New Mars Forums

You are not logged in.

- Topics: Active | Unanswered

Announcement

#26 Re: Meta New Mars » Housekeeping » 2025-11-14 17:52:27

Of course all changes in scale as bricks are small and blocks are just larger ie cinder blocks. so what come next to build something larger?

#27 Re: Science, Technology, and Astronomy » Brick on Mars » 2025-11-14 15:20:39

sure we can build using a system of bricks or blocks.

For building arch shapes, you can use either tapered/wedge-shaped bricks or standard rectangular bricks. Tapered bricks are specially designed for arches to create uniform mortar joints, while rectangular bricks can be used for a flatter arch, sometimes called a soldier arch. Special shapes like double-tapered arch bricks or bricks with a specific angle (like a 70° skew-back angle for flat arches) are also available for curved elements.

Types of bricks for arches

Tapered or wedge-shaped bricks:

These are the most common for rounded arches. They are tapered to ensure that the mortar joints are of a consistent thickness throughout the depth of the arch.

Double-tapered arch bricks: These are double-tapered in either width or length to form curved features, like an archway or a circular window.

Rectangular bricks (cut or full-size):

Soldier arches:

These are created by placing standard rectangular bricks on their ends, with their long sides set vertically. This type is more of a flat arch and requires support like a lintel or frame.

Flat arches:

Flat arches are often constructed with standard rectangular bricks that are the same size and have parallel sides, sometimes with a specific skew-back angle.

Specialty and pre-fabricated arches: Modern technology allows for pre-fabricated brick arches built to specific dimensions and designs, which can be a cost-effective solution.

Key considerations for size and shape

Uniformity:

The key for most arches is achieving uniform mortar joints for structural integrity. Tapered bricks achieve this, while flat arches often use standard rectangular pieces with a consistent, small mortar joint.

Angle:

For flat arches, a 70° skew-back angle is common for the voussoirs (the wedge-shaped stones used to build the arch).

Customization:

If your design requires specific angles, curves, or a certain rise, you may need to specify custom dimensions or use pre-fabricated arches

#28 Re: Life support systems » Dust Mitigation Mars Solidified Regolith or Artificial Lichen » 2025-11-14 14:57:29

ArtificialLichen is to change the soil to somewhat more like earths in that decade plant life creates topsoil which if enough water is present makes the soil not blw and become part of the atmospheric abrasve to breathing and static electricity cling.

Mars at one time did have it but with the loss of water and a much warmer planet the process stopped making clay and good topsoil.

#29 Re: Meta New Mars » Housekeeping » 2025-11-11 17:02:03

Sounds like its in good hands.

My last couple of days have been up on the roof in the rain and wind covering the roof with a tarp since the rain was coming down through it.

#30 Re: Human missions » Shenzhou 9 launch LIVE » 2025-11-10 18:21:22

SpaceX and Musk called on to rescue China's Shenzhou-20 crew

Technical and political obstacles block collaboration following suspected space debris strike on craft

SpaceX and Elon Musk are once again being called upon to rescue spacefarers — this time, the Chinese crew of Shenzhou-20, delayed on China's Tiangong space station after suspected space debris damage.…The three-person crew including Chen Dong, Chen Zhongrui, and Wang Jie, arrived in April and were supposed to return in November after a handover with the Shenzhou-21 crew. That return has been postponed while engineers assess potential damage from what reports describe as "a tiny piece of space debris."

SpaceX fans quickly began calling for a rescue mission. Earlier this year, US President Donald Trump instructed Musk to "go get" the crew of Boeing's Starliner spacecraft, whom Trump claimed were "virtually abandoned" by the Biden administration. Rather than correct the misunderstanding, Musk pledged SpaceX would bring back the "stranded" astronauts.

A Chinese rescue mission is improbable as the Shenzhou-20 crew faces no immediate danger and China could simply launch Shenzhou-22 earlier as a replacement, if needed.

The situation is not without precedent. In 2022, a Soyuz spacecraft attached to the International Space Station (ISS) was struck by a micrometeor, and an uncrewed replacement vehicle was launched to ferry the 'nauts back to Earth. At the time, NASA explored the possibility of bringing the Soyuz crew back on a SpaceX spacecraft, but the option was deemed unnecessary.

Is a rescue mission for the Shenzhou-20 team using a Crew Dragon even feasible? The next Crew Dragon launch is currently scheduled for around March or April 2026 - the NASA Crew-12 mission to the ISS. The following one, set for June 2026, is to service the Vast-1 space station. One of those missions would need to be rescheduled to free up a spacecraft, as SpaceX does not have a fleet on standby in case of an emergency.

Then there is docking. Despite claims China copied the docking system used by SpaceX and the ISS - published international standards are readily available - China's orbital implementation likely won't mate with Crew Dragon hardware.

