New Mars Forums

You are not logged in.

- Topics: Active | Unanswered

Announcement

#51 2020-01-24 22:42:51

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,569

Re: New Solar Power Technology

Anything computer controlled connected in anyway back to a network can be hacked and these have happened to disrupt the grid.

The hackers do not care if its connected to a nuclear plant or a coal / propane / oil unit... Its just a joy ride on the next new car for many that do it just as much as a terrorist for thinking that they are hurting the governement...

Offline

Like button can go here

#52 2020-01-25 07:51:02

- tahanson43206

- Moderator

- Registered: 2018-04-27

- Posts: 24,098

Re: New Solar Power Technology

For SpaceNut re #51

Your statement here reminds me of the policy of a large bank with which I was familiar. From the beginning of the age of connectivity, which preceded the Internet, it was the policy of the management to keep the mainframes which did the bookkeeping isolated from contact with the outside world. That policy served them well when a virus swept through the entire PC network that had grown up along side. The PC network was down for a week while the mainframe systems just kept chugging along.

I see no reason for many of the networks corporations depend upon to be connected to the outside. However, even network isolation can be penetrated by a physical storage device. The Iranians experienced that when a simple thumb drive brought a virus into their otherwise secure uranium enrichment network.

Regardless of the challenges, management of organizations of all sizes MUST establish policies to protect networks, and to insure rapid and accurate recovery if a breech occurs. For many organizations, the extra costs of such care are not provided for in budgets, so the vulnerabilities persist.

(th)

Offline

Like button can go here

#53 2020-01-26 21:12:00

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,569

Re: New Solar Power Technology

I happened onto this forum that covers the energy topics we are discussing.

http://www.powerswitch.org.uk/forum/ind … dc40dc40e3

PowerSwitch

The UK's Peak Oil Discussion Forum & Community

Offline

Like button can go here

#54 2020-01-27 19:05:30

- louis

- Member

- From: UK

- Registered: 2008-03-24

- Posts: 7,208

Re: New Solar Power Technology

Good analysis from Casey Handmer about why solar is winning out against nuclear:

Let's Go to Mars...Google on: Fast Track to Mars blogspot.com

Offline

Like button can go here

#55 2020-01-28 02:03:25

- kbd512

- Administrator

- Registered: 2015-01-02

- Posts: 8,514

Re: New Solar Power Technology

Better analysis from someone who counted the dollars and cents associated with the incredible costs and paltry results of wind and solar power when it comes to watt-hours produced per dollar spent, no matter the propaganda behind them, and why it's not good for winning much except obscene levels of government subsidies:

powerelectronics.com - The True Cost of Solar Energy by Cabe Atwell

From the article:

The Truth Behind Solar Subsidies

The cost of solar infrastructure and installations has fallen largely due to government subsidies. In fact, some say solar energy could not survive at all without massive government subsidies. In terms of production, solar energy has received ten times the subsidies all other forms of energy. Subsidies for solar directly affect the production of electricity, directly affecting cost and pricing. Between 2010 and 2016, subsidies for solar energy ranged from 10¢ to 88¢ per kWh, while subsidies for coal, natural gas, and nuclear were from 0.05¢ to 0.2¢.

These subsidies incentivize solar panels, but end up increasing the cost of the electricity they generate. This cost is transferred directly to the ratepayers via utility bills. Moreover, customers involved in net metering are often paid inflated prices for excess power produced. Ratepayers end up funding the production of already heavily subsidized solar installations, a phenomenon which actually makes the adoption of renewable energy costlier.

I could concoct a scheme to make nuclear power cost less than nothing with the subsidies provided to solar power, but that would be completely dishonest and unfair to the rate payers. Only companies offering wind and solar are allowed to be completely dishonest and unfair to the rate payers. Incidentally Casey Handmer is every bit as guilty of engaging in reasoning by analogy when it comes to wind and solar power as he accuses others of engaging in when it comes to all the hand-waving major technological problems that thus far hasn't resulted in any Mars missions.

By Dr Handmer's own analogy, wind and solar have already been iterated dozens of times thus far they're still just as impractical as replacements for our total primary energy supply as they were when I was a child. Nuclear power was basically iterated twice and is still producing more of America's electricity than all the wind and solar combined. 1950's nuclear steam engine technology is still beating the snot out of wind and solar in terms of land usage efficiency more than half a century after both technologies were initially developed. Only ideologues refuse to acknowledge that the power contained within the atom and pretend we don't know how to control it, yet we're somehow going to manage the infinitely more complex technical task of starting a second branch of human civilization on a completely inhospitable planet such as Mars.

If 2030 is actually some magic number for climate change, though I will readily concede that it's not, then our only hope of making significant progress towards decarbonization by that target date is through massive deployment of nuclear power. Germany has the most significant deployment of wind and solar, yet their emissions reduction achieved is only equivalent to where they were 10 years ago. If they had spent the money they squandered on wind and solar power on nuclear power, then as of today none of their electricity would come from burning anything. Unfortunately, wild-eyed ideology of the same sort that you and Dr. Handmer are so enthusiastic about wasted incredible sums of money for very little result. That result is just a bitter fact and it doesn't matter if you or Dr. Handmer are willing to accept it yet. In the end, physics doesn't care about your ideology and, inevitably, physics always wins.

Offline

Like button can go here

#56 2020-01-28 07:02:00

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,305

Re: New Solar Power Technology

Solar PV is relatively easy and quick to assemble and has no moving parts. Handmer is correct in his appraisal of those attributes; these are big things in its favour. Unfortunately, its huge inherent embodied materials and energy requirements and its need for backup power; tend to outweigh these advantages. At present, a solar power plant is basically a CCGT power plant, with the solar input reducing the fuel bill a little, at the expense of extra capital cost. At present, even if solar plants produced electricity for free, the real reduction in electricity costs would be small. At present, they do not produce power for free, which is why increasing renewable energy penetration leads to higher fuel bills. You are paying for two power stations that do the job of just one. It is very difficult to achieve a cost reduction in that context. Batteries don't change that calculation. They are basically solid state power plants that have their own capital costs, embodied energy and maintenance requirements.

