New Mars Forums

You are not logged in.

- Topics: Active | Unanswered

Announcement

#3026 2025-10-26 17:55:15

- kbd512

- Administrator

- Registered: 2015-01-02

- Posts: 8,517

Re: Politics

RobertDyck,

We're going to start manufacturing more of what Americans need / want, right here in America. Canada is welcome to do the same and I think Canadians should do that, for their own economic benefit. You can continue complaining about President Trump until the cows come home, and no doubt will, but that is the only program America is running right now. President Biden ran the same program, even though more of it was directed at manufacturing that America previously outsourced to Asian countries. That means the past two Democrat and Republican administrations were broadly aligned on how we're handling trade policy going forward, if not the optics of how to present actions taken to the general public. Whether the media sensationalized it, as they did under President Trump, or not, under President Biden, is irrelevant to actions taken. Protectionism is either universally bad, or it's "do as I say, not as I do". If the former were true, then other nations, such as Canada, wouldn't practice it. If the latter is what they're aiming for, then that game is over, because we're not playing it with them anymore.

Globalism is dead. It's not sustainable. America is walking away from globalism because it's proven to be wasteful and ultimately self-destructive. As Peter Zeihan frequently points out, the post-WWII Global Order established by the US was never an economics-based proposition for America, merely a bribe to allied nations to permit America to determine how to fight the Cold War against the Soviets without starting WWIII in the process. That issue was successfully resolved about 35 years ago, without firing a shot. The old Imperial Order would've already fought WWIII. Right about now, we'd probably be using sticks and stones to start fighting WWIV. Thankfully, none of that happened, due in no small part to American military leadership. Whatever their character flaws and personal shortcomings, you're not speaking Russian or glowing in the dark, so our military strategy worked, despite all the real or imagined mistakes we made.

You think we should continue doing what we've been doing, which has been highly detrimental to American families and our national economy, for the purpose of making rich people richer and selling an endless variety of cheap products to people becoming ever-poorer from outsourcing. The issue is that many people are no longer buying it, because they can't afford to, and they're no longer convinced that a bewildering array of meaningless choices are better than a few choices made about things that truly matter. Bread and games hasn't solved any problems. However brilliant or errant our new strategy is, we're attempting to turn a page by re-shoring manufacturing. It's no longer "business as usual". The American electorate has voted out status quo candidates during the past 3 election cycles, including President Trump. There's an object lesson in there somewhere, as it relates to what the majority of Americans think about our present economics problems. The men in this country, especially young men, aren't interested in purchasing more or cheaper trinkets, nor do they view bread and games with favor. They certainly don't care about making rich men richer. A growing number of them want to build something worth having. They'd rather do business with people they know, and they're willing to forego endless variety if that means a better tomorrow. Many of them think the current economic system leaves few realistic paths to family formation, which they do value but see as unrealistically achievable because they cannot give their prospective wives a comfortable middle class lifestyle on a single income. A lot of them are turning back towards traditional religions, which offer something no amount of money / fame / business success ever could- faith in a purpose beyond pure selfishness and hedonism. Radicals either don't understand this or refuse to place any value in it.

At the same time, the political left has had an endless series of identity crises stemming from the fact that they don't have, let alone share, any core values that they actually uphold. They reactively wander between crusades against whatever they've been instructed to hate at the present time. That has caused the working public to part company with liberalism and the Liberal / Globalist Economic Order. Most people aren't built to exist in a "never ending now", because it's exhausting and empty. The left's worldview has all the worst predilections of a dogmatic religion combined with the socially corrosive class warfare of socialism, with none of the other redeeming qualities of the traditional religions. Their religion offers only everlasting bitterness and enmity. They don't believe in any form of non-performative compassion or forgiveness of their neighbors, which alienated large swaths of the American electorate as a result. Their behavior is endlessly punitive in nature for merely voicing disagreement with their beliefs. You'd have to be naive beyond belief, scared beyond reason, or simply lack any introspection to think the mob won't eventually turn on whomever / whatever you represent to them. That doesn't describe most people. You can't remain naiver forever, the strongest fear eventually leads to numbness, and everyone will eventually catch an eyeful of their reflection in the mirror- most won't like what they see.

How else do you provide inter-generational prosperity and social mobility to your own people without locally making the things they use every day?

Offline

Like button can go here

#3027 2025-10-26 18:03:09

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,305

Re: Politics

Trump is trying to rebuild the US domestic manufacturing base, as it existed in the 1970s. The problem is that we live in a very different world today to the one he would have known as a young man. The demographics of the workforce are different. The workforce has gotten older throughout the world, but especially in Western countries. Energy is more expensive.

To a great extent, globalisation was an attempt at keeping production costs down by relocating manufacturing to places where energy was cheaper, the workforce was younger and environmental regulations were weak or absent. But there is more to globalisation than just that. Many products cross national borders multiple times before they are finished. Different parts of the manufacturing process require labour at different price points and skill levels. It isn't as simple as saying that a car is made in Mexico or Japan. In the modern manufacturing system individual components may cross national borders multiple times for specific manufacturing processes that just happen to be most efficient in a particular place.

Tariffs risk disrupting trade arrangements that took many years and a lot of dollars to set up. They also ignore the reality of how products are produced in the modern world. Tariffs are a tax on consumers not producers. The additional revenue that the US government is receiving is coming directly from the US consumer, who is now paying higher prices. This is a direct source of inflation that erodes consumer purchasing power. This is on top of the post-COVID inflation that had already eaten into wages. So consumer spending is going to be squeezed on both sides.

Last edited by Calliban (2025-10-26 18:12:06)

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#3028 2025-10-26 18:31:45

- RobertDyck

- Moderator

- From: Winnipeg, Canada

- Registered: 2002-08-20

- Posts: 8,394

- Website

Re: Politics

Ford is expanding their Oakville Ontario assembly plant so it can assemble F-150 trucks. Vehicle manufacture involves parts moving back and forth across the border many times. Tariffs charged every time. Ford chose to move all manufacturing for F-150 out of the US, so tariffs will only be paid once, when the finished truck enters the US.

So what were you saying about manufacturing moving?

Offline

Like button can go here

#3029 2025-10-26 18:39:32

- RobertDyck

- Moderator

- From: Winnipeg, Canada

- Registered: 2002-08-20

- Posts: 8,394

- Website

Re: Politics

Moving manufacturing back to the country makes sense, but you have to be strategic. Destroying Canada-US trade does not make sense, is harmful. Move manufacturing from overseas back, don't attack Canada or Mexico.

Offline

Like button can go here

#3030 2025-10-26 21:22:39

- kbd512

- Administrator

- Registered: 2015-01-02

- Posts: 8,517

Re: Politics

RobertDyck,

Since, offshoring didn't happen over 4 or even 10 years, reshoring won't be complete inside of 4 or even 10 years, either. Nobody here in America is "attacking" Canada or Mexico. Canada's worst enemy is its leadership, or lack thereof, not America, and certainly not President Trump. He sees Canada as a failing state on the basis of demographics, and Mexico as a state overrun by criminals in addition to poor demographics, neighboring failing states at that, hence his stream of commentary on this topic.

Try taking the point for once, instead of the entire arrow. If President Trump truly did not care about Canada and Canadians, then he would simply sit back and say / do nothing about it, and pretend everything was "fine". It's not fine, though, is it. Canada's demographics are horrific. City busy bodies quit having kids, and nothing we say or do is going to fix that. That's a "you problem". No kids equals no future. Your ideology and ways of doing things die with you. Liberalism and globalism has become a self-correcting problem. People who are so "airy-fairy" that they don't think a future generation is necessary are doomed to historical and cultural irrelevance. Getting upset at me or President Trump for pointing that out, however crudely, doesn't solve the problem.

Prove me wrong. Create some children of your own. Hopefully you'll learn how to value someone beyond yourself in the process. Get some first-hand experience with being "talked-at" instead of "talked-to", when your kids come home from school with ideas put in their heads by dictionary definition crazy people. That's been so much "fun" for me to deal with. The entire process of attempting to raise children with some basic direction and morals has been a very humbling endeavor- one which has made me appreciate my own parents ever-more as the years pass me by. Whatever their mistakes, I could never claim that they did not do the best they knew how. Invest in our collective futures instead of complaining about what went wrong with our past. Pour some of that anxious energy into something more productive than getting overly-upset at whomever is currently in power. That's what long term thinkers do. They don't fixate on one generation of problems because they view the world in terms of multi-generational patterns and dynamics. Today's problem is tomorrow's opportunity, but attitude and perspective truly do matter.

States That Have Lost the Most Manufacturing Jobs Since the Turn of the Century

States That Have Lost the Most Manufacturing Jobs Since the Turn of the Century, by ETQ

After decades of offshoring, the United States is attempting a manufacturing revival. Under the Biden administration, federal programs like the CHIPS and Science Act, the Inflation Reduction Act, and the Infrastructure Investment and Jobs Act directed hundreds of billions toward reshoring critical industries. More recently, President Trump’s sweeping tariff agenda has added new pressure to relocate production back to U.S. soil.

Together, these policies aim to rebuild domestic capacity in high-priority sectors such as semiconductors, pharmaceuticals, and clean energy. Across the country, companies are pouring money into new factories and expansion projects, with federal leaders frequently touting job creation as a central outcome of this industrial strategy.

But while reshoring may help reverse some losses, it is unlikely to restore manufacturing employment to its former scale. The modern factory floor is leaner and more automated than in decades past. The number of U.S. workers employed in manufacturing has dropped sharply over the last two decades—even as output has continued to grow. To assess the full picture, researchers at ETQ—a quality management platform for the manufacturing sector—analyzed data from the U.S. Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA), examining how manufacturing jobs have changed nationwide since 2000, which sectors and states were hit hardest, and the disconnect between employment trends and output.

