New Mars Forums

You are not logged in.

- Topics: Active | Unanswered

Announcement

#1 2024-03-25 04:29:44

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,304

Oil, Peak Oil, etc.

I realised that this forum lacks a specific topic for oil and the important issue of Peak Oil.

Below is a link from the IEA showing global production of crude & lease condensate from Jan 1973 to present.

https://www.eia.gov/international/data/ … 73&ev=true

I have excluded natural gas liquids, biofuels and refinery gains. NGLs are light alkanes like propane and butane. Whilst these are useful in many applications, they do not power the global transport system. Biofuels are often added to gasoline and diesel. But their volumetric energy density is lower and substantial fossil fuel inputs are needed to produce them. Refinery gains amount to nothing more than the increase in volume that occurs due to cracking and fractionating. It isn't a measure of a gain in useful energy.

Between Jan 2005 and Jan 2011, global production barely moved. This coincided with the period of rapid demand growth for refined products in China. A static global production of crude oil supply and a rapidly growing demand, led to soaring prices. This resulting in high inflation in prices of many goods and services. Central banks dealt with this by raising interest rates. This led to the economic recession of 2007 - 2008. Peak conventional oil was the root cause of the financial crisis.

The increase in output that occured in the second decade of the 21st, can be seen on the graph. This came from three sources, US tight oil, Canadian tar sands and Iraq. Compared to previous growth periods it really is impressive. The US tight oil and the Canadian tar sand industries, grew hand in hand. Both products are blended to produce syncrude, which has sufficient heat capacity and specific gravity to be processed by US refineries. Both grew during a period where three factors combined in their favour: (1) Interest rates that were effectively beneath zero for large investors; (2) High oil prices exceeding $100/bl up until 2014, allowing the industries to become established; (3) Very cheap materials available in huge quantities from China. Two out of three of these supporting factors is now undone. How long China can continue providing cheap refined metals is uncertain. The effects of depletion are now evident in US shale plays outside of the Permian. But the Permian appears to have enough Tire 1 acreage remaining to allow growth for a few years yet. This growth must be sufficient to offset declines almost everywhere else if global supply is the continue growing.

Last edited by Calliban (2024-03-25 04:53:05)

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#2 2024-03-25 06:21:21

- tahanson43206

- Moderator

- Registered: 2018-04-27

- Posts: 24,077

Re: Oil, Peak Oil, etc.

This post is reserved for an index to posts NewMars members may contribute over time.

This is clearly an important topic, and it is good to see it included in the forum offerings.

As of 2024/12/20, this topic has 19 posts. It seems likely (as I scan the list) that there are are several worth indexing.

Indexing entries in the various topics of this forum could be a full time job for a volunteer.

Perhaps AI can be enlisted to perform that service at some point.

However, the topic creator might have the time to create an index that one of the mods can paste into the #2 post.

Calliban, if you would have the time to make an index and post it I'd be happy to quote it here.

https://newmars.com/forums/viewtopic.ph … 11#p233411

Post by Void about substitution of Carbon for Copper in an electric motor winding

(th)

Offline

Like button can go here

#3 2024-03-25 07:36:25

- kbd512

- Administrator

- Registered: 2015-01-02

- Posts: 8,500

Re: Oil, Peak Oil, etc.

When are we going to discuss the simple and undeniable fact that 2/3rds of all investment dollars have been removed since about 2010 or so?

How are we expecting all these green energy machines to be built when hardly any of it presently exists?

Are we going to miracle all of it into existence?

If not, then I suspect we're going to burn coal, oil, and gas like gangbusters, whether any of our green energy fanatics admit to that or not.

We can't "talk" all this new stuff into existence. It takes a lot of energy. We don't have a large excess supply of that anymore because we quit putting money into hydrocarbon fuels without any kind of substitute energy source, and governments are actively preventing people from investing in hydrocarbon fuels, without so much as plan to create all this nonexistent stuff they're betting the farm on. The universe itself doesn't care where the energy comes from to transform ore into metal, but it won't simply "give you the metal" because you delivered a speech that you found to your liking. That's not how energy works.

Throwing crap at the wall to see if something sticks is only planning to fail. If you had any clue about what to do, then you wouldn't throw crap at the wall. People who have real plans organize, execute, check to see how well reality aligns with their plans, and then adjust if the solution results don't match their plan. They certainly don't double-down or triple-down on something that isn't working. Oddly enough, that's what real management looks like for people who have never been blessed with the opportunity to witness such a thing in action.