Rapidly falling prices of solar panels and batteries have given people a misleading impression of what will ultimately be possible. Much of this is the result of central bank monetary policies that will ultimately need to be reversed. For the past decade, the world's manufacturing economy has been on shaky ground, with continued growth only possible due to enormous stimulus provided by the Chinese, US and ECB. Stock and bond prices are being propped up by quantitative easing and interest rates that are lower than inflation. Companies everywhere are producing products at less than their true cost. On top of this, commodity prices are now low, due to weakening consumer demand.

For solar power, whose lifetime cost is disproportionately capital cost; this allows artificially cheap production and assembly. Manufacturers are able to sell something made with artificially cheap materials, at less than it costs to build it, to gain market share, whilst borrowing money to cover losses, knowing that inflation will reduce the debt to zero more rapidly than interest payments stack up. The buyer is able to purchase the equipment and install it, using the same zero interest rate money. Even with its high embodied energy, this tends to make solar power look very cheap. But the debt associated with it is not really any smaller; it is just easier to manage at near zero interest rates. The same economics that allow companies to produce dirt cheap solar panels, has also allowed an explosive increase in US oil production, from tight oil deposits that would not have been considered economically viable back in 2007.

The problem is that this state of economics is temporary. Debt levels are increasing to the point where they now pose a threat to fiat currencies. Ultimately, it will be necessary to raise interest rates and reverse quantitative inflation of the money supply to avoid hyperinflation. When this will happen, I cannot say. But when it does, the global economic model of the past decade, in which companies and consumers alike have grown accustomed to economics at close to zero interest rates, will rapidly be turned upside down. And many cherished assumptions about the continued cost reduction of low-power density intermittent energy, will be shattered.

https://schiffgold.com/key-gold-news/co … gy-bubble/

https://www.bloomberg.com/news/articles … nergy-boom

https://wattsupwiththat.com/2019/12/27/ … le-energy/

Last edited by Calliban (2020-01-28 07:15:45)

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#57 2020-01-28 08:08:48

- louis

- Member

- From: UK

- Registered: 2008-03-24

- Posts: 7,208

Re: New Solar Power Technology

Did you read the conclusion?:

"Solar energy can provide consumers with significant savings on electricity. If adequate measures are taken to minimize its effects on the environment, the technology could prove to be a strong alternative to fossil fuels and wind power."

That's hardly a negative appraisal.

But in any case the article is poorly referenced and frankly all over the place.

Firstly, this 2 year old article relies on 4 year old estimates for subsidy contributions. These estimates appear to include back of the envelope calculations by some writer at The Hill. Not credible.

Secondly, it appears to be focussed on domestic rooftop solar - the most expensive type of solar power. So, only of marginal relevance.

Thirdly, it doesn't properly evaluate the price of utility solar power, which is really what Handmer (and I) am focussed on.

Finally, it appears not to recognise that now, with utility solar power, chemical batteries are allowing intermittency to be mitigated, which in turn is reducing back-up power requirements.

Better analysis from someone who counted the dollars and cents associated with the incredible costs and paltry results of wind and solar power when it comes to watt-hours produced per dollar spent, no matter the propaganda behind them, and why it's not good for winning much except obscene levels of government subsidies:

powerelectronics.com - The True Cost of Solar Energy by Cabe Atwell

From the article:

The Truth Behind Solar Subsidies

The cost of solar infrastructure and installations has fallen largely due to government subsidies. In fact, some say solar energy could not survive at all without massive government subsidies. In terms of production, solar energy has received ten times the subsidies all other forms of energy. Subsidies for solar directly affect the production of electricity, directly affecting cost and pricing. Between 2010 and 2016, subsidies for solar energy ranged from 10¢ to 88¢ per kWh, while subsidies for coal, natural gas, and nuclear were from 0.05¢ to 0.2¢.

These subsidies incentivize solar panels, but end up increasing the cost of the electricity they generate. This cost is transferred directly to the ratepayers via utility bills. Moreover, customers involved in net metering are often paid inflated prices for excess power produced. Ratepayers end up funding the production of already heavily subsidized solar installations, a phenomenon which actually makes the adoption of renewable energy costlier.

I could concoct a scheme to make nuclear power cost less than nothing with the subsidies provided to solar power, but that would be completely dishonest and unfair to the rate payers. Only companies offering wind and solar are allowed to be completely dishonest and unfair to the rate payers. Incidentally Casey Handmer is every bit as guilty of engaging in reasoning by analogy when it comes to wind and solar power as he accuses others of engaging in when it comes to all the hand-waving major technological problems that thus far hasn't resulted in any Mars missions.

By Dr Handmer's own analogy, wind and solar have already been iterated dozens of times thus far they're still just as impractical as replacements for our total primary energy supply as they were when I was a child. Nuclear power was basically iterated twice and is still producing more of America's electricity than all the wind and solar combined. 1950's nuclear steam engine technology is still beating the snot out of wind and solar in terms of land usage efficiency more than half a century after both technologies were initially developed. Only ideologues refuse to acknowledge that the power contained within the atom and pretend we don't know how to control it, yet we're somehow going to manage the infinitely more complex technical task of starting a second branch of human civilization on a completely inhospitable planet such as Mars.

If 2030 is actually some magic number for climate change, though I will readily concede that it's not, then our only hope of making significant progress towards decarbonization by that target date is through massive deployment of nuclear power. Germany has the most significant deployment of wind and solar, yet their emissions reduction achieved is only equivalent to where they were 10 years ago. If they had spent the money they squandered on wind and solar power on nuclear power, then as of today none of their electricity would come from burning anything. Unfortunately, wild-eyed ideology of the same sort that you and Dr. Handmer are so enthusiastic about wasted incredible sums of money for very little result. That result is just a bitter fact and it doesn't matter if you or Dr. Handmer are willing to accept it yet. In the end, physics doesn't care about your ideology and, inevitably, physics always wins.