So a spacewalk then? SpaceX demonstrated EVA capability in 2024 when Jared Isaacman exited through Crew Dragon's nose. However the Chinese crew's launch suits aren't spacewalk-rated, and while Tiangong has Feitian EVA suits, they're incompatible with SpaceX systems — and might not even fit through Crew Dragon's hatch.

Then there is the whole political heat such a mission would generate. It is difficult to imagine a US rocket company and China cooperating in this way.

If Shenzhou-20 can't fly, it is more likely Shenzhou-22 will be launched as a replacement. The Tiangong space station was not designed to host a crew of more than three for extended stays.

The incident, which comes less than a year after SpaceX's "rescue" of the Boeing crew, underscores two increasingly critical issues: spaceflight systems need to be standardized to enable cross-nation rescues, and space debris is becoming impossible to ignore.

The irony wouldn't be lost on Reg readers if the debris that - possibly - struck Shenzhou-20 originated from a Chinese anti-satellite weapon (ASAT) test years ago.

#31 Re: Meta New Mars » Housekeeping » 2025-11-10 18:15:43

Its been raining now for a couple of days and had to go up on the roof to pull a tarp over it to stop the rain from coming in.

I was scared the whole time I was on it to the point of being ill to the stomach but its on until wind tears it off.

#32 Re: Science, Technology, and Astronomy » Pedestrian Martian Cities » 2025-11-09 18:14:07

US cities are also very far appart requiring speed to travel the 30 minute to 1 hour of dsistance.

Walking speed of 2.5 mph is sort of typical for how unfit most are.

Myself I live 4 to 5 miles to the near by city and towns so a rould trip take half a day.

#33 Re: Science, Technology, and Astronomy » Rocket Engine Design » 2025-11-07 17:42:23

SpaceX's Raptor Engine Vs. Blue Origin's BE-4 - What's The Difference In These Rocket Engines

The Raptor engine is designed to create a thrust of 507,000 pound-force (lbf).

The SpaceX Raptor engine operates on a sub-cooled mixture of liquid methane (CH4) and liquid oxygen, which has a high boiling point and is neither toxic nor corrosive, making it safer and more straightforward to store than conventional fuels

The Raptor engine has possibly the highest chamber pressure of any rocket engine. In 2019, the engines achieved a chamber pressure of 257 bar, equivalent to over 3,700 pounds-force per square inch (psi). In 2023, that record was obliterated by the Raptor V3, which achieved 350 bar (over 5,000 psi).

Raptor engine's specific impulse was 350 or 380 seconds, depending on the nozzle,Meanwhile, the Blue Origin BE-4 is produces 550,000 lbf.

The Blue Origin BE-4, in contrast, uses a liquified natural gas (LNG) and liquid oxygen combination.While a single BE-4 engine outperforms an individual Raptor engine, the SpaceX Super Heavy first-stage booster has more overall thrust because it uses 33 Raptor engines to provide an explosive 16.7 million pounds of thrust.

Comparatively, the BE-4 lags behind by an ever-widening margin. In 2016, the BE-4 achieved a pressure of 134 bar (1,950 psi).

In contrast, the New Glenn's comparatively scant set of seven BE-4 engines produces 3.85 million pounds of thrust for its booster.

whereas Jeff Bezos stated that the BE-4's specific impulse was around 340 seconds.The Raptor engines utilize a full-flow staged combustion, and the BE-4 an oxygen-rich staged combustion. Both are forms of "staged combustion," where the propellant travels through several chambers and combusts in stages. This method is mechanically complex, converting space fuel into astonishing levels of thrust, along with highly pressurized and searing exhaust. Oxygen-rich combustion cycles burn a small amount of fuel along with a large amount of oxidizer in the preburner. In contrast, a full-flow engine has multiple preburners: one for the oxygen-rich combustion cycle and another for burning a small amount of oxidizer with a lot of fuel. While more complex than oxygen-rich staged combustion engines, full-flow staged engines operate at cooler temperatures and lower pressures, resulting in a longer lifespan.

#34 Re: Meta New Mars » Housekeeping » 2025-11-07 17:23:17

The shutdown is doing a number on those that are still working but not getting paid. Sure once a budget gets passed all will be corrected but it hurts now for many that are living paycheck to paycheck.

160 hrs worked but zero pay does where on many, sure far I am ok but that last until I need more than the money set aside for house construction.

#35 Re: Not So Free Chat » Zaanse Schaanes Windmill Museum, Holland. » 2025-11-06 17:19:27

The only place that even comes close in my state is in Portsmouth down near strawberry bank.

#36 Re: Science, Technology, and Astronomy » Pedestrian Martian Cities » 2025-11-06 15:39:24

The idea of walking in space suits are not the open feeling of being under a protective dome.

Or walking in that of a under ground world in subway tunnels.