Key Findings

U.S. manufacturing has become more productive but less labor-intensive: Despite a loss of over 4.5 million manufacturing jobs since 2000, real manufacturing GDP grew by 45%, revealing a sharp disconnect between employment and output.

Tech and printing sectors were hit hardest: More than 750,000 computer and electronics manufacturing jobs and over 450,000 printing jobs disappeared between 2000 and 2024.

The industrial Northeast suffered the steepest declines: States like New York, Rhode Island, and Massachusetts lost over 40% of their manufacturing workforces, more than any other region on a relative basis.

Only a handful of industries and states bucked the trend: Food manufacturing and beverage manufacturing were the only sectors to see net job growth. Nevada was the only state where manufacturing jobs grew faster than total private-sector employment.

Automation, not offshoring alone, explains the shift: The majority of states increased their manufacturing GDP while shedding jobs, pointing to rising productivity and a shift toward advanced, less labor-intensive manufacturing.

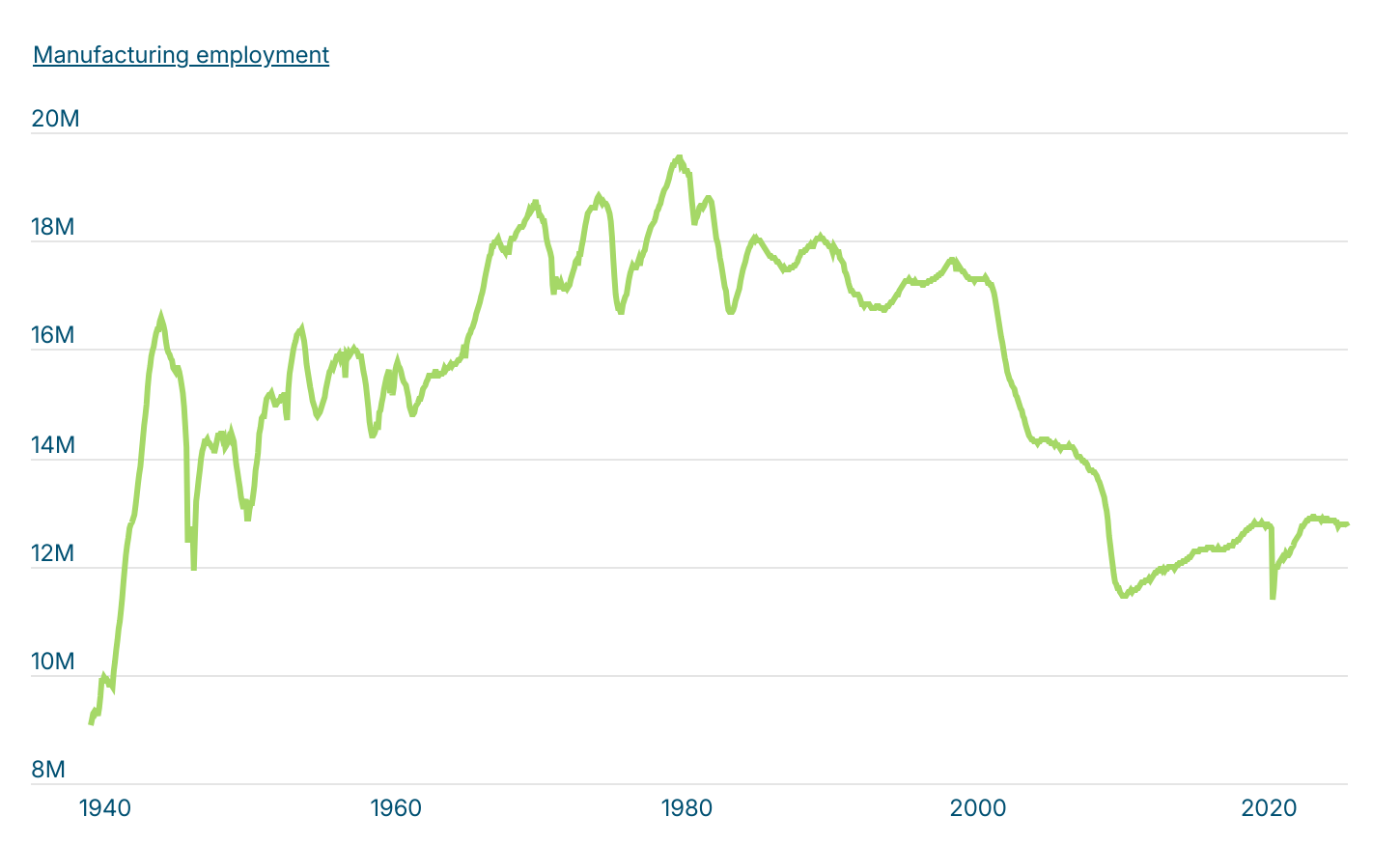

Source: ETQ analysis of U.S. Bureau of Labor Statistics dataU.S. manufacturing employment has followed a century-long arc—growing rapidly through the early 20th century, peaking in the late 1970s, and declining sharply in the decades that followed. From 1900 to 1945, industrial expansion and wartime production drove strong job growth. The postwar boom pushed manufacturing employment to a record 19.5 million workers in 1979, sustained by high demand and strong unionization.

From 1980 to 2000, U.S. manufacturing employment declined gradually as automation and rising global competition began to reshape industrial production. But between 2000 and 2010, job losses accelerated sharply—driven in large part by China’s entry into the World Trade Organization in 2001 and the ensuing “China Shock,” which triggered a wave of offshoring and plant closures across the U.S.

Since 2010, the sector has seen a modest recovery, but these efforts have not reversed long-term losses. Between 2000 and 2024, the U.S. shed over 4.5 million manufacturing jobs—a 26% decline—despite a 45% increase in real manufacturing GDP, according to the BEA. New technologies, automation, and process efficiencies have enabled producers to do more with fewer workers, underscoring a central tension in the reshoring debate: rebuilding industrial output doesn’t always mean rebuilding employment.

Manufacturing Job Losses by Sector

More than three-quarters of a million U.S. tech manufacturing jobs have disappeared since 2000

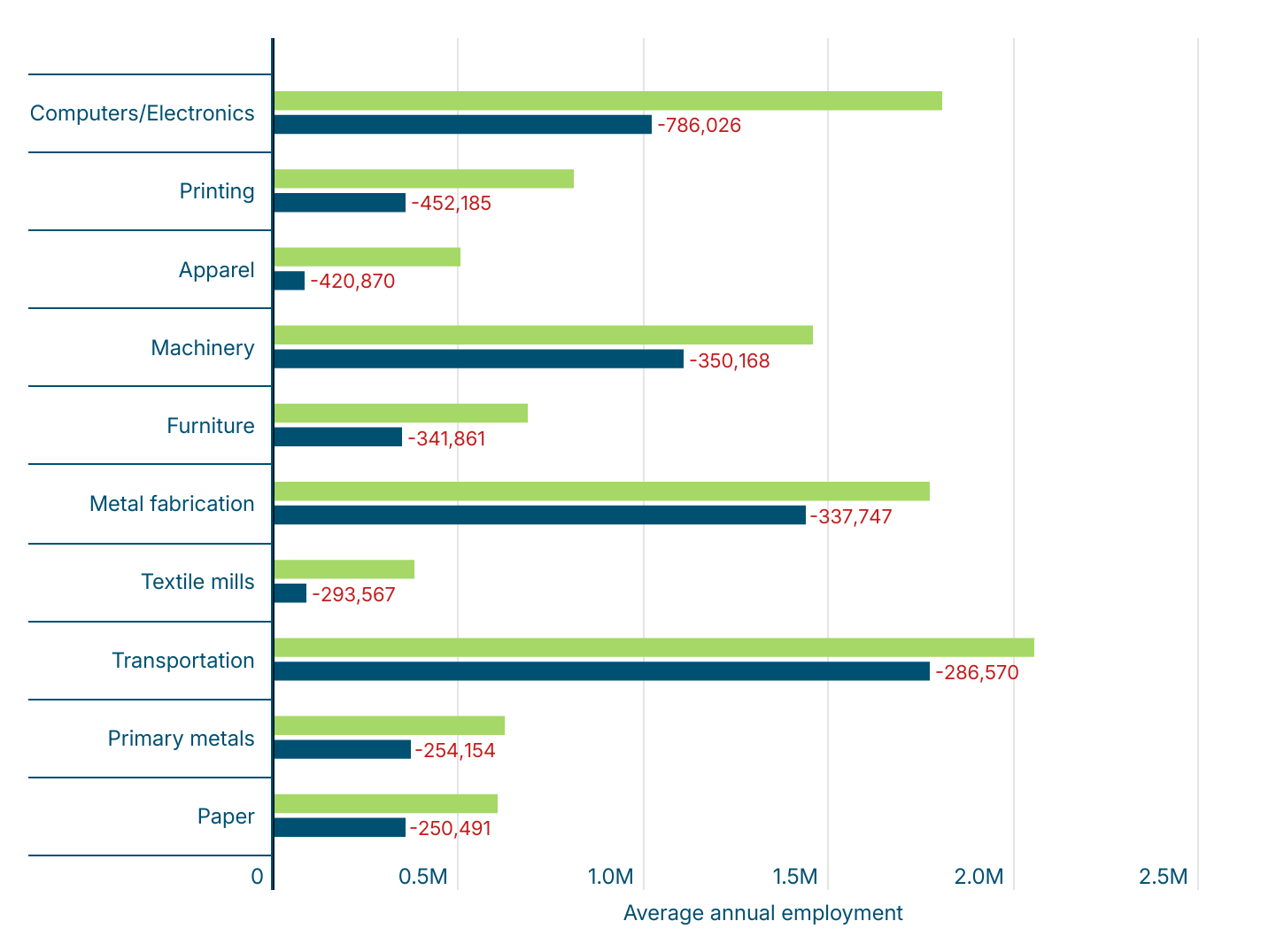

Source: ETQ analysis of U.S. Bureau of Labor Statistics dataNot all parts of the manufacturing economy have experienced the same level of job loss. Since 2000, employment in computer and electronic product manufacturing has fallen by 786,000 jobs, a decline of over 43%. Other sectors with substantial losses include printing and related support activities (-452,000), apparel manufacturing (-421,000), and machinery manufacturing (-350,000).