Let's Go to Mars...Google on: Fast Track to Mars blogspot.com

Offline

Like button can go here

#58 2020-01-28 08:37:38

- louis

- Member

- From: UK

- Registered: 2008-03-24

- Posts: 7,208

Re: New Solar Power Technology

Solar PV is relatively easy and quick to assemble and has no moving parts. Handmer is correct in his appraisal of those attributes; these are big things in its favour. Unfortunately, its huge inherent embodied materials and energy requirements and its need for backup power; tend to outweigh these advantages. At present, a solar power plant is basically a CCGT power plant, with the solar input reducing the fuel bill a little, at the expense of extra capital cost. At present, even if solar plants produced electricity for free, the real reduction in electricity costs would be small. At present, they do not produce power for free, which is why increasing renewable energy penetration leads to higher fuel bills. You are paying for two power stations that do the job of just one. It is very difficult to achieve a cost reduction in that context. Batteries don't change that calculation. They are basically solid state power plants that have their own capital costs, embodied energy and maintenance requirements.

Batteries do change the calculation and that is being reflected in price already. That's one of the reasons price is going down to around 2 cents per KwH in the SW USA already.

Once the storage issue is fully resolved then solar is no longer a CCGT plus plant. How quickly will that happen? We don't know. But it is clear that chemical batteries as a percentage of the overall system add value, rather than adding cost (since the solar power company can get more return on their overall investment). This article suggests battery storage needs to drop 90% in price for a fully workable solution with renewables.

https://www.pv-magazine.com/2019/08/12/ … o-drop-90/

Firstly, such a reduction is not impossible. There may be a breakthrough. Secondly, solar can still expand on a 20, 30 or 50% reduction.

Rapidly falling prices of solar panels and batteries have given people a misleading impression of what will ultimately be possible. Much of this is the result of central bank monetary policies that will ultimately need to be reversed. For the past decade, the world's manufacturing economy has been on shaky ground, with continued growth only possible due to enormous stimulus provided by the Chinese, US and ECB. Stock and bond prices are being propped up by quantitative easing and interest rates that are lower than inflation. Companies everywhere are producing products at less than their true cost. On top of this, commodity prices are now low, due to weakening consumer demand.

World GDP has grown strongly every year apart from one year (2008 I think). People across the world have been getting wealthier year on year. You are not describing economic reality.

For solar power, whose lifetime cost is disproportionately capital cost; this allows artificially cheap production and assembly. Manufacturers are able to sell something made with artificially cheap materials, at less than it costs to build it, to gain market share, whilst borrowing money to cover losses, knowing that inflation will reduce the debt to zero more rapidly than interest payments stack up. The buyer is able to purchase the equipment and install it, using the same zero interest rate money. Even with its high embodied energy, this tends to make solar power look very cheap. But the debt associated with it is not really any smaller; it is just easier to manage at near zero interest rates. The same economics that allow companies to produce dirt cheap solar panels, has also allowed an explosive increase in US oil production, from tight oil deposits that would not have been considered economically viable back in 2007.

Solar costs have continued to fall since 2008 even while interest rates have remained broadly stable. It's technology and economies of scale that are the more important determinants of the price of solar power.

The problem is that this state of economics is temporary. Debt levels are increasing to the point where they now pose a threat to fiat currencies. Ultimately, it will be necessary to raise interest rates and reverse quantitative inflation of the money supply to avoid hyperinflation. When this will happen, I cannot say. But when it does, the global economic model of the past decade, in which companies and consumers alike have grown accustomed to economics at close to zero interest rates, will rapidly be turned upside down. And many cherished assumptions about the continued cost reduction of low-power density intermittent energy,

will be shattered.

There are lots of entities that don't need to borrow to manufacture solar power panels. I think this is economic gobbledegook you are putting across here. You might see a slow down in the rate of increase in solar power if interest rates suddenly went high again but you wouldn't see a halt or decline in the amount of solar power. That's all.

Let's Go to Mars...Google on: Fast Track to Mars blogspot.com

Offline

Like button can go here

#59 2020-01-28 09:43:50

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,305

Re: New Solar Power Technology

Finally, it appears not to recognise that now, with utility solar power, chemical batteries are allowing intermittency to be mitigated, which in turn is reducing back-up power requirements.

Louis, I'm sorry to be the bearer of bad news, but battery capacity installed at wind farms and solar power plants is typically there to provide frequency control for the grid. With diminishing spinning reserve, many grids lack inertia and need buffering of this sort to avoid frequency instability that would result from intermittent energy sources with high slew rates. This sort of instability has resulted in wind and solar power plants tripping the grid.

These battery systems typically provide minutes of storage, some provide up to 1 hour. Useful tools in their context, but a little different to the 'storage' that you are alluding to.

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#60 2020-01-28 11:46:02

- louis

- Member

- From: UK

- Registered: 2008-03-24

- Posts: 7,208

Re: New Solar Power Technology

Minutes at a time? No I think you are wrong. These latest tenders seem to focus on being able to produce around 3-4 hours of electricity from storage. This one for example has storage of 1200 MwHs, with an output of 300 Mws, so 4 hours:

https://www.8minute.com/2020/01/capital … ge-center/

The solar facility is described as 400 MWac. Not sure if that is average output (over the whole day or hours of daylight) or capacity or what...

I think your info is out of date.

Chemical batteries are doing more than just regulating flow. They are able to provide "despatchable" power as 8minute claim.

I'm not saying the intermittency problem has been resolved but it is being addressed. The more dependable on a daily basis that solar power is, the more you build up hydro as a battery reserve for periods of anomalous weather, when the system might be hard pressed. That in turn reduces reliance on gas turbines to plug the gap.

louis wrote:Finally, it appears not to recognise that now, with utility solar power, chemical batteries are allowing intermittency to be mitigated, which in turn is reducing back-up power requirements.

Louis, I'm sorry to be the bearer of bad news, but battery capacity installed at wind farms and solar power plants is typically there to provide frequency control for the grid. With diminishing spinning reserve, many grids lack inertia and need buffering of this sort to avoid frequency instability that would result from intermittent energy sources with high slew rates. This sort of instability has resulted in wind and solar power plants tripping the grid.

These battery systems typically provide minutes of storage, some provide up to 1 hour. Useful tools in their context, but a little different to the 'storage' that you are alluding to.