Offline

Like button can go here

#4 2024-03-25 08:58:15

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,304

Re: Oil, Peak Oil, etc.

As a percentage of GDP, overall investment in oil and gas production is about the same as it was in the early 2000s. It is above the levels seen between 1985 - 2000.

https://www.gisreportsonline.com/wp-con … 40x576.png

Of course, in 2023 dollars the investments now would be much larger than those that took place in previous decades, because nominal global GDP is much higher. This graph only goes up to 2015, which is a while back now. But look how much investment has exploded higher since 1973.

https://www.eia.gov/todayinenergy/detail.php?id=23072

What is concerning is that production is not proportionately higher. Investment does not stretch as far as it once did, because the remaining oil and gas reserves are more challenging and expensive to extract. And much of what we are getting is lower quality. Things like NGLs, condensates, tight oil, etc. These liquids have their uses, but they don't produce as much or any diesel, which is the lifeblood of the global economy.

This is a slow motion problem. Falling net energy returns on oil and gas investments are slowly squeezing the wealth out of industrial economies. Many people jumped onto the peak oil bandwaggon in the early 2000s, expecting that industrial society would very soon come to a shuddering halt due to shortages and they would get to remake the world in their image. But it doesn't work that way. Resource bases are like pyramids. There are more resources that aren't profitable today because of the energy, technology and investment needed to harvest them. This was the position that shale was at in the 1990s. Everyone knew it was there, but it took high oil prices and huge investment to develop the infrastructure and technology to bring it online. Those investments required a combination of low interest rates, high oil prices and cheap industrial materials before they were viable.

The problem is that new technology doesn't change the physical nature of the resource. It takes a lot more drilling and upfront investment for each barrel of oil than it used to. And that problem isn't going to reverse itself unless we find a vast new basin of untapped conventional oil that was previously overlooked. Otherwise, we remain trapped in a paradigm that requires us to continye investing more and more money to extract from the ground the liquid fuels that we need. At some point, the cost will end up being more than people can afford to pay. At that point, we get some kind of breakdown.

Last edited by Calliban (2024-03-25 09:21:04)

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#5 2024-03-25 13:26:12

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,304

Re: Oil, Peak Oil, etc.

Oil geolologist Art Berman discusses the impending decline of US shale production.

https://m.youtube.com/watch?v=6J9vmQYoiSg

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#6 2024-03-25 14:13:32

- kbd512

- Administrator

- Registered: 2015-01-02

- Posts: 8,500

Re: Oil, Peak Oil, etc.

Calliban,

Businesses cannot secure a short term loan from a bank in the United States of America to merely pay their own oilfield workers. That is a fact. The banks' stated reason for this is ESG. Ideology about energy has become untethered from reality. That is also a fact. If you removed 2/3rds of all investment dollars from farming, then within 10 years, you should expect to have a lot less food available, and whatever is left will demand higher prices.

Offline

Like button can go here

#7 2024-03-25 16:35:57

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,304

Re: Oil, Peak Oil, etc.