On the other hand, some sectors have remained more resilient. The food manufacturing sector and the beverage and tobacco product manufacturing sector are the only two to report job gains since 2000. These gains reflect increased domestic demand and relative insulation from offshoring, as many food-related manufacturing jobs remain tied to local agricultural supply chains and consumer markets.

States That Lost the Most Manufacturing Jobs

Rust Belt states, along with California and North Carolina, have lost the most manufacturing jobs

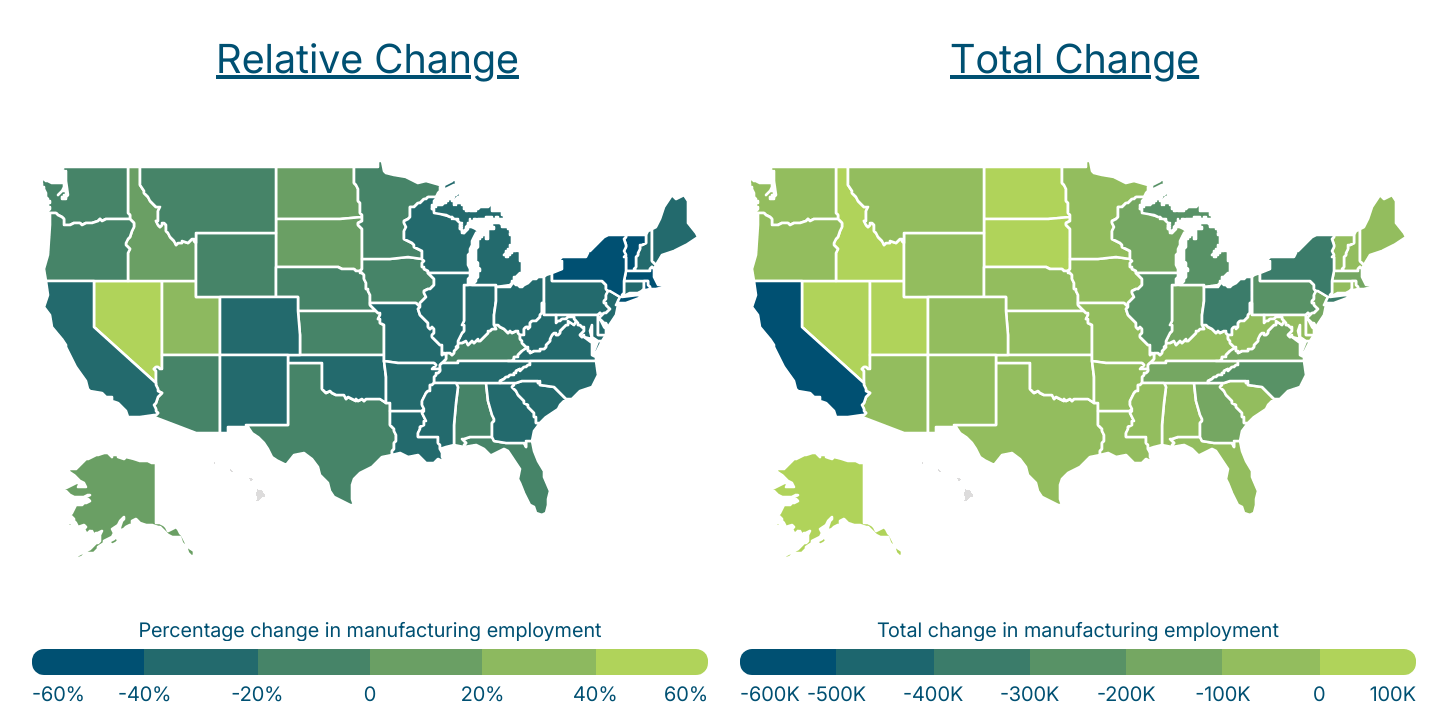

Source: ETQ analysis of U.S. Bureau of Labor Statistics dataManufacturing job losses have been most pronounced in the Northeast and Midwest, where many states were historically tied to heavy industry. When measured by percentage decline, the steepest losses occurred in the Northeast:

New York saw a nearly 45% drop in manufacturing employment between 2000 and 2024, shedding more than 330,000 jobs.

Rhode Island, Massachusetts, and Vermont also lost more than 40% of their manufacturing jobs during this period.

The states that reported the most total jobs lost were more geographically diverse, spanning the East Coast, Midwest, and California:

California, the nation’s largest manufacturing state by output, lost nearly 615,000 jobs.

Other major losses occurred in Ohio, New York, Pennsylvania, North Carolina, Illinois, and Michigan, each of which lost between 290,000 and 340,000 jobs.

Nationally, manufacturing employment fell by 26.5% between 2000 and 2024, even as overall private-sector employment grew by approximately 20%. Nevada stood out as the only state where manufacturing job growth exceeded the rate of overall job growth—driven largely by its expanding advanced manufacturing sector, including battery and electric vehicle production. A handful of other states—Utah, North Dakota, South Dakota, Idaho, and Alaska—also added manufacturing jobs during this period, though their growth trailed behind overall private-sector gains.

The Decoupling of Manufacturing Employment & Output

Manufacturing GDP has grown in all but four states, despite job losses

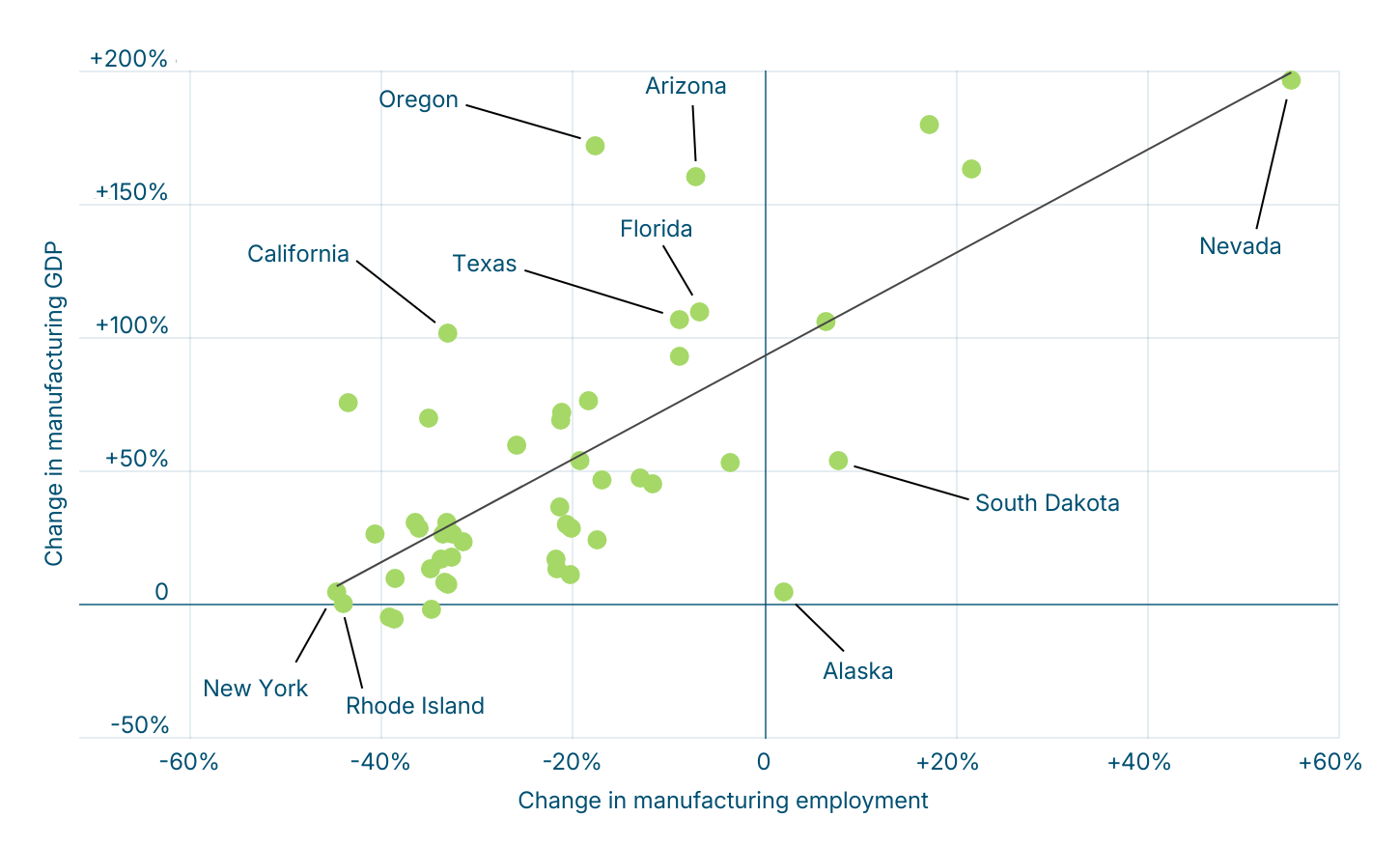

Source: ETQ analysis of U.S. Bureau of Labor Statistics and U.S. Bureau of Economic Analysis dataWhile most states lost manufacturing jobs between 2000 and 2024, nearly all saw gains in manufacturing output. All but four states experienced real, inflation-adjusted growth in manufacturing GDP over the period, highlighting a growing disconnect between employment and production.