Let's Go to Mars...Google on: Fast Track to Mars blogspot.com

Offline

Like button can go here

#61 2020-01-28 18:54:44

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,569

Re: New Solar Power Technology

The battery discharge time has to do with the current draw from the battery by the device its trying to power and not its actuall wattage of the batteries ampere hrs or what it is rated at. That is why it can be so short a period of time. You do not want to do this as it will degrade the batteries due to internal heating.

Batteries do conditioning when charging and do dispatch power when discharging. It has to do with the direction that the current is flowing.

The use of the battery in the windmill is because the windmill creates random frequecies based on the rpm coil count for the out going ac that it produces. A diode is used to change the ac via rectification into dc that is used to charge the batteries.

For the solar panel its output is dc but to be able to match the battery charging condition the voltage is converted to an ac format to raise the incoming voltage to a value that is higher than the battery as a step up so as to charge the battery. As the voltage from the panel rises the convert changes operation from a boost or step up convertor to a buck style in that it is trying to step voltage back down or in this case control current pulses into the battery.

Offline

Like button can go here

#62 2020-01-28 19:25:45

- louis

- Member

- From: UK

- Registered: 2008-03-24

- Posts: 7,208

Re: New Solar Power Technology

The link I gave refers to solar plus storage. I don't understand the point you are making. The link says the storage is 1200 MwHs. The whole point of these packages is that they can deliver power for hours at a time. That is why they can deliver "despatchable power", as the company 8minute claim.

From Wikipedia: "Dispatchable generation refers to sources of electricity that can be used on demand and dispatched at the request of power grid operators, according to market needs. Dispatchable generators can be turned on or off, or can adjust their power output according to an order."

Now, I appreciate 8minute are marketing their product and their system is not fully despatchable 24/7 as some gas turbines are, or as nuclear is. But they are able to respond more readily to demand and extend beyond the hours of daylight. The batteries are not just putting out power for a few minutes at a time.

I think you are confusing this system with previous battery systems that had a much more limited function.

The battery discharge time has to do with the current draw from the battery by the device its trying to power and not its actuall wattage of the batteries ampere hrs or what it is rated at. That is why it can be so short a period of time. You do not want to do this as it will degrade the batteries due to internal heating.

Batteries do conditioning when charging and do dispatch power when discharging. It has to do with the direction that the current is flowing.The use of the battery in the windmill is because the windmill creates random frequecies based on the rpm coil count for the out going ac that it produces. A diode is used to change the ac via rectification into dc that is used to charge the batteries.

For the solar panel its output is dc but to be able to match the battery charging condition the voltage is converted to an ac format to raise the incoming voltage to a value that is higher than the battery as a step up so as to charge the battery. As the voltage from the panel rises the convert changes operation from a boost or step up convertor to a buck style in that it is trying to step voltage back down or in this case control current pulses into the battery.

Let's Go to Mars...Google on: Fast Track to Mars blogspot.com

Offline

Like button can go here

#63 2020-01-28 19:31:34

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,569

Re: New Solar Power Technology

If you store 1200 MwHs and then your demand is 1200 MwHs then its only going to last 1 hr

The article calls out "400MWac solar and storage center project features a 300MW/1200 MWh energy storage facility" means that the storage is made up of 4 x 300 MW units that will produce 1200 MWhrs...something ;ole this one

400MWac is the company name...on a 25-year power purchase agreement

More details https://www.prnewswire.com/news-release … 90780.html

700 MW Eland Solar Energy and Storage Center, which currently is the lowest cost PPA for a new generation of fully dispatchable solar plus storage baseload power plants with 1200 MWh of energy storage at a price below 4 cents/kWh.

https://pv-magazine-usa.com/2019/06/28/ … C2%A2-kwh/

Los Angeles seeks record setting solar power price under 2¢/kWh

The city’s municipal utility is readying a 25-year power purchase agreement for 400 MWac of solar power at 1.997¢/kWh along with electricity from 200 MW / 800 MWh of energy storage at a 1.3¢/kWh adder, for an aggregate price of 3.297¢/kWh.

https://ocisolarpower.com/texas-utilities/

The City of San Antonio, OCISP to develop 400 MWac of clean, renewable energy to serve about 90,000 homes.

Offline

Like button can go here

#64 2020-01-29 05:50:49

- louis

- Member

- From: UK

- Registered: 2008-03-24

- Posts: 7,208

Re: New Solar Power Technology

The example given in the table appears to show a storage output time of 4 hours (4 x 100 MWhs).

I am assuming the idea is to even out supply and make it more despatchable. So if demand is greater than expected at 25% in excess of a max. of 200 MW ie at 250 MW and your supply is 25% below normal because of cloudy conditions then you cover that for at least four hours with your battery. Well, that would be a simplified example. If it's a sunny day perhaps you can supply 100 MWs per hour for four hours after late afternoon. And all the while if you have good access to hydro, you can be keeping your hydro topped up, so that can be used as a big battery to cope with periods of difficult weather conditions. It's helping stability all round.

It's not the end of intermittency as a problem but it is alleviating the problem substantially.

If you store 1200 MwHs and then your demand is 1200 MwHs then its only going to last 1 hr

The article calls out "400MWac solar and storage center project features a 300MW/1200 MWh energy storage facility" means that the storage is made up of 4 x 300 MW units that will produce 1200 MWhrs...something ;ole this one

https://secureservercdn.net/45.40.155.1 … LowRes.jpg

400MWac is the company name...on a 25-year power purchase agreement

More details https://www.prnewswire.com/news-release … 90780.html

700 MW Eland Solar Energy and Storage Center, which currently is the lowest cost PPA for a new generation of fully dispatchable solar plus storage baseload power plants with 1200 MWh of energy storage at a price below 4 cents/kWh.

https://pv-magazine-usa.com/2019/06/28/ … C2%A2-kwh/

Los Angeles seeks record setting solar power price under 2¢/kWhThe city’s municipal utility is readying a 25-year power purchase agreement for 400 MWac of solar power at 1.997¢/kWh along with electricity from 200 MW / 800 MWh of energy storage at a 1.3¢/kWh adder, for an aggregate price of 3.297¢/kWh.

https://l0dl1j3lc42iebd82042pgl2-wpengi … 00x583.png

https://ocisolarpower.com/texas-utilities/

The City of San Antonio, OCISP to develop 400 MWac of clean, renewable energy to serve about 90,000 homes.