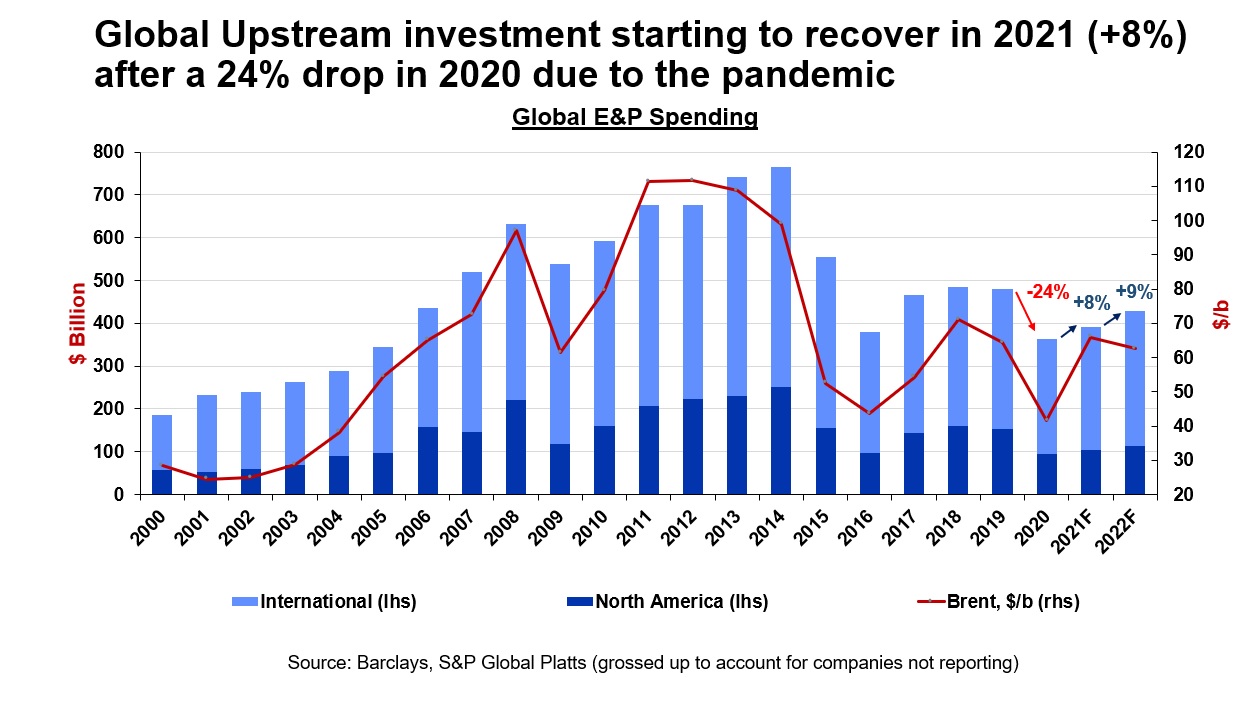

Upstream oil & gas capex has not dropped by 2/3rds globally. Though it has dropped considerably since the highs reached after 2008.

https://www.hellenicshippingnews.com/oi … il-prices/

It is a lot higher now than it was back in the early 2000s. Investment in oil and gas is still high by historical standards. It just isn't quite so crazy high as it was during the 2008 - 2014 period. The point is, we are investing much more now than we did 20-30 years ago. But we aren't getting that much more oil. And a lot of what is being produced is condensates.

Even North America is investing substantially more now than it was before 2005. After 2005, investment went to crazy highs. The tight oil boom is a legacy product of that investment. And it did produce a lot of oil. But it was only sustainable at almost zero interest rates. Compared to that surge in investment, todays spending is about 60% lower. But it is still high by historic standards. Will it continue in a high interest rate environment? That is an open question.

Last edited by Calliban (2024-03-25 16:50:46)

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#8 2024-03-26 18:25:53

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,473

Re: Oil, Peak Oil, etc.

bump as I saw that the US output is the highest that it's ever been and that we are importing less due to it happening.

Offline

Like button can go here

#9 2024-05-02 10:15:33

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,304

Re: Oil, Peak Oil, etc.

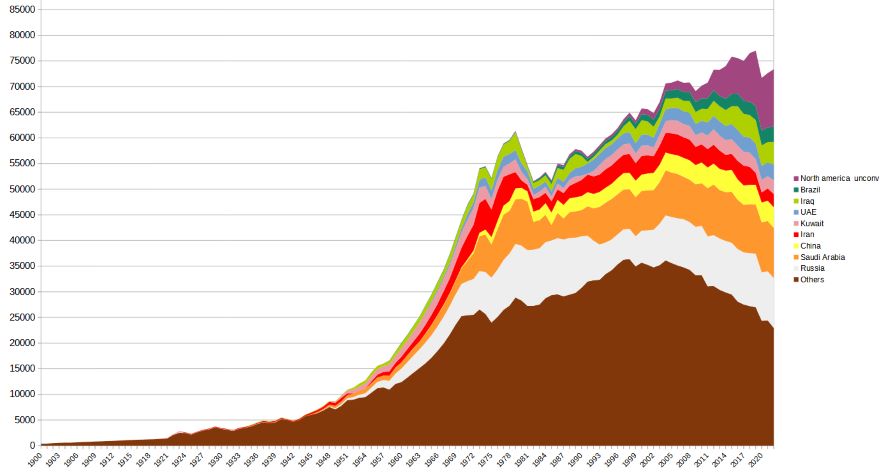

This graph from Peak Oil Barrel is sobering.

This is world crude oil production from 1900 until 2023. It looks to me like we are past global peak oil. Were it not for North American shale & syncrude, the peak year would have been 2005. Those things pushed it out another 13 years. God bless America! The graph refers only to crude. There are other liquids like NGLs, condensates, biofuels, etc. But the direction of travel is clear enough. Could solar synfuels fill the gap?