As mentioned above, this divergence is driven by structural changes in the sector. New software, automations, and advanced manufacturing processes have reduced the need for manual labor, while high-value industries like pharmaceuticals, semiconductors, and aerospace generate substantial output with relatively few workers. As a result, many states have expanded their manufacturing economies without a corresponding increase in jobs—reflecting a broader shift toward capital-intensive, technology-driven production.

This trend is especially evident in states like Oregon, Arizona, Florida, and Texas, all of which more than doubled their manufacturing GDP during this period despite a net decline in manufacturing employment.

Final Thoughts

Reshoring manufacturing is central to U.S. economic and national security policy, but it’s unlikely to restore jobs at historic levels. Advances in automation and high-efficiency production mean that factories can expand output with far fewer workers. As a result, while reshoring may boost domestic manufacturing capacity, it won’t necessarily lead to widespread job growth.

Instead, it is creating demand for high-skilled, technical roles—positions that are increasingly hard to fill. The U.S. is projected to face a shortage of over 2 million skilled manufacturing workers by 2030, with hundreds of thousands of positions already unfilled. Closing this gap will require targeted investment in training and education. The success of reshoring will ultimately depend not just on bringing factories back, but on preparing workers for the jobs they require.

Methodology

Data for this analysis comes from the U.S. Bureau of Labor Statistics (BLS) Quarterly Census of Employment and Wages (QCEW) and the U.S. Bureau of Economic Analysis (BEA) GDP by State dataset. Changes were analyzed from 2000 to 2024. Only private-sector employment was included. Changes in GDP were inflation-adjusted using real chained-dollar values. Only states with complete data from both sources were included.

Offline

Like button can go here

#3031 2025-10-26 23:06:59

- RobertDyck

- Moderator

- From: Winnipeg, Canada

- Registered: 2002-08-20

- Posts: 8,394

- Website

Re: Politics

kbd512, this post makes you sound like a brainwashed MAGA nut. You're more intelligent that this. We've spoken many times, I know you're more intelligent than this.

Canada is not a "failing state", and you know it. Demographics is a serious problem for absolutely every developed country in the world, including the United States. Most developed countries have been compensating with immigration. Trump is obsessed with immigration, treating it as a problem. But the US has a fertility rate of 1.6. I've explained this before, but I'll do it again. You may expect that a married couple must have 2 children to ensure the next generation has the same number of people. But due to child deaths and other technical factors, the average across the country must be 2.1. Since families can have various structures, that's presented as 2.1 babies born per woman during her life. The US is currently at 1.6, which is not sustainable. Canada has a slightly lower fertility rate, but Canada accepts a significant number of immigrants. When Stephen Harper was Prime Minister (2006-2015), he increased immigration. His government emphasized immigration from places that leaned toward conservative values, in an attempt to create more voters for Stephen Harper's party. Justin Trudeau was Prime Minister 2015-2025 (spring of this year). He believed developed countries would have to compete for immigrants, so drastically increased the number of immigrants and actively encouraged mass immigration. He over did it. A lot! Canada doesn't have enough housing for them all, which has driven cost of housing way up. Canada's healthcare system can't handle this population increase either. Too many, too fast. But all these workers have benefited Canada's economy.

Ironically, the "patch" to the problem is actually making the core problem worse. One reason young people are not having babies, is they can't afford a house. Many young people feel they need a house with a yard to raise children. But housing costs are way too high. Bringing in immigrants too fast caused housing costs to skyrocket, which in tern caused people to have even fewer babies.

Canada is not a failing state, and Canada is not accepting a large number of criminals. That is political bullshit from Trump. The US Constitution states tariffs must be passed by Congress. The US did pass a law that states the President can impose tariffs under emergency conditions, to Trump just claimed those emergency conditions do exist. It's bullshit, just an excuse to allow him to impose tariffs.

As for illegal immigrants: there are far more entering Canada from the US than the other way around.

Anyone treating Canada as if it's the same as Mexico is either ignorant, or deliberately repeating political bullshit. Canada has a modern economy, on par with USA.

Trump wants to treat Canada as a vassal state. Canada is no such thing. Canada is an equal, partner, pier.

Offline

Like button can go here

#3032 2025-10-27 03:21:51

- kbd512

- Administrator

- Registered: 2015-01-02

- Posts: 8,517

Re: Politics

RobertDyck,

How else do you provide inter-generational prosperity and social mobility to your own people without locally making the things they use every day?

I'll keep asking that question until you provide a thoughtful answer. I'm starting to think that you don't have one, even while I hold out hope that you have a better solution.

kbd512, this post makes you sound like a brainwashed MAGA nut. You're more intelligent that this. We've spoken many times, I know you're more intelligent than this.

How many people have ever convinced you to change your opinion through ridicule?

We have fundamental points of disagreement over what policies America should implement. That's fine. I want policies that ultimately benefit working class Americans, because I believe our shared destiny is important. If I have to endure some economic pain and ridicule to achieve a better outcome for our children, then that is what I must do.

One reason young people are not having babies, is they can't afford a house.

Speaking of brainwashing, where does the belief that you first need a house with a yard, in order to have children, actually come from?

But housing costs are way too high.

As a percentage of income, housing costs today are no worse than what they were when my parents raised their four children, but fewer and fewer of us have memory of what life was like two or three generations ago. Interests rates today on home loans are dramatically lower than they were in the 1980s, which means the total cost over time is less than what it once was, as a total percentage of income. Whereas my parents' generation prioritized family formation and stable relationships, the current "city culture", which is driven exclusively by leftist agenda, prioritizes wealth accumulation and social status.

Anyone treating Canada as if it's the same as Mexico is either ignorant, or deliberately repeating political bullshit. Canada has a modern economy, on par with USA.

Nobody here is suggesting that Canada is exactly the same as Mexico. If you think what I wrote even attempted to insinuate that, then you performed some Olympic caliber mental gymnastics by reading something into what was actually stated, which went far beyond what was actually stated and meant.

Trump wants to treat Canada as a vassal state. Canada is no such thing. Canada is an equal, partner, pier.

If there was no money involved, what shared policy goals would America and Canada still pursue together, as partners?

Offline

Like button can go here

#3033 2025-10-27 10:10:29

- Void

- Member

- Registered: 2011-12-29

- Posts: 9,338

Re: Politics

There is this:

https://www.bing.com/videos/riverview/r … ee45c51a4c Quote:

The TRUTH about Trump's TARIFFS - Why Canada & China FAIL to Join the NEW AMERICAN DEAL

YouTube

Clyde Do Something

145 views

I will pick two topics to start with:

1) Carbon.

2) Robotic Labor/Electric Economy.

1) Carbon. In the previous world, the globalist one, (Mostly) America had to protect OPEC oil, notice that they are a cartel, to assure energy for Europe and East Asia, (Including China). Fuels had to be shipped across the seas. While water is low friction (P. Zeihan), it is a long distance. This also provided mischief money to cultures who want to forcibly convert us to their way of thinking and if possible, get on top of us.

If the continent of North America were all dry land, it might be justified to continue Ocean traffic to feed our coasts.

North America has several internal waterways though.

A) Mississippi and its tributaries.

B) Coastal for much of the East and Gulf coasts.

C) Great Lakes (I will give Canada 60% of the credit for that). But much of the most productive lands for that trade basin is American.

4) Large Ship Coastal which is both East and West Coasts.

So, we have a Low Carbon internal transport system.

https://en.wikipedia.org/wiki/Intracoastal_Waterway

Image Quote:

So, we reduce our Carbon footprint by internalizing such productivity as we can sustain with our own productive capacity.

We guard our Market, as who can access it may produce more Carbon to the atmosphere by long distance transport. Also, unfriendly actors overseas that get mischief money by selling into our markets, may force us to spend money on military actions which kill people and also produce more Carbon to the Atmosphere as we have to move massive military machines about the planet. Better to just take away their allowances and then spank them if necessary. It is preferred to take away their allowances and hope that they will repent of their ways.

Some areas of the continent require overland travel. It can't be helped, but now we are entering to Electric Transportation.

2) Robotic Labor/Electric Economy. Teala does more point the way on much of this, such as robots on wheels and robots on legs.

Coffee............

Robotic-Electric Trucks are emerging. Eventually they may even be autonomous. I don't need to mention that they will not burn as much Carbon. They probably will not yet use Aluminum or Sodium Batteries, but eventually they will likely do so. Those Batteries are reported to have enormous lifetimes. So, good chances that trucking will become "Green".

Robotic-Electric Cars are also emerging. Similar future. But there will likely be less of a need for people to own cars, so again "Green".

Leged Robots: Who as a Canadian, Robert, would you prefer to own the robots that service the American market? The USA or others such as China?

Your survival of Canada probably depends on a well-protected America.

We do detect your hatred and loathing. Your feeling of superiority. That was then, this is now. You don't have European powers to be of much use in maintain a hostile posture. I feel that Canada has been somewhat careless in some of its moves. You need to get with the team, or we have no choice but to remove you from the "Circle of Trust". (Ominous noise).

We had to carry a world against Marxist problems, while being snipped at from the socialist frenemies.

Atlas Shrugged and said "BULLSHIT!".

Ending Pending ![]()

Last edited by Void (2025-10-27 10:58:15)

Is it possible that the root of political science claims is to produce white collar jobs for people who paid for an education and do not want a real job?

Offline

Like button can go here

#3034 2025-10-27 15:08:31

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,613

Re: Politics

Business that have left the US

AI Overview

A variety of American businesses either left the U.S. or closed down entirely during the 1960s, a decade of significant shifts in the U.S. economy. This included the merger of prominent brands, the expansion of some companies into foreign markets, and the failure of many smaller businesses.

Acquisition and consolidation

The 1960s saw many companies become targets for acquisition, leading to the disappearance of once-familiar names.