Last edited by louis (2020-01-29 05:52:41)

Let's Go to Mars...Google on: Fast Track to Mars blogspot.com

Offline

Like button can go here

#65 2020-01-29 06:36:17

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,305

Re: New Solar Power Technology

Could rising interest rates pop the renewable energy bubble?

https://schiffgold.com/key-gold-news/co … gy-bubble/

As the Federal Reserve and other central banks try to turn off the easy money spigot, we will likely see a growing number of corporate bankruptcies in the coming years. The renewable energy sector is particularly vulnerable and exemplifies broader problems in the global economy.

Last year, we saw a number of high-profile corporate bankruptcies, particularly in the retail sector. Toys R Us was probably the most high profile. It ranks as the second-largest US retail bankruptcy ever, according to S&P Global Market Intelligence. The story behind the Toys R Us bankruptcy gives us a glimpse at a fundamental problem eroding the strength of the economy – easy money created by Federal Reserve monetary policy. The ability to borrow a lot of money at low interest rates fueled borrowing and speculation. Malinvestment has distorted the economy and inflated bubbles that will eventually pop. This is exactly what happened at Toys R Us.

The rate of bankruptcies will likely accelerate over the next several years and spread into other sectors if the Fed follows through on its monetary tightening policies. The ugly truth is that these overleveraged companies simply can’t survive in anything remotely resembling a normal interest rate environment.

As economist Daniel Lacalle noted in an article on the Mises Wire, the past eight years of easy money and massive liquidity enabled companies to increase imbalances and create complex debt structures. Two facts bear this out.

•Corporate net debt to EBITDA levels is at record highs. About 20% of US corporates face default if rates rise, according to the IMF.

•The number of zombie companies has risen above pre-crisis levels according to the Bank of International Settlements (BIS).

The incredible transformation of the renewable energy sector over the last decade was built on easy money and government subsidies. Lacalle said understanding that disruptive technologies cannot be more leveraged than traditional technologies is key to understanding what’s going on in the renewable energy sector.

"When technology reduces costs and disrupts inflationary models, basing the business on ever-increasing subsidies and higher prices and financing it with massive debt is suicidal. In the era of cheap money and extreme liquidity, many companies used the ‘green’ subterfuge to implement an extremely leveraged builder-developer model, ignoring demand, costs, and competition. A model whose sole objective was to install for the sake of installing capacity, whether there was a demand or not, and that pursued subsidies while stating that it is very competitive.”

Even in a period of low interest rates and ample liquidity, we’ve seen a number of spectacular bankruptcies in the renewable energy sector. In fact, solar company bankruptcies have exceeded those of coal and fracking companies combined. As Lacalle says, if the renewable sector is already struggling, imagine what will happen as interest rates rise.

"Bankruptcies such as SolarWorld, ET Solar, American Solar, SunEdison, Sungevity, Suniva, Beamreach, Verengo Solar and others did not happen due to lack of support or technology, but due to a bubble-type business model. Increase debt to pay debt, death from excess capacity and working capital amidst unbridled imperialistic growth aspirations. While many companies filled Powerpoint slides with the competitive advantages of lower costs, their business sank due to the impossibility of generating returns above the cost of capital and the evidence of death by building working capital.”

According to Lacalle, global renewable energy sector faces refinancing needs over the next seven to eight years that exceed its entire market capitalization (134 billion euros, based on information from Renixx Index).

Lacalle says this isn’t just an issue in the renewable energy sector. The problems facing solar and wind energy companies exemplifies an economy-wide problem.

"It is not a problem of technology, it is the addiction to cheap debt and growth for growth sake. And it’s not just a problem in the renewable sector. The combination of lower revenues and increased debt costs is a danger. Cost of debt rises, and cost of equity soars due to higher perceived risk, which in turn can dry up the market for capital increases and refinancing. It is not just renewables, but it is worth highlighting that energy is -again- the most vulnerable sector due to the cyclical nature of its revenues and the perpetuation of overcapacity of the past eight years. In 2018, for all sectors, refinancing needs exceed one trillion euros in Europe, Africa, and the Middle East. This figure is doubled if we include China and other markets. At the same time, the number of zombie companies has skyrocketed in the era of cheap money. What is a zombie company? Those that are not able to pay interest expenses with operating profits.”

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#66 2020-01-29 06:57:49

- louis

- Member

- From: UK

- Registered: 2008-03-24

- Posts: 7,208

Re: New Solar Power Technology

Rising interest rates can slow down expansion. Recessions can slow down development. But remember: capital-intensive electricity grids expanded hugely during the worst depression we've ever seen, in the 1930s. The internet expanded hugely when interest rates were very high, in the 80s and 90s.

If interest rates go up, we'll likely see an increase in profitability at the same time. Also, electricity grid owners and suppliers will likely begin to build wind and solar themselves if they think they can produce cheaper electricity. They don't have to borrow - they can charge the consumer up front.

Bankruptcies are not really very relevant to this discussion. Hundreds of rail firms went bust as railways expanded across the world. Hundreds of car companies have gone bust over the last 100 years, but worldwide, automobile manufacture continues to expand.

Solar and wind energy are similar to railways. If the rail company goes bust, you still have the railway, but now it is available for purchase at a low price without debt. That's how capitalism works! Some gambles pay off and some, or maybe most, don't. SImilarly with solar and wind, even if the power company goes bust, the wind turbines and the solar panels are still there and now available to be bought at a cheap price.

Could rising interest rates pop the renewable energy bubble?

https://schiffgold.com/key-gold-news/co … gy-bubble/

As the Federal Reserve and other central banks try to turn off the easy money spigot, we will likely see a growing number of corporate bankruptcies in the coming years. The renewable energy sector is particularly vulnerable and exemplifies broader problems in the global economy.