Last edited by Calliban (2024-05-02 10:23:40)

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#10 2024-05-02 12:31:17

- Void

- Member

- Registered: 2011-12-29

- Posts: 9,293

Re: Oil, Peak Oil, etc.

The USA and I think Canada also have a lot of "Oil Shale" which is not to be confused with "Shale Oil". If prices got high enough or technology improvements allowed it this might also be tapped. (Ignoring climate implications).

https://en.wikipedia.org/wiki/Oil_shale

But if nuclear or orbital solar or other develop, probably it stays in the ground.

https://www.usgs.gov/centers/central-en … /oil-shale

Quote:

The USGS Energy Resources Program has studied oil shale resources of the United States, with a significant effort on the Eocene Green River Formation of Colorado, Utah, and Wyoming. This formation contains the largest oil shale deposits in the world. Oil shale, despite the name, does not actually contain oil, but is a precursor of oil that is converted to crude oil when heated.

Done

Last edited by Void (2024-05-02 12:35:13)

Is it possible that the root of political science claims is to produce white collar jobs for people who paid for an education and do not want a real job?

Offline

Like button can go here

#11 2024-05-05 15:29:21

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,473

Re: Oil, Peak Oil, etc.

Researchers analyzed 1 million measurements taken by aircraft flying over oil and gas sites across the country. They determined that about 3% of the natural gas produced in the U.S. is escaping into the atmosphere.

That's a staggering 6.2 million tons of methane leaking every hour during the daytime. This wasted gas is worth around $1 billion per year. But the true cost is even higher when you consider the damage to our atmosphere.

The study covered over half of all American oil wells and nearly a third of the nation's total gas production and delivery infrastructure. While more research is needed to calculate a precise national average, the 3% leak rate was consistent across the six regions examined.

Offline

Like button can go here

#12 2024-06-11 12:53:02

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,304

Re: Oil, Peak Oil, etc.

Enormous oil province found in Antarctica.

https://oilprice.com/Energy/Crude-Oil/M … cerns.html

The province appears to contain 511billion barrels. That is two-thirds of the total oil reserves of the Middle East and 17.5 years of global crude demand. The 1959 treaty forbids its development. I wonder how long that will last now?

If it is developed, this will be some of the most expensive oil ever produced, due to the extremely challenging environment. But it would push back any concerns about imminently running out. It suggests to me that the priority for next decade should be the development of efficient hybrid vehicles that can get high mpg.

Last edited by Calliban (2024-06-11 12:56:29)

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#13 2024-06-12 10:53:45

- Void

- Member

- Registered: 2011-12-29

- Posts: 9,293

Re: Oil, Peak Oil, etc.

That is an interesting discovery, but in order to overcome the political opposition that might be expected, You have to deal with economic entities that will want to stifle it.

The 3 major producers, Middle East Russia, and USA/Canada, will not be eager for another source of oil. Yes, in the current situation Russia is being reduced in capabilities, but it still offers a potential in the future.

The Middle East at one time had almost free money from spices, and now operates in a similar way with Hydrocarbons. It has not yet run out, and will expect as demand rises and supply may dwindle, prices will go up, so it is likely to be a game they will play to the end.

As for North America, after oil plays out including Shale Oil, then reserves of Natural Gas may persist. But the pattern seems to be to export it as fast as possible, for quick bucks. Those who can control the flow, may want to get it out as fast as possible to avoiding it being stranded in the ground. And of course, those powers will continue to try to kill Nuclear Fission.

This is a pattern typical for Colonial Economics, I believe, control the supplies and the Markets.

And then there is alternative energy. They may or may not see options for themselves in those.

But after that, Canada still has Tar Sands, Venezuela, still has its very heavy oil, and the USA still has Oil Shale, (Not to confuse with Shale Oil).

https://en.wikipedia.org/wiki/Oil_shale

Quote:

Deposits of oil shale occur around the world, including major deposits in the United States. A 2016 estimate of global deposits set the total world resources of oil shale equivalent of 6.05 trillion barrels (962 billion cubic metres) of oil in place.[6] Oil shale has gained attention as a potential abundant source of oil.[7][8] However, the various attempts to develop oil shale deposits have had limited success. Only Estonia and China have well-established oil shale industries, and Brazil, Germany, and Russia utilize oil shale to some extent.[9]

I guess the Antarctic Oil could be tapped, provided that the economic powers that tap into and control oil markets see it as a better option than the alternate sources of energy that they would control.