Good Humor: The Ohio-based ice cream company, founded in the 1920s, was purchased in 1961 by the British-Dutch company Unilever.

Kinney Shoes: This shoe retailer, which started in 1894, was acquired by the F.W. Woolworth Corporation in 1963. It was later shut down completely in 1998, though its legacy remains part of Foot Locker.

Ling-Temco-Vought (LTV): In the 1960s, conglomerates like LTV expanded rapidly by acquiring other businesses. As the era ended, many of these highly leveraged companies saw their fortunes unravel.

American Motors Corporation (AMC): Formed by a merger in 1954, AMC struggled to compete with the "Big Three" U.S. automakers and was eventually acquired by Chrysler in 1979.

Expansion overseas

Many U.S. companies started moving production and expanding operations into other countries, spurred by foreign competition and changes in international trade laws.

Offshoring and nearshoring: U.S. manufacturing began moving to countries with lower labor costs. For example, some factories moved to Mexico, a process facilitated by customs laws that incentivized U.S. firms to conduct labor-intensive assembly operations there.

McDonald's: The fast-food chain expanded internationally in the 1960s, opening its first locations in Canada and Puerto Rico in 1967.

Business failures

For many small businesses and retailers, the 1960s were a time of increased competition from larger corporations.

Decline of small farms: Nearly a million small farms disappeared in the 1960s, consolidated into larger operations that benefited from new farming technologies and government subsidies.

End of an era for retailers: While some famous brands like Woolworth's, Montgomery Ward, and Gimbels wouldn't vanish until later decades, the 1960s marked a period of declining relevance as they struggled against newer competitors like discount chains.

Early signs of deindustrialization

While most major job losses happened later, the 1960s showed early signs of deindustrialization, particularly in the "Rust Belt."

Competition from Europe and Japan: By the mid-1960s, European and Japanese industries had recovered from WWII and began producing cars and other goods that competed directly with U.S. manufacturers.

Early manufacturing job shifts: The manufacturing sector began a longer-term decline in its share of total U.S. employment. The industry moved production to lower-cost domestic areas and, increasingly, overseas

Major US businesses did not "leave" the country in the 1970s, but many either declined, went bankrupt, or were acquired by international conglomerates due to significant economic turmoil. Key factors contributing to this trend included stagflation, increased foreign competition, and two severe oil crises.

Iconic brands that faded or were sold

Oldsmobile: At its peak, this General Motors brand produced America's best-selling car in 1976. However, it saw declining sales as flashier import models gained popularity in the following decades, and GM ultimately discontinued the marque in 2004.

Howard Johnson's: A roadside icon famous for its orange-roofed restaurants, Howard Johnson's was a popular fast-food chain that peaked in the 1970s. However, it struggled to adapt to new competition and evolving consumer tastes, with the brand's restaurant business eventually dissolving.

Woolworth's: The F.W. Woolworth Company, a beloved "five-and-dime" store chain, began facing financial difficulties in the latter half of the 20th century. While it survived into the 1990s, the company eventually closed its US stores.

Sunglass Hut: While the brand still exists, its American ownership ended in the 70s. Founded in Miami in 1971, optometrist Sanford Ziff grew the company to 100 stores by 1986. The Ziff family sold their interest, and Italian eyewear giant Luxottica acquired the chain in 2001.

Reasons for business decline in the 1970s

The era's economic upheaval created a challenging environment for many American businesses.

Stagflation: This unusual economic combination of stagnant growth and high inflation meant consumers had less purchasing power, which hurt sales. Companies could not simply raise wages to compensate, leading to worker dissatisfaction and pressure on profits.

Increased competition: After decades of American dominance, new overseas competition emerged from economies like Japan and Germany. This was particularly impactful on US manufacturing, as foreign companies offered more fuel-efficient cars and cheaper, higher-quality products.

Oil crises: Two major oil price shocks in 1973 and 1979 quadrupled oil prices and caused gas shortages. This sent production costs soaring and drastically shifted consumer demand away from large, gas-guzzling vehicles.

Deindustrialization: This trend began in the 1970s as companies sought cheaper labor, moving jobs and capital out of established industrial centers. This shift hit cities in the "Rust Belt" especially hard, weakening the tax base and local economy

Multiple well-known U.S. businesses and entire industries failed or underwent significant decline in the 1980s, primarily driven by a severe economic recession and the Savings and Loan crisis.

Notable businesses that left in the 1980s

Retail and entertainment

D'Lites: A fast-food chain that offered health-conscious options, D'Lites filed for bankruptcy in 1986, largely because larger competitors started offering healthier items and the public's interest in healthy eating waned.

E.J. Korvette: One of the original discount department stores, E.J. Korvette filed for bankruptcy in 1980 and liquidated its stores.

Toys "R" Us (pre-reorganization): While the brand continued, its financial troubles began in the 1980s amid increasing competition.

F.W. Woolworth Company: The five-and-dime store giant started its long decline in the 1980s, although it continued operating for years.

Babbage's: A software and video game retailer that is now part of GameStop.

Pizza Time Theatre: Founded by Atari creator Nolan Bushnell, this franchise with animatronics went bankrupt in 1984 and merged with competitor ShowBiz Pizza Place, which later rebranded as Chuck E. Cheese's.

Video rental stores: The home video rental business took off in the 1980s with the rise of VHS, but many local and smaller chains failed during this time.

Financial sector

The Savings and Loan (S&L) crisis of the 1980s led to the failure of over 1,000 S&L institutions.

Lincoln Savings and Loan Association: A California-based S&L that was central to the political scandal involving the Keating Five, failed in 1989.

Financial Corporation of America: The parent company of American Savings and Loan, this was the largest S&L at the time of its 1988 bankruptcy.

Industrial sector

Bethlehem Steel: Once the second-largest U.S. steel producer, the company was in decline by the late 1980s due to foreign competition and decreasing domestic demand for manufactured goods. Though the company did not file for bankruptcy until 2001, its shipbuilding business was gone by 1997.

Texaco: The American oil company filed for bankruptcy in 1987 in the middle of a legal dispute with Pennzoil. It emerged from bankruptcy in 1988 and was later acquired by Chevron.

Economic conditions driving 1980s business failures

The early 1980s recession: The U.S. suffered back-to-back recessions from 1980 to 1982. In an effort to combat high inflation, the Federal Reserve raised interest rates, which led to a sharp increase in unemployment and a decline in manufacturing.

The Savings and Loan crisis: Deregulation in 1980 allowed S&Ls to pursue higher-risk investments. When interest rates rose, many became insolvent, and risky commercial real estate loans turned sour. The crisis ended up costing taxpayers an estimated $124 billion.

Global competition: U.S. industrial and manufacturing firms faced new pressure from lower-cost labor in other countries, leading to a decline in America's industrial base

Offline

Like button can go here

#3035 2025-10-27 15:10:39

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,613

Re: Politics

Several major U.S. businesses either left or went out of business in the 1990s, often due to bankruptcy or acquisition. Examples include the major retailer Montgomery Ward and the electronics company Compaq Computers, which was bought by Hewlett-Packard in 2002. The decade also saw major shifts in retail, leading to the bankruptcy and closure of numerous smaller chains and the decline of large department stores like Montgomery Ward, according to this Quora post and this Facebook post.

Montgomery Ward: A major department store that struggled with competition from big-box retailers and filed for bankruptcy, eventually closing all stores in 2001.

Compaq: A computer company that was a dominant force in the 1990s but was acquired by Hewlett-Packard in 2002, effectively ending its independent existence.

Edison Brothers Stores: A parent company to many 90s retailers like Coconuts and Sam Goody's, it went bankrupt in the 1990s and sold off its various brands.

Circuit City: The electronics retailer struggled with competition and filed for bankruptcy in 2008, closing all its stores.

Tower Records: The once-dominant music retailer filed for bankruptcy in 2006.

Radio Shack: The electronics chain filed for bankruptcy in 2015, marking the end of an era for the company.

Blockbuster: The video rental giant was unable to compete with the rise of streaming services and filed for bankruptcy in 2010.

Toys "R" Us: The toy retailer, once a symbol of childhood, filed for bankruptcy in 2017 and closed its stores, though the brand has since made a comeback.

Other businesses that left in the 90s

Pan Am: The airline ceased operations in 1991.

Kodak: The photography giant struggled to adapt to the digital age, filing for bankruptcy in 2012.

Enron: The energy company was involved in a massive accounting scandal that led to its collapse in 2001.

Polaroid: The instant photography company filed for bankruptcy in 2001.

Some of the most prominent U.S. businesses to leave or disappear during the 2000s were major brands in technology, retail, and manufacturing. The reasons they left varied, including failure to adapt to new technology, poor management, intense competition, and—in the case of companies that relocated overseas—corporate tax inversions.

Companies that went out of business

Blockbuster: The video rental giant failed to adapt to the rise of online DVD rentals (like Netflix) and streaming services. The company filed for bankruptcy in 2010.

Compaq: Once the largest personal computer supplier, Compaq was acquired by Hewlett-Packard in 2002. Internal conflicts and poor strategy weakened the brand, which was phased out by HP.

Enron: The energy company collapsed in 2001 due to a massive accounting fraud scandal that hid billions in debt.

Lehman Brothers: The 150-year-old investment bank declared bankruptcy in 2008, holding over $600 billion in assets. Its collapse is considered a significant event that contributed to the global financial crisis.

Limewire: This popular peer-to-peer file-sharing software was shut down in 2010 after a U.S. federal court ruled that it had committed copyright infringement.

WorldCom: This telecommunications rival to AT&T was undone by a major accounting fraud scandal in the early 2000s. It filed for bankruptcy and was later acquired by Verizon.

Borders: The book and music retailer struggled to compete with online competitors and filed for bankruptcy in 2011.

Companies that moved overseas

Anheuser-Busch: The St. Louis-based beer maker was acquired by the Belgian company InBev for $52 billion in 2008. The new parent company, AB InBev, is headquartered in Belgium.

