and how well-insulated your apartment is. If you live in Las Vegas, for example, you'll spend a lot more on air conditioning this summer than someone in Minneapolis. But budgeting an average of $50 to $60 per month to power a one- or two-bedroom apartment should suffice. Many apartments come with garbage and water service included, so you may not have to worry about that.

For renter's insurance, a good policy can run about $200 a year-or $17 a month.

In terms of dollar figures, this actually breaks down pretty close to the lines of what things will actually cost you. Housing, of course, will vary depending on your location and also on whether you live alone or with roommates. Debt repayment is another wild card for which you may have to make adjustments. But for now, let's take a closer look at the utilities and household expenses categories.

Internet, Cable, Phone

You can save money on your Internet service by going back to the stone age of dial-up. You can find service for about $10 a month. But if that's too drastic for your lifestyle, consider getting high-speed service through your cable-TV provider. You can usually get a cut-rate deal for bundling services together. The national average cost for basic cable is about $15 a month-$30 for expanded basic, to which the vast majority of cable watchers subscribe. Add a high-speed Internet connection for $40, and you'd do well to budget $70 or so for the whole package.

You might save money on your phone bill by scrapping your land line altogether and sticking to your cell phone. (A bare-bones landline service typically costs about $20 to $25 a month.) Cell phone bills can vary widely by location, provider and, of course, your own personal use. But the average cell phone bill in the U.S. runs about $50 to $60 a month. If that's too steep for your budget, consider using a prepaid cell phone that charges you only for the minutes you use. If that's too conservative, you may have to look for other areas to cut back.

Total

Now let's add 'em all up: $50 for utilities, $17 for renter's insurance, $70 for cable and Internet plus $50 for your cell phone, and you're looking at $187 a month. We had budgeted $211, so that leaves you a $24 cushion for those months in which costs may vary. And if you live with a roommate, you may be able to share the cost of your utilities, cable and Web access, giving you even more leeway in your budget.

The benefit of the 50/20/30 rule is that it groups certain expenses together to make your budget easier to track. The 50/20/30 rule splits your living expenses into three main categories:

1.Fixed costs that stay the same month after month, such as your rent or mortgage, car payment, and cable bill. Fixed costs should take up 50% of your income.

2.Variable costs that can change from month to month, such as entertainment, groceries, and clothing. Variable costs should take up 30% of your income.

3.Savings, which should take up 20% of your income

Other Expenses

Clothing, food, toiletries, loans and related expenses also consume a large portion of income and the percentage of income required depends on family size, lifestyle and other factors. Ideally, you should not spend more than 15 percent of your income or $500 per month on these items if you earn $40,000 per year.

Taxes

The first rule of establishing a budget is figuring out your take-home pay. Remember, your salary is not the amount you take home. If your job pays you $60,000 a year and you're in the 25% tax bracket, then you'll pay about $10,800 in taxes on that income, leaving you with $49,200. That's about $4,100 a month that you can put toward living expenses and savings. (Note that your tax bracket, also known as your marginal tax rate, is not the rate you pay on all your income. Your effective tax rate is generally much lower

Transportation

Transportation plays a significant role in earning your income and covering this living expense is equally important. Your transportation costs should not exceed 15 percent of your after-tax income, or $500 per month for an annual after-tax income of $40,000. But, depending on your type of transportation, the monthly amount can get tricky or exceed 15 percent. For example, if you make a monthly car payment, your transportation budget becomes a fixed expense and added expenses, such as insurance, maintenance and gas, drive up the cost. If you use public transportation, you can better control the expense by purchasing discounted travel cards if your local authority offers them.

Transportation

If you own your car outright, $211 a month for transportation is a good estimate-perhaps even too high. But if you have a car loan, your monthly payment will probably be more than $211 to begin with, let alone the money you'll spend on gas, parking, maintenance and repairs. So before you rush out after graduation to buy your first set of wheels, make sure you are aware of the real cost of buying a car. For maintenance and repairs, you should budget at least $500 a year, or $42 a month-maybe more if you're buying an older car.

For gas, let's assume you drive 1,000 miles a month and your car averages 23 miles per gallon. You'd need to budget $117 per month with prices at $2.70 per gallon. That leaves only $52 for a car payment, parking and other transportation expenses. Clearly, not enough. (And, of course, wildly fluctuating gas prices can throw a curve ball here.)

Remaining Income

You should allocate the remaining 40 percent of your income to a mixture of non-essential, but important living expenses, such as entertainment, dining out, savings and debt repayment. Allocating 10 percent of your income to each category further helps control monthly costs. For example, you could spend approximately $133 per month on restaurants, medical bills and movies. The remaining $133 can go into a long-term savings account for emergencies and other financial goals.