That is how it works if we like it or not. At least that is my opinion.

Done

Last edited by Void (2024-06-12 11:08:16)

Is it possible that the root of political science claims is to produce white collar jobs for people who paid for an education and do not want a real job?

Offline

Like button can go here

#14 2024-12-19 14:39:15

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,304

Re: Oil, Peak Oil, etc.

Demographic ageing is already weighing on global oil demand.

https://www.artberman.com/blog/the-end- … e-falling/

This is due to ageing and shrinking populations in the developed parts of the world. This trend will proceed slowly but progressively over the next century. It places a downward pressure on oil prices, because it results in reduced demand.

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#15 2024-12-19 20:41:34

- Void

- Member

- Registered: 2011-12-29

- Posts: 9,293

Re: Oil, Peak Oil, etc.

Mentioning Electric Cars, I have seen some claims that a child 8 year old now will never need a drivers license. The point is that public transportation per autonomous cars, may make more efficient use of a car than a social system where most people own a car.

And getting to a humanoid robot, it has occurred to me to ask, how much energy does it take to support a pregnancy, and then to raise a child to be capable of doing tasks of value sufficient to justify the cost. That has to be a lot of literal energy, which also includes supplying competent parents, and an adult population that is not predatory on the young.

But an Optimus Robot will take only some energy and be able to do at least some tasks. So the up-front as you guys might say "Embodied Energy" will be much less. Also I suspect that the energy to maintain the robot will not be as much as to maintain a productive adult person who can do tasks.

But I am thinking literally in calories expended. I don't know how to make the measurements, or do the calculations, but I think we are on the edge of a very energy efficient task preforming society.

And with a sufficient labor force that can thread a needle, or play a piano, the need to ship things back and fourth across the oceans will diminish. Autarky, I believe is the notion.

We have talked about: https://en.wikipedia.org/wiki/Autarky on this site before. The conversation might at least have involved Louis as I recall.

Anyway, if Optimus and its competitor robots are to be as good as is being advertised, There will be much less need for North America to ship stuff across the oceans seeking low cost talented labor such as East Asia.

But the East Asians will also get a favor as they will not have to be competing to be the low cost labor pool. They will have robots to work for a lower rate than them.

But even in the future, maybe we go back just a little closer to Ozzy and Hariet, with some kids two adults and maybe two Optimus in the family.

It was just after WWII, and we were on the winning side, so this happened, (In dreams if not reality): https://www.bing.com/search?q=the+adven … ORM=DEPNAV

This picture needs to Optimus added to it:

Perhaps the Optimus can force Ozzy and Hariet to boogie down a little more at night.

But they could definitely help with raising the kids and keeping a household running.

Strange world. I might live to see some of it.

Ending Pending ![]()

Last edited by Void (2024-12-19 20:55:26)

Is it possible that the root of political science claims is to produce white collar jobs for people who paid for an education and do not want a real job?

Offline

Like button can go here

#16 2024-12-19 23:20:33

- clark

- Member

- Registered: 2001-09-20

- Posts: 6,386

Re: Oil, Peak Oil, etc.

you have kids because you want kids, and maybe it is a biological imperative that any conscious logical counter thought gets overridden, but the social and psychological reinforcements post birth result in a counter argument being moot. The impetus to reproduce will always exceed the impetus to not; darwin outlined this basic math.

Offline

Like button can go here

#17 2024-12-20 04:25:13

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,304

Re: Oil, Peak Oil, etc.

Goehring & Rozencwajg latest blog post is a 'well' of useful information on the future of oil production in the US.

https://blog.gorozen.com/blog/the-depletion-paradox

The short of it is that US tight oil and gas production will peak within the first half of Trump's presidency. Their model appears to be quite sound and has succesfully predicted the production profile of a number of shale basins for both oil and gas.

The good news is that the depletion curve from shale appears to be less symetrical than it is for conventional wells. That implies that decline rates will generally be slower than growth rates. The bad news is that US oil imports will probably grow in the years ahead. That will tend to weigh on the US trade deficit, pushing down the value of the dollar and providing impetus for higher interest rates. This will occur at a time of record high government indebtedness. It will be increasingly difficult to run the sort of deficits that western governments have run up since the turn of the century. The centre for government efficiency certainly has its work cut out. On the plus side, a weakening dollar will make reshoring manufacturing easier and will provide an incentive to reshore mining activities as well. Declining domestic oil production makes it all the more important to repeal the Jones Act and prioritise development of domestic rail infrastructure.