Seagate Technology: The hard-drive manufacturer moved its global headquarters to the Cayman Islands in 2000 and then to Ireland in 2010.

Tyco International: This diversified manufacturing conglomerate relocated its incorporation to Bermuda in 1997. It faced a major scandal in the early 2000s involving its top executives, who were convicted of looting the company.

Accenture: The consulting firm, spun off from the accounting firm Arthur Andersen, reincorporated in Bermuda in 2001.

IBM's Personal Computer division: In 2005, IBM sold its PC division to the Chinese company Lenovo. This move enabled IBM to focus on software and services.

Cooper Industries: This electrical products manufacturer reincorporated in Bermuda in 2002. It was acquired by Eaton in 2012.

Ingersoll-Rand: The industrial manufacturer moved its incorporation to Bermuda in 2002. It has since relocated its official domicile to Ireland.

Factors that drove companies to leave the US

Acquisitions and foreign ownership: Many American brands, such as Sunglass Hut, Ben & Jerry's, and Anheuser-Busch, were acquired by foreign companies during this era.

Corporate tax inversions: To lower their corporate tax burdens, some companies reincorporated their businesses overseas, often in countries with lower tax rates.

Failure to innovate: Companies like Blockbuster and Compaq were unable to adapt to new technologies and market shifts, leading to their demise.

Financial crisis and poor management: The 2008 financial crisis devastated many businesses, including Lehman Brothers. Other companies, like WorldCom and Enron, suffered from corporate misconduct and accounting scandals.

Shifting manufacturing overseas: The trend of outsourcing manufacturing accelerated in the 2000s. Companies seeking lower labor costs and less regulation moved production to countries like China and Mexico

Multiple U.S. businesses either left the country, went out of business, or moved significant operations overseas during the 2010s due to factors such as globalization, shifting consumer trends, and tax laws.

Iconic companies that went defunct

Blockbuster: The video rental giant declared bankruptcy in 2010. It had failed to compete with the rise of streaming services like Netflix and mail-order rentals.

Borders: The bookstore chain went out of business in 2011. Like Blockbuster, it was unable to adapt to the rapidly changing retail landscape dominated by online sellers like Amazon.

RadioShack: A decades-old electronics retailer, RadioShack began closing stores in 2010 and filed for bankruptcy in 2015.

Toys R Us: After years of competition from big-box retailers and e-commerce, the iconic toy store declared bankruptcy in 2017.

Barneys New York: The luxury department store closed its doors in 2019 after facing financial difficulties throughout the decade.

American Apparel: This apparel retailer, known for its "Made in the USA" manufacturing, lost its cultural relevance and was purchased out of bankruptcy by a Canadian company in the mid-2010s.

Companies that moved their headquarters (corporate inversions)

Corporate inversions were a major trend in the early 2010s, where U.S. companies would merge with smaller foreign firms to reincorporate abroad and reduce their tax burden. The U.S. government put the kibosh on such deals in 2014.

Burger King: In 2014, the fast-food chain merged with Canadian company Tim Hortons to form Restaurant Brands International, which was headquartered in Canada.

Seagate Technology: The hard-drive manufacturer officially moved its global headquarters to Ireland in 2010.

Valient: The pharmaceutical company merged with Canada's Biovail in 2010 and relocated its headquarters to Canada.

Companies that offshored operations

A large number of companies offshored manufacturing and other operations during the 2010s to reduce costs, leading to job losses in the U.S..

Cisco Systems: Between 2010 and 2014, the networking company saw its percentage of overseas workers rise from 25% to 46%, primarily in China and India.

Hewlett-Packard (HP): In 2010, the company laid off human resources employees in the U.S., transferring their functions to Panama.

Hilton Worldwide: Also in 2010, the hotelier moved a reservations center to the Philippines to save money.

Ford Motor Company: A significant portion of Ford's workforce was moved out of North America during the 2010s. By 2009, the North American workforce made up only 37% of its total payroll.

JPMorgan Chase: The bank moved its telephone banking operations to the Philippines in 2010

Offline

Like button can go here

#3036 2025-10-27 15:11:44

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,613

Re: Politics

Since the start of the 2020s, numerous US businesses have either gone bankrupt or significantly downsized, with the COVID-19 pandemic serving as a major catalyst for existing financial troubles. Many of these were retailers and restaurant chains that struggled with lockdowns, reduced foot traffic, and shifts in consumer behavior.

Some of the most prominent businesses that went under or dramatically downsized since 2020 include:

Retailers

Bed Bath & Beyond: The home goods retailer, a "recent COVID-19 failure" according to U.S. News, officially filed for bankruptcy in 2023.

Lord & Taylor: After filing for bankruptcy in 2020, the department store chain closed all of its remaining locations in 2021.

J.C. Penney: The long-standing department store filed for bankruptcy in 2020. It was eventually purchased by mall owners Simon Property Group and Brookfield Asset Management, which led to a smaller footprint.

Neiman Marcus: The luxury department store filed for bankruptcy in 2020 and emerged with a reduced debt load.

Pier 1 Imports: The home goods retailer filed for bankruptcy in 2020 and liquidated all of its stores. Its brand name was later relaunched as an online-only store.

Tailored Brands: The parent company of Men's Wearhouse and JoS. A. Bank, filed for bankruptcy in 2020 due to decreased demand for professional wear. It closed hundreds of stores and emerged with less debt.

GNC: The nutrition and supplement retailer filed for bankruptcy in 2020 and closed a significant number of its stores.

Stein Mart: The discount retail chain filed for Chapter 11 bankruptcy in 2020 and liquidated its stores.

Papyrus: The stationery and card company went out of business in early 2020, closing all of its stores.

Century 21: The off-price retailer filed for bankruptcy in 2020 and shuttered its physical stores.

Brooks Brothers: The menswear retailer, which had struggled as business attire became more casual, filed for bankruptcy in 2020 but was later purchased and saved from total shutdown.

Restaurants and entertainment

Friendly's: The family-friendly restaurant chain filed for Chapter 11 bankruptcy in 2020.

Sizzler: The restaurant chain filed for bankruptcy in 2020, blaming the pandemic for indoor dining closures.

Souplantation / Sweet Tomatoes: The parent company of these buffet restaurants announced the permanent closure of all 97 US locations in 2020.

Chuck E. Cheese: The parent company of the family entertainment chain filed for bankruptcy in 2020.

Cirque du Soleil: The entertainment company filed for bankruptcy in 2020 after the pandemic halted its productions.

Le Pain Quotidien: The cafe and bakery chain filed for bankruptcy in 2020 and sold all of its US locations.

Other sectors

Hertz: The car rental company filed for bankruptcy in 2020 as travel came to a halt during the pandemic.

Remington Arms: The gun manufacturer filed for bankruptcy in 2020.

24 Hour Fitness: The gym chain filed for bankruptcy in 2020 after pandemic-related closures.

Gold's Gym: The fitness chain filed for bankruptcy in 2020 but planned to keep hundreds of locations open.

Intelsat: The satellite operator filed for bankruptcy in 2020 but continued operations

While jobs are being filled the issue is old businesses have comeback after leaving.

Sure new business have stated

Data from the US Census Bureau shows a record-breaking 5,481,437 new businesses were started in 2023. The onset of the pandemic in 2020 has driven a surge in new business creation, so the number of new businesses is trending up. On average, there are 4.7 million businesses started every year.

Offline

Like button can go here

#3037 2025-10-27 17:06:16

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,613

Re: Politics

The 1960s saw the rise of new businesses in various sectors, including fast food franchises like Domino's Pizza and the first discount retailers such as Kmart, Walmart, and Target. The decade was also characterized by the growth of large conglomerates, the development of shopping centers, and the establishment of tech and service companies like Medtronic, Dolby Laboratories, and Instinet.

Retail and consumer goods

Discount Retailers: Kmart was the first, opening in 1962, followed by Walmart and Target in the same year, which introduced a new model of bulk purchasing to offer lower prices.

Franchises: The franchise boom was in full swing, with chains like Domino's Pizza, McDonald's, and Holiday Inn expanding rapidly.

Shopping Centers: More than 8,000 shopping centers were built during the decade, changing how and where people shopped.

Technology and services

Tech and Manufacturing: Companies like Medtronic, Teradyne, and Dolby Laboratories were founded.

Financial Services: NationsBank, Duane Reade, and Jackson Hewitt were among the new financial and service businesses.

Logistics and communication: Sea-Land Service pioneered containerized shipping, and Instinet launched an electronic system for institutional investors.

Conglomerates and hospitality

Conglomerates: A wave of business acquisitions led to the formation of large, diversified conglomerates like ITT Corp. and Litton Industries.

Hospitality: New hotels were built to accommodate the growing population, and new restaurant chains emerged, such as the Playboy Club

he 1970s saw the establishment of many new US businesses, particularly in the tech sector with the rise of semiconductors and venture capital firms like Sequoia Capital and Kleiner Perkins. Other notable companies started in this decade include retail giants like Days Inn, Chili's, and Chi-Chi's; technology and software companies such as Atari and Microsoft; and others like Intel and Acadian Ambulance. The business landscape also reflected broader societal changes, with the emergence of niche stores catering to specific subcultures, such as record stores and boutiques.

Technology and computing

Intel: A major player in the semiconductor industry, which saw significant growth in memory products like the Intel 1103 DRAM.

Microsoft: Founded in 1975 by Bill Gates and Paul Allen.

Atari, Inc.: Founded in 1972, it became a major force in the video game industry.

Venture capital firms: The decade saw the founding of Silicon Valley's top venture capital firms, such as Sequoia Capital and Kleiner Perkins Caufield & Byers, both established in 1972.

Retail and services

Days Inn: A hotel chain that began in the 1970s.