Growing your savings

Once you distinguish between your essential costs and those that are "wants" more than "needs," you can work on making changes that allow you to build your savings. While the majority of your income will probably go toward your living expenses, make sure your budget leaves you enough room to save money as well. Your first savings goal should be to put together an emergency fund with enough money to cover three to six months' worth of expenses. From there, you should work on saving for retirement. Many financial experts recommend saving at least 10% of your income for retirement, and the sooner you begin, the more time you'll have for that money to grow. You may start off by saving a small sum each month and increasing that amount gradually, but the key is to make saving a priority regardless of how much money you earn.

Debt repayment

As for debt repayment, a college senior graduates with at least $20,000, on average, in student-loan debt. If you fall into that camp, you'll spend $230 a month on a standard ten-year repayment schedule at 6.8 percent interest. You may need to negotiate a different time schedule with your lender, say, a 15- or 20-year repayment. Or you can ask for a graduated repayment schedule where you pay less per month now, but more toward the end of your loan period. There is also an income-contingent repayment which bases your bill on a percentage of your actual salary.

The average college senior also graduates with $3,300 in credit card debt. At 18% interest and paying $80 a month (4 percent minimum payment of initial balance), it'll take you about 2½ years to rid yourself of that debt. And that's assuming you don't charge another dime.

Now if you have any money to put into the category of savings, paying down debt. entertainment. extra food not a home ect....

Then you can even further refine the percentages as you come up with you working budget.

.15% ($317) Food (at home and away)

.10% ($211) Transportation (including car loan)

.10% ($211) Debt repayment (student loans and credit cards)

.10% ($211) Saving.

. 5% ($106) Clothing

. 5% ($106) Entertainment

. 5% ($106) Car insurance and miscellaneous personal expenses

That all said once you plug in the real numbers you may find that the percentages do not work and the pay check does not go as far as it should you just found that you really was poor and are not able to come up with that $1,000 in a pinch....

Offline

Like button can go here

#49 2018-01-28 19:04:24

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

Don't Count on Social Security's Minimum Benefit to Be There for You

Most workers count on Social Security to provide vital benefits after they retire, and the system plays an important role in keeping older Americans out of poverty. The way Social Security benefits are calculated acts to replace more income for low-income workers than for those who earn more during their careers. If you decide to take benefits early, then you'll get correspondingly less -- as much as 25% to 30% less at age 62, depending on when you turn 62 and therefore what your full retirement age is.

Sounds like its failing....

Researchers at the CBPP used the Census Bureau's definition of poverty, which in 2015 meant $11,367 or less for an elderly individual, $14,342 or lower for an elderly couple, and $24,257 or less for the average family of four, and compared poverty rates for the elderly (ages 65 and up), adults (ages 18-64), and children (under age 18) with and without Social Security benefits.

Offline

Like button can go here

#50 2018-01-30 17:50:18

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,646

Re: Why do we have Poverty in America

Seem so long ago now but the cold that gripped much of the US is now being tallied up for the protective shelter that helped the homeless as well as the needy that did not have heat.

Officials set sights on permanent warming shelter

If local municipalities were to model a seasonal overnight warming shelter on Rochester’s temporary facility, officials estimate it could cost more than $46,000 to operate every two weeks.

That figure is a ballpark total calculated based on the staffing, food and other costs Rochester’s regional shelter was able to absorb largely through donations and volunteers while the shelter served more than 80 homeless and needy individuals between Dec. 28 and Jan. 11, according to Tory Jennison, director of population health for the local region of the Integrated Delivery Network.

Rochester’s temporary warming shelter opened because of the historic cold snap that began in late December. The $46,5000 cost estimate was made public during a two-hour “after-action meeting” last Friday, a meeting that served as the primary debriefing following the closure of the warming shelter.

Nearly half of the estimated cost estimate is due to roughly $20,000 worth of free volunteer staff labor, a key reason why officials say the facility was possible in the first place. Jennison said more than 40 individuals donated more than 1,000 staff hours to run the warming shelter. The $20,000 estimate was calculated based on three staff members working six four-hour shifts a day at $20 an hour.

In addition, the Rochester warming shelter received $12,000 in food and meal donations from local restaurants, organizations and community members, said Jennison.

Listen: Latest From the NewsroomAnother $2,500 in private monetary and gift card donations funded various supplies and clothing for the individuals served at the warming shelter. Thousands of unquantifiable articles of clothing and other supplies were also donated to the shelter. Jennison said all of those items have since been distributed to the sheltered individuals and the area agencies that serve vulnerable populations.

The IDN paid $6,000 to buy 25 cell phones, six phone cards and various clothing. Jennison said the money was also used to cover transportation and behavioral health support staff. The social service agencies that operated the warming shelter conducted more than 60 assessments and coordinated wraparound services during the facility’s two-week operation.

Individuals connected with the warming shelter also spent $6,000 of their own money to buy groceries, toiletries and other items for sheltered individuals before donation mechanisms were in place, according to Jennison.

Frisbie Memorial Hospital and Cleary’s Cleaners also partnered to provide $1,200 in laundry services during the shelter’s operation, according to Jennison.

The remaining portion of the estimated cost of the Rochester warming shelter — $478.65 — is the exact cost incurred by the city of Rochester.

Offline

Like button can go here