Last year, we saw a number of high-profile corporate bankruptcies, particularly in the retail sector. Toys R Us was probably the most high profile. It ranks as the second-largest US retail bankruptcy ever, according to S&P Global Market Intelligence. The story behind the Toys R Us bankruptcy gives us a glimpse at a fundamental problem eroding the strength of the economy – easy money created by Federal Reserve monetary policy. The ability to borrow a lot of money at low interest rates fueled borrowing and speculation. Malinvestment has distorted the economy and inflated bubbles that will eventually pop. This is exactly what happened at Toys R Us.

The rate of bankruptcies will likely accelerate over the next several years and spread into other sectors if the Fed follows through on its monetary tightening policies. The ugly truth is that these overleveraged companies simply can’t survive in anything remotely resembling a normal interest rate environment.

As economist Daniel Lacalle noted in an article on the Mises Wire, the past eight years of easy money and massive liquidity enabled companies to increase imbalances and create complex debt structures. Two facts bear this out.

•Corporate net debt to EBITDA levels is at record highs. About 20% of US corporates face default if rates rise, according to the IMF.

•The number of zombie companies has risen above pre-crisis levels according to the Bank of International Settlements (BIS).The incredible transformation of the renewable energy sector over the last decade was built on easy money and government subsidies. Lacalle said understanding that disruptive technologies cannot be more leveraged than traditional technologies is key to understanding what’s going on in the renewable energy sector.

"When technology reduces costs and disrupts inflationary models, basing the business on ever-increasing subsidies and higher prices and financing it with massive debt is suicidal. In the era of cheap money and extreme liquidity, many companies used the ‘green’ subterfuge to implement an extremely leveraged builder-developer model, ignoring demand, costs, and competition. A model whose sole objective was to install for the sake of installing capacity, whether there was a demand or not, and that pursued subsidies while stating that it is very competitive.”

Even in a period of low interest rates and ample liquidity, we’ve seen a number of spectacular bankruptcies in the renewable energy sector. In fact, solar company bankruptcies have exceeded those of coal and fracking companies combined. As Lacalle says, if the renewable sector is already struggling, imagine what will happen as interest rates rise.

"Bankruptcies such as SolarWorld, ET Solar, American Solar, SunEdison, Sungevity, Suniva, Beamreach, Verengo Solar and others did not happen due to lack of support or technology, but due to a bubble-type business model. Increase debt to pay debt, death from excess capacity and working capital amidst unbridled imperialistic growth aspirations. While many companies filled Powerpoint slides with the competitive advantages of lower costs, their business sank due to the impossibility of generating returns above the cost of capital and the evidence of death by building working capital.”

According to Lacalle, global renewable energy sector faces refinancing needs over the next seven to eight years that exceed its entire market capitalization (134 billion euros, based on information from Renixx Index).

Lacalle says this isn’t just an issue in the renewable energy sector. The problems facing solar and wind energy companies exemplifies an economy-wide problem.

"It is not a problem of technology, it is the addiction to cheap debt and growth for growth sake. And it’s not just a problem in the renewable sector. The combination of lower revenues and increased debt costs is a danger. Cost of debt rises, and cost of equity soars due to higher perceived risk, which in turn can dry up the market for capital increases and refinancing. It is not just renewables, but it is worth highlighting that energy is -again- the most vulnerable sector due to the cyclical nature of its revenues and the perpetuation of overcapacity of the past eight years. In 2018, for all sectors, refinancing needs exceed one trillion euros in Europe, Africa, and the Middle East. This figure is doubled if we include China and other markets. At the same time, the number of zombie companies has skyrocketed in the era of cheap money. What is a zombie company? Those that are not able to pay interest expenses with operating profits.”

Let's Go to Mars...Google on: Fast Track to Mars blogspot.com

Offline

Like button can go here

#67 2020-01-29 07:08:29

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,305

Re: New Solar Power Technology

US interest rates have been held lower than inflation for nearly 12 years now. All other central banks have pursued the same policy. It is an unprecedented situation that destroys the return on capital and reflects the underlying weakness in the global economy following the peak in conventional oil production in 2005.

https://www.macrotrends.net/2015/fed-fu … ical-chart

https://www.thebalance.com/u-s-inflatio … st-3306093

Maybe base rates are a long way beneath inflation, depending upon whose figures you choose to believe.

http://www.shadowstats.com/alternate_da … ion-charts

The price of solar panels per watt fell off a cliff at exactly the same time. There was practically zero installed solar capacity before 2008, in spite of heavy subsidies. This is due to the simple reality that 90% of the lifetime cost of a solar installation is capital cost. If interest rates are zero, suddenly the capital cost issue goes away.

https://www.treehugger.com/renewable-en … world.html

What will happen when rates eventually go back up? Eventually they must to avoid a currency crisis. Debt to GDP ratio has been soaring across the world since 2008. China is especially worrisome.

https://www.gold-eagle.com/article/prep … e-collapse

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#68 2020-01-29 08:04:24

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,305

Re: New Solar Power Technology

Rising interest rates can slow down expansion. Recessions can slow down development. But remember: capital-intensive electricity grids expanded hugely during the worst depression we've ever seen, in the 1930s. The internet expanded hugely when interest rates were very high, in the 80s and 90s.

If interest rates go up, we'll likely see an increase in profitability at the same time. Also, electricity grid owners and suppliers will likely begin to build wind and solar themselves if they think they can produce cheaper electricity. They don't have to borrow - they can charge the consumer up front.

Bankruptcies are not really very relevant to this discussion. Hundreds of rail firms went bust as railways expanded across the world. Hundreds of car companies have gone bust over the last 100 years, but worldwide, automobile manufacture continues to expand.

Solar and wind energy are similar to railways. If the rail company goes bust, you still have the railway, but now it is available for purchase at a low price without debt. That's how capitalism works! Some gambles pay off and some, or maybe most, don't. SImilarly with solar and wind, even if the power company goes bust, the wind turbines and the solar panels are still there and now available to be bought at a cheap price.

What bankruptcies should tell you is that the solar sector is dominated by zombie companies. That is to say, companies with very low or zero operating profit, that cover losses by borrowing at very low rates, knowing that debt will be eroded by inflation.

https://seekingalpha.com/article/389329 … or-returns

https://www.forbes.com/sites/mayrarodri … cc2d4c3944

Present zero rates allow companies to ignore operating profit and build market share, trying to build up economy of scale, whilst taking on huge amounts of debt that they can never repay. So long as rates remain very low, they don't need to. Modules and other supporting elements are sold beneath their real manufacturing cost. The US shale sector uses exactly the same kind of Ponzi economics.