Chili's and Chi-Chi's: Two popular restaurant chains that were established during this period.

Apple Computers: Though not a business startup in the 1970s, the company was founded in 1976.

Specialty stores: A rise in niche stores, including record stores and boutiques, reflected the segmentation of the market and counterculture movements.

American Home Shield: A company that was established in 1971.

Other notable businesses

Amdahl Corporation: A computer company established in the 1970s.

Acadian Ambulance: A company that was established in 1971.

DeLorean Motor Company: A car company established in 1975

The 1980s saw the establishment of many new US businesses, spanning various sectors like technology, retail, and direct sales. Notable tech companies founded during this decade include Adobe Inc. and Synnex. Retail and service-based companies like The UPS Store and ShowBiz Pizza Place also emerged. The direct selling industry experienced significant growth, with companies like Herbalife and The Pampered Chef being founded in the 1980s.

Technology and software

Adobe Inc.: A company that would become a giant in the software industry.

Synnex: A technology services company.

Access Software: A video game developer.

Symbolics: A computer company specializing in Lisp machines.

Retail and food service

ShowBiz Pizza Place: A family entertainment center and restaurant chain.

The UPS Store: A retail franchise focused on packing and shipping services.

Amy's Kitchen: A company that prepares and sells frozen organic meals.

Sierra Nevada Brewing Co.: A craft brewery.

Direct sales

Herbalife: A company that sells nutrition, weight management, and skincare products.

The Pampered Chef: A company specializing in kitchen tools.

Nu Skin: A company in the beauty and wellness sector.

Stampin' Up!: A company focused on paper crafting supplies.

Other sectors

Aéropostale: An American lifestyle clothing company.

Airgas: A distributor of industrial gases.

American Graphics Institute: A company providing design and technology training

Offline

Like button can go here

#3038 2025-10-27 17:08:27

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,613

Re: Politics

The 1990s saw the rise of new businesses in both the retail and tech sectors, driven by the advent of the internet and the growth of large-scale retail. Prominent examples include the expansion of big-box stores like Walmart and Target and the founding of online pioneers such as Amazon and eBay. The tech industry also saw the emergence of companies like AOL and Yahoo!.

Tech and e-commerce

Amazon and eBay: Founded in the 1990s, these companies were early pioneers of e-commerce, providing online alternatives to traditional brick-and-mortar stores.

AOL and Yahoo!: The 1990s saw the massive growth of the internet, and companies like AOL, with its dial-up service, and Yahoo!, a search engine and web portal, became household names.

Palm: This company was a leader in the early personal digital assistant (PDA) market before the rise of modern smartphones.

Retail

Big-box retailers: Companies like Walmart and Target expanded significantly in the 1990s, offering a wide variety of products at low prices and changing the retail landscape.

Blockbuster: The video rental giant was at its peak in the 1990s before the advent of streaming services.

Einstein Bros. Bagels: This coffee and bagel chain was established in 1995.

Other sectors

Alamo Drafthouse Cinema: A unique cinema-and-restaurant concept, the Alamo Drafthouse was founded in 1997.

Align Technology: This company, founded in 1997, is the maker of the Invisalign clear aligners.

Energy Transfer: This company, founded in 1995, is a major player in the midstream energy sector

The 2000s saw a rise in new businesses across various sectors, particularly in technology, with notable examples including Alarm.com, 2U, and 5-hour Energy. The decade also witnessed the founding of companies focused on areas like e-commerce, with Ocado launching in 2000, and the emergence of businesses in fields that would grow to include telemedicine and clean beauty by the end of the decade and into the next.

Technology and internet companies

Alarm.com: A company specializing in the smart home and security sector, founded in 2000.

2U: An online education platform that was established in 2008.

ActiveCampaign: A marketing automation and email marketing software company, founded in 2003.

51 Minds Entertainment: An entertainment production company that began in 2004.

Consumer goods and food

5-hour Energy: The popular energy shot brand was created in 2004.

AG Jeans: A denim and apparel company established in 2000.

4moms: A company that produces innovative children's products, founded in 2005.

Other notable companies

Ocado: Although based in the UK, this e-commerce grocery company launched in 2000 with a tech-focused approach to home delivery.

Acceleron Pharma: A biopharmaceutical company that started in 2003

he 2010s saw the rise of many new US businesses, particularly in technology, such as the mobile app economy giants like Uber, Spotify, and Snapchat. While the decade had a lower overall entrepreneurship rate compared to previous eras, it was marked by a surge in highly influential tech startups that grew rapidly through digital platforms and venture capital. Notable examples include Square, Airbnb, and Pinterest, as well as The Real Real in the luxury resale market.

Examples of new businesses from the 2010s

Technology and Apps:

Uber: Founded in 2009, the ride-sharing service grew exponentially throughout the 2010s to become a global mobility giant.

Square: Launched in 2010, this company revolutionized small business payments by creating a simple credit card reader for mobile devices.

Spotify: After launching in Europe in 2008, it entered the US in 2011, shifting the music industry from ownership to a streaming subscription model.

Snap Inc.: The parent company of the Snapchat app, which launched in 2011, became a major player in the social media landscape.

Pinterest: This visual discovery engine launched in 2010 and became a leading platform for inspiration and e-commerce.

E-commerce and Services:

The Real Real: Founded in 2011, this online luxury resale retailer grew rapidly, eventually opening its first brick-and-mortar store in 2017.

Airbnb: While founded in 2008, the short-term rental platform saw its most significant growth in the 2010s.

Beyond Meat: This plant-based meat company was founded in 2009 but gained significant traction in the 2010s before its major IPO in 2019.

Other industries:

Instant Pot: This multi-cooker became a household name after its 2010 release, supported by a massive social media community.

GoFundMe: The online fundraising platform was founded in 2010, providing a new way for individuals and organizations to raise money.

Entrepreneurship trends in the 2010s

Lower Entrepreneurship Rate: The decade was marked by one of the lowest rates of new business creation in recent US history.

Slow Job Growth: New firms hired fewer workers in 2019 than they did in 1982, despite the larger overall workforce.

Growth of the Mobile App Economy: The mobile app store ecosystem provided a new, low-capital way for many startups to reach a massive scale very quickly

Offline

Like button can go here

#3039 2025-10-27 17:10:08

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,613

Re: Politics

Since 2020, the U.S. has experienced a historic surge in new business applications, with record-breaking numbers filed in 2021 and 2023. This sustained period of high business creation is a significant shift from previous decades and was primarily driven by pandemic-induced disruptions and a changing labor market.

New business applications per year

Data based on information from the U.S. Census Bureau.

Year Business Applications Change vs. Prior Year Notes

2020 4.4 million +24.5% A sharp increase during the first year of the pandemic, with applications soaring 51% higher than the 2010–2019 average.

2021 5.4 million +23.5% A new annual record for business applications, largely influenced by pandemic-era economic and labor shifts.

2022 5.0 million -6.0% A slight dip from the 2021 peak, but applications remained well above pre-pandemic levels.

2023 5.5 million +8.1% The highest number of new business applications ever recorded in a calendar year.

2024 5.21 million -4.77% A moderation from the 2023 peak, though still a period of robust entrepreneurship.

2025 Projected millions +3.15% (partial data) As of August 2025, over 3.5 million applications had been submitted, indicating that a high level of business formation is continuing.

Key drivers and characteristics of the boom

Pandemic as a catalyst: The COVID-19 pandemic fueled entrepreneurship by necessity, as many people who lost their jobs started their own businesses.

Shift in work: The rise of remote work and the gig economy gave people more flexibility to pursue entrepreneurial ventures.

Growth in specific sectors: Initial growth was most significant in sectors that supported the "home-based economy," such as e-commerce (retail trade), transportation, and personal services.

Increased diversity: New entrepreneurs in the 2020s have been more diverse than in the past, with women, Black, Asian, and Hispanic shares of self-employed Americans near all-time highs.

Mix of high and low-propensity businesses: The surge included both "high-propensity" businesses, which are likely to hire employees, and a large number of sole proprietorships and ventures less likely to have a payroll.

Long-term outlook

This era of heightened business creation marks a new, higher "plateau" for entrepreneurship in the United States. The surge has proven to be more than a temporary blip, representing a lasting shift in the country's economic landscape

So the shift of job types is clear.

Offline

Like button can go here

#3040 2025-10-28 17:01:36

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,613

Re: Politics

There is another part of the picture and that is the businesses that failed.

Notable American businesses that failed in the 1960s include the Studebaker Corporation, the Lehigh and New England Railroad, and early ventures by American Motors (AMC). These failures highlight how quickly a company's fortunes could change due to new competition, changing consumer tastes, and poor management.

Studebaker Corporation

For over a century, Studebaker was a household name that produced wagons, cars, and trucks. But intense competition and insufficient resources eventually led to its downfall.

The rise of compact cars: In the late 1950s, Studebaker's compact Lark model had a sales bump. But its advantage disappeared in the 1960s when the "Big Three" (General Motors, Ford, and Chrysler) introduced their own compacts.

Lack of capital: Studebaker lacked the funds to invest in the frequent redesigns needed to compete with larger automakers. This led to cost-cutting measures, including closing its main factory in South Bend, Indiana, in 1963.

High-risk gamble: In a final effort to boost sales, Studebaker released the innovative Avanti sports coupe in 1963. However, production problems and a costly labor strike doomed the project. The company ceased all automotive production in 1966.

American Motors Corporation (AMC)

While AMC survived the 1960s, its missteps during this decade paved the way for its later collapse. After early success with compact, economical cars, management decided to chase trends instead of building on its niche.

Failed strategy: In the mid-1960s, AMC's strategy was to compete directly with the Big Three by creating trendy, larger, and more powerful vehicles.

Disastrous model: A prime example of this failure was the 1965 Marlin, a large and ungainly "pony car" meant to compete with the wildly successful Ford Mustang.