Declining global demand for oil due to demographic ageing, would at first appear to make it easier for the world to manage the consequences of oil and gas depletion. But the flip side is that those same factors are also undermining globalised business models. Geopolitics is trending towards regionalisation. The disruption of business continuity for western oil companies in the Russian sector is a good example. The gradual failure of the Iranian state is another. Stupid leftwing politics in the UK has hastened the decline of the British North Sea and damaged the US UK relationship. Trade tariffs could potentially impact oil trade between nations within trading blocs, i.e US and Canada. Demographic ageing and growing skills shortages also present bottlenecks to development of resources in geographically remote areas.

How the overall dynamic will play out is difficult to predict. We will experience falling supply and falling demand simultaneously, but also a shortage of skilled labour needed to run the economy generally. The slow breakdown of global trade is ominous, because greater regionalisation will tend to undermine scale economies already weakened by the shrinking demand resulting from demographic ageing. It also undermines global capital flows needed to sustain oil production in geographically distant regions.

There are wild cards on the horizon that could alter outcomes. A possible resurgence in nuclear power, in the form of a mass producable and rapidly buildable nuclear reactor, could substantially reduce electricity prices. That would be a boon for manufacturing. The perfection of a human equivelent robot has the potential to significantly boost worker productivity, but will not mitigate any of the problems associated with a shrinking consumer base. The development of AI may make business smarter and will help optimise manufacturing with less waste and smarter products.

The development of 3D printing technologies is especially promissing, because it allows precision manufacturing of components in smaller numbers, without the cost of retooling. This is clearly very valuable in a world in which consumer bases and scale economies are shrinking. Technologies like injection molding and die casting work well for production at scale. Producing a specialised die or mould, is expensive and time consuming. But this tooling burden is mitigated by mass production of product. But in situations where large numbers of unique components are needed without much scale, they break down. The development of Computer controlled 3D printing obviates the need for such retooling.

Last edited by Calliban (2024-12-20 05:28:10)

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#18 2024-12-20 12:50:19

- Void

- Member

- Registered: 2011-12-29

- Posts: 9,293

Re: Oil, Peak Oil, etc.

I find that I cannot trust news as given. For instance, I can see articles about how the Russians have suffered terrible losses, and then the same time that the Ukraine is the one losing by far. Someone is lying, and perhaps everyone is lying. It does make me have contempt for our so-called leadership of the news.

I have this statement on how much Natural Gas the USA has left:

https://www.eia.gov/tools/faqs/faq.php? … 86%20years.

Quote:

Assuming the same annual rate of U.S. dry natural gas production in 2021 of about 34.52 Tcf, the United States has enough dry natural gas to last about 86 years.

I don't really have a strong grasp on the information. It is usually planed that people like me are to be confused by the manner data is presented, and also by conflicting descriptions of data. If I understand, the "Dry Gas" is after liquids have been removed from it, so the liquids would be an additional smaller amount of production of fuels, I am inclined to believe.

Granted, if the Oil does taper off then we would likely start consuming the gas at a higher rate.

Rude as it may seem also Canada tends to have extra stuff to send us as it is more convenient to go south with some of it than to try East and West.

I have more faith in the OIL tapering off. But the language for that is also made muddy, I suspect on purpose.

https://www.ncesc.com/geographic-faq/do … eserves%29.

Quote:

How long can the US survive on its own oil? The United States has proven reserves equivalent to 4.9 times its annual consumption. This means that, without imports, there would be about 5 years of oil left (at current consumption levels and excluding unproven reserves).

The trick word is "Unproven" or "Proven".

I recall at a meeting one time a co-worker saying, "Figures Lie, and Liars Figure". It did not go over very well with the boss.

https://www.investopedia.com/ask/answer … sector.asp

I am not saying that you are wrong CALLIBAN, perhaps it will be as your news sources say it will be. But as I said at the beginning of this post, it seems to be sort of "He said, She said".

On the question of the results of humanoid robot labor.....I am not sure that the deflation that is likely is the same thing as was deflation for the great depression.

If a cost for a "widget" goes down to 10% of the previous, it depends on what the "widget" is, to say if demand for it's type could increase. You can only sleep in one bed, so then demand for that may not go up that much. But other things may have a demand increase response.

I am not trying to indicate that I have a greater knowledge, but rather a sense of uncertainty about what the future holds.

In a productive inflationary economy, even if you have a part time job, that money might get you much further than it does now.