The utility buying the systems can also borrow at close to zero rates. So capital cost does not weigh very heavily on the cost of power. The end result is an energy source with generally crappy EROI, providing some very cheap electricity at the bus bar. If a utility can lock in the low interest rate loan, this isn't such a bad deal for its customers.

The question is what will happen to the industry and utilities when interest rates (and bond rates) rise again and economic gravity reasserts itself?

None of this would be happening if we were living in normal economic times of course. When they lowered rates to zero after the Great Crash of 2008, central banks knew that they were living on borrowed time. The problem is that this has become the new normal and we would experience huge economic contraction without it.

Last edited by Calliban (2020-01-29 08:07:27)

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#69 2020-01-29 09:53:13

- Calliban

- Member

- From: Northern England, UK

- Registered: 2019-08-18

- Posts: 4,305

Re: New Solar Power Technology

Even at zero effective interest rates, growth in new investment in renewable energy stalled back in 2011 and has remained flat since then.

https://solarindustrymag.com/wp-content … 24x771.jpg

Total capacity additions started tapering off in 2015 and are now at a steady 170GW per year.

https://bioenergyinternational.com/heat … r-capacity

At this rate, it will take 200 years to replace the energy we receive from fossil fuels. Long before then of course, new wind and solar plants would simply be replacing those that had worn out. At present rates of capacity addition, that would happen when renewable energy provided about 10% as much energy as fossil fuels do now. Part of the problem is that with the growth in capacity, subsidies have become unaffordable. And growth appears to have stalled as they are increasingly withdrawn.

This is a huge problem for two reasons:

1. Interest rates are already effectively zero. The economic conditions favouring renewable energy will never be better than they are now. And yet the industry is full of zombie companies with a high bankruptcy rate. What would happen if interest rates went back up to 'normal' levels?

2. Because of their poor baseline EROI, building up renewable energy capacity will take a lot of energy, most of which comes from fossil fuels. But as conventional oil and gas deplete, the EROI of fossil fuels is falling fast. Analysis by Tim Morgan of Surplus Energy Economics, suggests that the Energy Cost of Energy from fossil fuels is already above 10% and very little will be economically viable by the middle of this century.

These inconvenient truths suggest that renewable energy will not be capable of substituting fossil fuels at anything like present rates of energy use. A world running on renewable energy would be a very different place. It would be a world of much more expensive energy and much lower incomes. It is questionable whether we could feed the present world population under those conditions.

The question then is: How long will it take the world to wake up to the reality of our energy problems? Will that happen soon enough to replace declining fossil fuel energy production with a High EROI nuclear alternative, before famine becomes a serious problem?

Last edited by Calliban (2020-01-29 10:08:36)

"Plan and prepare for every possibility, and you will never act. It is nobler to have courage as we stumble into half the things we fear than to analyse every possible obstacle and begin nothing. Great things are achieved by embracing great dangers."

Offline

Like button can go here

#70 2020-01-29 18:09:59

- louis

- Member

- From: UK

- Registered: 2008-03-24

- Posts: 7,208

Re: New Solar Power Technology

There's a natural cap on renewable energy investment. No one using a fossil fuel system is going to voluntary close down that system before it reaches the end of its life. Whether we've reached the cap (a reducing cap over time) I don't know.

I wouldn't be surprised if it takes 60 years to completely eliminate fossil fuel energy systems.

You shouldn't confuse investment with capacity. Even if investment is stable capacity could be increasing as technological advances give more "bangs for your bucks".

We shouldn't forget that railways and freeways enjoyed huge benefit from subsidies both direct and indirect (e.g. legislation forcing people to sell their homes and land at knock-down prices).

You have yet to explain how the internet, IT companies and IT systems expanded so hugely in the 1980s when (real) interest rates were so high?

High interest rates are not the death knell of innovation. Quite the reverse.

The most important thing is whether an economy is receptive in all sorts of ways to technological innovation.

You need to give up on this Lacalle guy! lol Grandson of a Francoist and son of a Marxist - no good can come of him!! ![]()

Even at zero effective interest rates, growth in new investment in renewable energy stalled back in 2011 and has remained flat since then.

https://solarindustrymag.com/wp-content … 24x771.jpgTotal capacity additions started tapering off in 2015 and are now at a steady 170GW per year.

https://bioenergyinternational.com/heat … r-capacityAt this rate, it will take 200 years to replace the energy we receive from fossil fuels. Long before then of course, new wind and solar plants would simply be replacing those that had worn out. At present rates of capacity addition, that would happen when renewable energy provided about 10% as much energy as fossil fuels do now. Part of the problem is that with the growth in capacity, subsidies have become unaffordable. And growth appears to have stalled as they are increasingly withdrawn.

This is a huge problem for two reasons:

1. Interest rates are already effectively zero. The economic conditions favouring renewable energy will never be better than they are now. And yet the industry is full of zombie companies with a high bankruptcy rate. What would happen if interest rates went back up to 'normal' levels?

2. Because of their poor baseline EROI, building up renewable energy capacity will take a lot of energy, most of which comes from fossil fuels. But as conventional oil and gas deplete, the EROI of fossil fuels is falling fast. Analysis by Tim Morgan of Surplus Energy Economics, suggests that the Energy Cost of Energy from fossil fuels is already above 10% and very little will be economically viable by the middle of this century.

These inconvenient truths suggest that renewable energy will not be capable of substituting fossil fuels at anything like present rates of energy use. A world running on renewable energy would be a very different place. It would be a world of much more expensive energy and much lower incomes. It is questionable whether we could feed the present world population under those conditions.

The question then is: How long will it take the world to wake up to the reality of our energy problems? Will that happen soon enough to replace declining fossil fuel energy production with a High EROI nuclear alternative, before famine becomes a serious problem?