Lost momentum: By abandoning its unique focus on smaller, efficient cars, AMC lost its edge. When the larger automakers began making more economical vehicles in the 1970s, AMC could not keep up due to its limited resources.

Lehigh and New England Railroad (LNE)

Many American railroad companies struggled in the 1960s, a trend that accelerated in the following decade. The LNE was a major early casualty.

Dependence on coal: The LNE's fortunes were tied to the anthracite coal industry in Pennsylvania. As the demand for coal rapidly declined, the railroad's future became untenable.

Preemptive shutdown: Even while still turning a profit, the LNE's board saw the writing on the wall and decided to cease all railroad operations in October 1961, liquidating while they still had assets.

Pan American World Airways (Pan Am)

Though the company did not go bankrupt until 1991, the roots of its decline can be found in the 1960s. After being the world leader in international travel, the airline began to face significant challenges.

Overextension: Under CEO Juan Trippe, Pan Am became overextended with a sprawling route system that was costly to maintain.

Large investment: The company made a massive investment in a fleet of Boeing 747 jumbo jets in the mid-1960s. This proved to be a risky move, as an economic downturn and rising fuel prices in the following decade made the jets much more costly to operate.

Growing competition: The 1960s saw intense competition from both foreign and domestic airlines. Without a strong domestic route network, Pan Am was left vulnerable

Several notable US businesses failed in the 1970s due to various factors like changing consumer preferences, technological advancements, and economic downturns, including department store chains like Bonwit Teller and W.T. Grant, and the Franklin National Bank. The decline of large manufacturing employers also had a devastating impact on regional economies, as seen with the "Boeing Bust" in Seattle.

Retail

W.T. Grant: A large department store chain that went bankrupt in 1976.

Bonwit Teller: An upscale department store that eventually lost its prestige and was demolished.

S. S. Kresge: In 1977, this company sold its original stores and renamed the Kmart stores to Kmart.

E. J. Korvette: Another large retail chain that is no longer in business.

Bonwit Teller: An upscale department store that lost its prestige and was eventually demolished.

Banking

Franklin National Bank: A large bank that failed in 1974 due to issues in its foreign exchange portfolio and was eventually acquired by European-American Bank & Trust Company.

Technology

Sony Betamax: While a 1975 invention, the Betamax format ultimately lost the "format war" to VHS, largely because rival companies adopted the competing VHS format and Sony kept its format proprietary.

Manufacturing

Boeing: The cancellation of the SST program in 1971 led to massive layoffs and a significant economic downtown in the Seattle area, a period known as the "Boeing Bust".

Other sectors

Pan American World Airways (Pan Am): The airline, once a symbol of American innovation in air travel, failed to withstand economic pressures and turbulent times, collapsing in 1991

Several major US businesses failed in the 1980s due to various factors like market shifts, failed product launches, and the Savings and Loan crisis. Examples include KCO, a video game and toy company that went bankrupt after an overextension into computers, and the failure of RJ Reynolds' "Premier" smokeless cigarettes. The steel industry also began its major decline in the late 1980s, with Bethlehem Steel starting its decline during that period, and the Savings and Loan crisis led to the failure of many financial institutions.

KCO: The company, known for Cabbage Patch Kids, went bankrupt in the mid-1980s after launching the unsuccessful Atom computer and failing to compete with Nintendo's NES.

RJ Reynolds: Introduced a failed smokeless cigarette called "Premier" in 1989, which was pulled after only five months due to poor consumer reception and a high cost of over $300 million.

Bethlehem Steel: Began its significant decline in the late 1980s as the US transitioned away from industrial manufacturing, although it didn't fully close until 1998.

Savings and Loan institutions: The Savings and Loan crisis of the 1980s and early 1990s resulted in the failure of many banks, with 1,617 FDIC-insured commercial and savings banks closing or receiving financial assistance during that period

Offline

Like button can go here

#3041 2025-10-28 17:04:23

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,613

Re: Politics

Several major US businesses failed in the 1990s due to factors like increased competition, failure to adapt to market changes, and poor management, including the iconic department store chain Woolworth's and PC manufacturer Compaq. Other notable failures include the defunct toy retailer KB Toys and Frito-Lay's fat-free "WOW! Chips" line, which failed due to digestive side effects.

Retail and department stores

Woolworth's: Faced increasing competition from stores like Walmart and Target, leading to the closure of its U.S. five-and-dime stores in 1997 before the parent company rebranded as Foot Locker.

KB Toys: Went bankrupt and vanished due to competition from big-box retailers and the rise of e-commerce.

Gantos: A women's clothing chain that filed for bankruptcy and liquidated its stores by the end of the decade.

Technology

Compaq: Once the largest PC supplier, it faltered due to product quality issues and an inability to keep up with low-cost competitors like Dell. The company was eventually acquired by Hewlett-Packard in 2002.

Etoys.com: An early online toy store that collapsed when the dot-com bubble burst.

Tiger Electronics: Its "Arzone" portable gaming device failed due to its blurry screen and clunky gameplay.

Food and drink

Frito-Lay WOW! Chips: The "fat-free" chips, made with Olestra, caused severe digestive issues for many consumers, leading to the product's failure.

Zima: This clear, carbonated malt beverage was marketed as a sophisticated alternative to beer but failed to gain traction with consumers.

Other

Blockbuster Video: While its collapse occurred in the early 2000s, its failure to adapt to streaming and buy Netflix was rooted in the 1990s, making it a notable example of a 90s-era business failing to look ahead

Several major US businesses failed in the 2000s due to issues like accounting scandals, failure to adapt to new technology, and a lack of innovation. Prominent examples include Enron and WorldCom (accounting fraud), Blockbuster and Polaroid (failure to adapt to digital streaming and photography, respectively), and the dot-com bubble failures like Pets.com and Webvan.

Failed due to accounting scandals

Enron: Once a leading energy company, its collapse in 2001 was one of the largest accounting scandals in history, says the FBI.

WorldCom: The telecommunications giant also collapsed due to a massive accounting scandal in 2002.

During the 2010s, many long-standing US businesses failed due to a combination of new technology, shifting consumer behavior, and heavy debt. The "retail apocalypse" was a primary driver, as e-commerce giants like Amazon displaced traditional brick-and-mortar stores.

Prominent failures in the 2010s

Retail

Toys "R" Us: Filed for bankruptcy in 2017 and closed all US stores in 2018. It struggled to compete with Amazon and Walmart and was burdened with massive debt from a leveraged buyout in 2005. The brand later attempted a comeback with a smaller footprint.

Sears Holdings Corp: The parent company of Sears and Kmart filed for bankruptcy in 2018. The iconic department store chain suffered a slow decline from intense competition from big-box and online retailers.

Borders: The bookstore giant filed for bankruptcy in 2011 and liquidated its remaining stores. It failed to adapt to the shift to online bookselling and e-readers, leaving its customers and website to its competitor, Barnes & Noble.

Payless ShoeSource: The discount shoe retailer filed for bankruptcy in 2017 and 2019, closing all 4,400 stores across 30 countries. It was unable to compete with online retailers and other discount stores.

RadioShack: Known for electronics and batteries, RadioShack filed for bankruptcy twice during the decade (2015 and 2017). It was a victim of changing tech trends and fierce online competition.

The Bon-Ton: The regional department store chain, which operated stores like Carson's and Younkers, filed for bankruptcy in 2018 and liquidated after not turning a profit since 2010.

American Apparel: The clothing retailer filed for bankruptcy in 2015 and 2016, weighed down by debt and sales declines. The brand now operates as an online-only business.

Entertainment

Blockbuster: The video rental chain, which once had over 9,000 stores, filed for bankruptcy in 2010. The company failed to adapt to the new competitive landscape of Netflix, Redbox kiosks, and streaming services.

Movie Gallery: This competitor to Blockbuster and parent of Hollywood Video filed for bankruptcy in 2010, resulting in the closure of all its 2,400 US locations.

Technology and others

Theranos: The blood-testing startup, founded by Elizabeth Holmes, was one of the most high-profile tech failures of the decade. The company, which was valued at $9 billion at its peak, dissolved in 2018 after it was exposed as fraudulent.

Eastman Kodak Co.: The film photography giant filed for Chapter 11 bankruptcy in 2012. The company, which invented the first digital camera, failed to capitalize on the digital revolution and was a "corporate America poster child" for a company that resisted transition.

BlackBerry: Once a leader in mobile devices, BlackBerry's popularity waned in the 2010s due to its slow adoption of touchscreen technology and app ecosystems. The company exited the smartphone business in 2016 to focus on cybersecurity.

Hummer: The SUV brand was discontinued in 2010 after parent company General Motors filed for bankruptcy the year before. The brand fell out of favor following the 2008 oil price spike and a shift toward fuel-efficient vehicles

Many US businesses failed in the 2020s, especially during the initial COVID-19 pandemic, including retailers like J.C. Penney, Neiman Marcus, J. Crew, and Brooks Brothers. Other significant failures included Bed Bath & Beyond, which went bankrupt in 2023, and Pier 1 Imports, Modell's Sporting Goods, and Art Van Furniture, which all filed for bankruptcy in 2020. Financial institutions like First Republic Bancorp and SVB Financial Group also failed.

Major retail bankruptcies in the 2020s

Bed Bath & Beyond: Filed for bankruptcy in 2023.

J.C. Penney: Filed for bankruptcy in 2020.

Neiman Marcus: Filed for bankruptcy in 2020.

J. Crew: Filed for bankruptcy in 2020.

Pier 1 Imports: Closed all stores after filing for bankruptcy in 2020.

Modell's Sporting Goods: Filed for bankruptcy in 2020.

Art Van Furniture: Filed for bankruptcy in 2020.

Brooks Brothers: Filed for bankruptcy in 2020.

Tuesday Morning: Filed for bankruptcy in 2020.