The deflation of the great depression was not productive, but rather somehow a cascade of financial loss of liquidity, I think. Common people did not have money to buy products.

I am inclined to believe that there was a dark force trying to correct moral decay by inflicting poverty on the lower so called classes.

Royal Thinking entered the USA after the Civil War, I believe, and they finally seized control of America and tried to milk it dry. But their power is crumbling now. We will see what comes now.

Ending Pending ![]()

Last edited by Void (2024-12-20 13:18:04)

Is it possible that the root of political science claims is to produce white collar jobs for people who paid for an education and do not want a real job?

Offline

Like button can go here

#19 2024-12-20 13:55:28

- Void

- Member

- Registered: 2011-12-29

- Posts: 9,293

Re: Oil, Peak Oil, etc.

I guess I need to make clear, I have no problem with other countries royalty. The arrangements you have suit you and that is good enough for me.

I just don't like royal thinking in people who have no business in behaving in such a way. Particularly in the USA.

Curious that the Democrat Party seems to have much more of that as far as I can see.

Ending Pending ![]()

Is it possible that the root of political science claims is to produce white collar jobs for people who paid for an education and do not want a real job?

Offline

Like button can go here

#20 2024-12-20 14:28:43

- kbd512

- Administrator

- Registered: 2015-01-02

- Posts: 8,500

Re: Oil, Peak Oil, etc.

We could finally get serious about using algae to grow our own biofuels. In the worst case scenario / lowest projected yield per acre of 20,000L per year, we would need to devote a patch of desert or ocean of approximately 2,186mi^2, so 46.75 miles by 46.75 miles, in order to supply 100% of our current annual demand for fuels.

I'm reasonably sure we could do that, if we decided we were going to do it. It won't be easy or cheap, but the end result is all the fuel we presently use without having to constantly drill for more. Algae can make gasoline, diesel, kerosene, heating oil / bunker fuel, and tar. I know there are a lot more fractions of products, mostly natural gas, propane, and butane, but the present NGL supply is pretty stable. If the algae can take care of those major fractions of product being consumed, then I think we can manage the use of nuclear and solar thermal for generating electricity. All the steel and concrete devoted to drilling can then be used to construct new power reactors or solar power collectors / mirrors.

Call me crazy, but I do not foresee any "world beyond organic chemistry" in our immediate future. Our "beyond oil" people seem to think we're going to stop making roads, tires for vehicles, shoes, soap, plastic storage containers, medical equipment, pharmaceuticals, composites, cell phones, computers, electrical wiring insulation, etc. That sounds like going back to the pre-industrialization dark ages to me. I don't think they're going to find many takers for that proposition, unless most of us are going to start living the Amish lifestyle, which mostly eschews the use of electricity in favor of manual labor. There is precisely zero evidence of that starting to happen at any significant scale.

Could we, under some weird futurism fantasy, all start living like the Amish do?

I suppose that's possible, but some serious creativity and conservation of resources would be required to prevent hundreds of millions of people from literally starving to death. Nearly all labor would be devoted to what little power we do use and farming. Everyone moved off the farms in the late 1940s to 1950s, and almost nobody ever went back to farming.

Offline

Like button can go here

#21 2024-12-22 09:57:37

- Void

- Member

- Registered: 2011-12-29

- Posts: 9,293

Re: Oil, Peak Oil, etc.

This is something I want to pin here. I will return later about this: https://www.msn.com/en-us/news/technolo … cb1d&ei=12

Quote:

Hidden hydrogen reserves could power world for 200 years

Story by AMM • 5d • 3 min read

If it were true to a large extent then this could get us over the hump of transition to something like power to hydrocarbons or power to other methods.

Ending Pending ![]()

Last edited by Void (2024-12-22 09:59:12)

Is it possible that the root of political science claims is to produce white collar jobs for people who paid for an education and do not want a real job?

Offline

Like button can go here

#22 2025-05-06 13:00:21

- Void

- Member

- Registered: 2011-12-29

- Posts: 9,293

Re: Oil, Peak Oil, etc.

I sometimes see videos from Joe Blogs. This is an interesting one.

https://www.bing.com/videos/riverview/r … d6f2dd2531

Quote:

USA Starts Oil Price War

YouTube

Joe Blogs

663 views

This, I think is related to the Globalist vs. Regionalist, conflicts.

It seems to me that if we are going to use Tariffs as a tool, dealing with OPEC and even getting a bit of revenge might be considered. Don't get me wrong, I think that some oil exporters from the M.E. have been relatively responsible, at least in this century. However, some have not been so. So, maybe there could be oil tariffs for jerks. Jerks would be those who seem to hate us simply because we are us.