Let's Go to Mars...Google on: Fast Track to Mars blogspot.com

Offline

Like button can go here

#71 2020-01-29 21:10:53

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,569

Re: New Solar Power Technology

What I see for solar is panel cost seems to be rising pricing anyone that wants them for residential to business use as to not be able to afford them without the subsidies when you can be taxed on the far market price of the energy as income and taxed on just having them as property.

https://batteryuniversity.com/learn/art … h_voltages

One of the issues for Battery Energy Storage System (BESS) is the battery rules for cell fully charged versus a fully discharged cell to contend with and each battery formular of materials have different voltages not just ampere hours for these. It can even change depending on how its made in the same form factor for the ampere hours that the cell can hold.

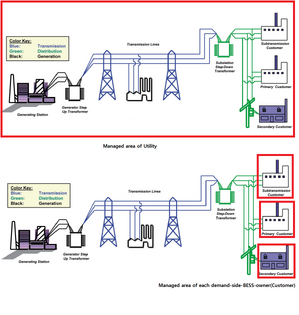

https://powersystem.fandom.com/wiki/Opt … age_System

Typical system wiring of how these are used

https://www.solarchoice.net.au/blog/kW- … y-capacity

https://www.sandia.gov/ess-ssl/docs/pr_ … Hughes.pdf

A 400 kWh Advanced Battery Energy Storage System (ABESS) manufacture a Zinc/Bromine in what looks like a flow battery design.

Outage count and battery types

http://gvea.com/energy/bess

Offline

Like button can go here

#72 2020-01-31 23:04:03

- SpaceNut

- Administrator

- From: New Hampshire

- Registered: 2004-07-22

- Posts: 30,569

Re: New Solar Power Technology

Learning how plants efficiently obsorb the suns energy is now where science is looking to see how they might improve the solar panels or cells that make them up.

New study on a recently discovered chlorophyll molecule could be key to better solar cells

cyanobacteria, and algae, are capable of directly converting this light energy into chemical energy

"About half of the solar energy that falls on the earth is visible light, and the other half is infrared light. Our research puts forth a mechanism that can use light on the lower energy spectrum, which has never been seen before. Our findings show how to improve the efficiency of energy transfer in photosynthesis and, by extension, also provide important insights into artificial photosynthesis."

Offline

Like button can go here

#73 2020-02-07 20:18:44

- tahanson43206

- Moderator

- Registered: 2018-04-27

- Posts: 24,098

Re: New Solar Power Technology

For Louis re topic ...

You have a number of topic relating to solar power ... the article at the link below is not so much about a new technology, as it is about the coming together of points you have made in a number of posts ....

A large solar panel installation is planned for Australia, with the purpose of contributing to the power needs of a natural gas liquefaction facility.

https://www.yahoo.com/finance/news/shel … 27030.html

Shell to Build First Big Solar Plant in Move to Power Production

James Thornhill

BloombergShell, which has set itself a goal to become the world’s top electricity producer by 2030, expects to complete the plant in Queensland, Australia, early next year. The facility will indirectly supply the company’s QGC liquefied natural gas export facility, reducing that project’s carbon footprint.

“Solar is one of the building blocks of Shell’s power strategy,” said Greg Joiner, Vice-President for Shell Energy in Australia. “We are increasingly incorporating renewable energy into customer offers, as we have done here for QGC.”

I note the qualifier "indirectly" in the quote above. I'm assuming the solar power will feed into a grid at one location, and the liquefaction facility will pull power from the same grid somewhere else, with the grid operator doing the book keeping.

(th)

Last edited by tahanson43206 (2020-02-07 20:21:02)

Offline

Like button can go here

#74 2020-02-08 19:21:17

- louis

- Member

- From: UK

- Registered: 2008-03-24

- Posts: 7,208

Re: New Solar Power Technology

Presumably so, but it might be the case, that the facility can use the electricity when solar is producing above average amounts, so when it is at its cheapest.

For Louis re topic ...

You have a number of topic relating to solar power ... the article at the link below is not so much about a new technology, as it is about the coming together of points you have made in a number of posts ....

A large solar panel installation is planned for Australia, with the purpose of contributing to the power needs of a natural gas liquefaction facility.

https://www.yahoo.com/finance/news/shel … 27030.html

Shell to Build First Big Solar Plant in Move to Power Production

James Thornhill

BloombergShell, which has set itself a goal to become the world’s top electricity producer by 2030, expects to complete the plant in Queensland, Australia, early next year. The facility will indirectly supply the company’s QGC liquefied natural gas export facility, reducing that project’s carbon footprint.

“Solar is one of the building blocks of Shell’s power strategy,” said Greg Joiner, Vice-President for Shell Energy in Australia. “We are increasingly incorporating renewable energy into customer offers, as we have done here for QGC.”I note the qualifier "indirectly" in the quote above. I'm assuming the solar power will feed into a grid at one location, and the liquefaction facility will pull power from the same grid somewhere else, with the grid operator doing the book keeping.

(th)

Let's Go to Mars...Google on: Fast Track to Mars blogspot.com

Offline

Like button can go here

#75 2020-02-16 18:08:04

- tahanson43206

- Moderator

- Registered: 2018-04-27

- Posts: 24,098

Re: New Solar Power Technology

The topic theme is "new" solar power technology ...

The article at the link below is about improvements in "old" technology.

https://www.yahoo.com/finance/news/brea … 00397.html

The Brown study found that the use of perovskite materials (“a broad class of crystalline materials”) can create a much more resilient and durable next generation of solar cells. Science Daily puts it in layman’s terms: “Though perovskite films tend to crack easily, those cracks are easily healed with some compression or a little bit of heat. That bodes well, the researchers say, for the use of inexpensive perovskites to replace or complement pricy silicon in solar cell technologies.” Padture elaborates: "The efficiency of perovskite solar cells has grown very quickly and now rivals silicon in laboratory cells."

Incorporating perovskites into solar cells is not a revolutionary discovery in and of itself. They’ve been used in the technology since 2009, but they haven’t always been efficient or durable. The importance of the Brown researchers’ discovery is that these brittle solar cells can also be fixed more easily than ever before.

Because perovskite is reported to be present on Mars, it is good to see that the material can be "healed" when it cracks.

(th)

Offline

Like button can go here