That would be an interesting turn of fate, where we might fill up our oil storage facilities with OPEC oil, while charging tariffs to protect from an Oil Price War, and having reduced taxes due to the revenue from the tariffs.

We should probably work to protect the Canada(s) oil industry as well, as it is a good benefit to the USA. And our little tiff with the Canada(s) will not last forever. They needed a little drama, and now they have it but things will perhaps settle down.

Ending Pending ![]()

Last edited by Void (2025-05-06 13:08:12)

Is it possible that the root of political science claims is to produce white collar jobs for people who paid for an education and do not want a real job?

Offline

Like button can go here

#23 2025-05-06 17:09:23

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,304

Re: Oil, Peak Oil, etc.

The problem that oil producers face now is proffitability. The economy is a thermodynamic machine that uses energy to rework matter into products and services that we consume. It follows that wealth is a result of energy reworking matter. This places an upper limit on what the economy can afford to pay for energy, given that x units of energy are needed to create y units of wealth.

The problem is that over time, depletion has pushed humanity to extract oil and gas from poorer resources that are more expensive to extract. There is an increasing disconnect between what consumers can afford to pay and what producers need to charge to stay proffitable. Add to this stagnating demand due to demographic ageing and it isn't hard to see why producers would want to push each other out of business to keep prices high. But high prices are unstable, because there are limits to what consumers can pay without pushing the economy into recession. This is how peak oil plays out in real life.

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#24 2025-05-06 18:56:01

- Void

- Member

- Registered: 2011-12-29

- Posts: 9,293

Re: Oil, Peak Oil, etc.

I don't have an arsenal of proof that I can deploy against your arguments.

But Trump has said that Anwar maybe be bigger than Saudi-Arabia.

No certainty though about that: https://alaskapublic.org/news/2016-12-0 … ly-in-anwr

And indeed that oil will cost to recover if even if the Doom Goblins cannot block it.

Now more than I remember you can get plenty of information that contradicts other information.

As for the Shale Oil, it is said that the easy oil has been had already. So, the cost may go up. I would not know, it seems probable.

Canada Oil Sands, probably will not become more expensive for some time, I expect, depending on what transpires with Canada. If Otowa blocks oil, it could be that we will be dealing with Canada(s), such as East and West or maybe more. I choose not to have a favorite in that battle. I do think that Canadians will not like getting poorer and are likely to head towards what looks good to them. I do not support annexation to the USA, at least not until a very long courtship, and likely not all of Canada for now at least.

Oil Sands apparently need dilutant oil. Probably they can get it for some time.

As for OPEC oil, I no longer have a hate for it, as I feel that if we are going to use a Tariff method, we can play favorites among them now.

It used to be that we seemed to have to go hammer some of them from time to time. But while Oil is power and that sometimes flows into terrorism and what the Houthi have been doing we can follow them or their friends home now with Tariffs. That is if you actions cost us so much in military actions then good luck avoiding tariffs, as we will tax the money back out of you for the cost you imposed on us. So, good OPECS get access to our markets bad OPECS get extra Tariff's in their poop sandwiches.

So, we are probably going to be good for a while, and over time things like Solar and Batteries, and wind, and nuclear will be brought to rational and effective levels.

Ending Pending ![]()

Last edited by Void (2025-05-06 19:16:14)

Is it possible that the root of political science claims is to produce white collar jobs for people who paid for an education and do not want a real job?

Offline

Like button can go here

#25 2025-05-08 13:09:19

- Void

- Member

- Registered: 2011-12-29

- Posts: 9,293

Re: Oil, Peak Oil, etc.

I did not know these things about the Alberta Oil Sands: https://www.bing.com/videos/riverview/r … &FORM=VIRE Quote:

EM Shorts May 8 2025MH oil sands

YouTube

Energi Media

49 minutes ago

That's not going to run out for some time, it seems.

Unless someone kills it.

And thanks from one American.

Ending Pending ![]()

So, technically the UK can get Oil from both the USA and Canada, but Quebec will not let it though, so, it has to go through the USA. That might be a deeper civilizational level game. Bad Froggies! Or is it Thanks! Froggies?

A very strange world.

Ending Pending ![]()

Last edited by Void (2025-05-08 13:17:57)

Is it possible that the root of political science claims is to produce white collar jobs for people who paid for an education and do not want a real job?

Offline

Like button can go here