#37 Re: Interplanetary transportation » Landing Platform off Earth Moon Mars Other » 2025-11-04 17:54:20

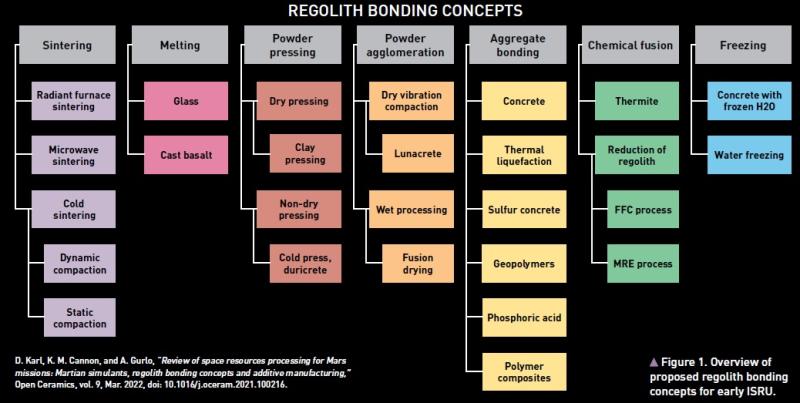

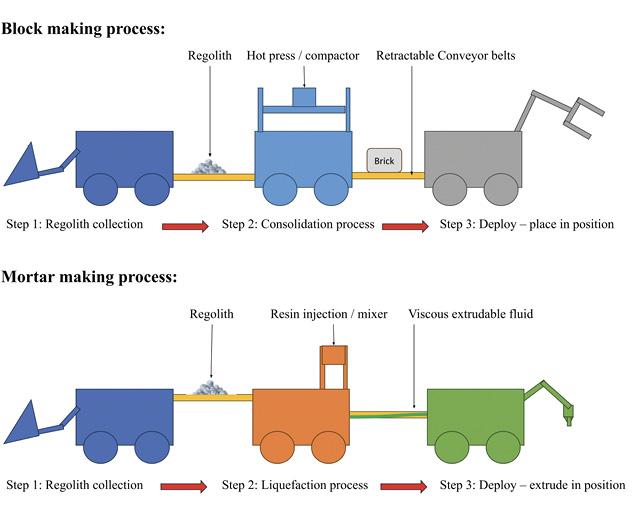

We talks about concrete and sintering regolith.

One topic carried a robotic unit that created a paving from the lunar use.

Paving the road for large area sintering of regolith

Laser melting manufacturing of large elements of lunar regolith simulant for paving on the Moon

Lunar construction with regolith and robots

#38 Re: Not So Free Chat » Zaanse Schaanes Windmill Museum, Holland. » 2025-11-04 17:39:42

I showed the images of Holland to my youngest son and the first thing that he noticed was the people walked and the bicycles not the large number of cars that we use in the US.

Next was the outdoors eating which we only have a few places that are still doing so in the summers since covid hit.

#39 Re: Meta New Mars » Housekeeping » 2025-10-31 16:49:50

The lawyer's office sent the engagement email with signature letter for the retainer today. It is pricy but in the end if it get the house done that's all that matters.

Government shutdown sucks as I am working everyday but not getting any pay until the budgets get signed.

#40 Re: Meta New Mars » Housekeeping » 2025-10-30 14:33:05

rebuilding the house

Its been at a stand still due to contractor being a ghost and town code protecting rather than going after him.

Got Lawyer filing papers to terminate unperformed work getting refund of up front deposits and then filing papers with States AG for criminal and civil suits.

#41 Re: Human missions » Starship Lunar Lander and landing legs » 2025-10-29 15:44:07

here is one of many topics.

Much changes when a lunar version does not need to come back to earth.

Six-legged freaks - can the Starship land on those legs?

The legs were also part of our discusions on Landing legs for the BFR

some feel that a starship for the moon is over kill SpaceX should withdraw Starship as an Artemis lunar lander.

Of course the Mars version is also a puzzle with the full sized starship for colonizing feeling that support for the ship requires Starship concrete Mars landing pad

Of course right sizing the ship is another alternative. Forty 40 Ton Mars Delivery Mechanism

#42 Re: Not So Free Chat » Erroding birthright citizenship » 2025-10-28 17:20:48

The issues facing americans after nearly a century of not removing has finally caught up to ordinary Americans.

US citizen, 67, ‘has ribs broken’ by Border Patrol agents after being dragged out of car while driving home into street they’d blocked off

seems that your papers do not matter just color and being in the wrong place...

#43 Re: Not So Free Chat » Politics » 2025-10-28 17:04:23

Several major US businesses failed in the 1990s due to factors like increased competition, failure to adapt to market changes, and poor management, including the iconic department store chain Woolworth's and PC manufacturer Compaq. Other notable failures include the defunct toy retailer KB Toys and Frito-Lay's fat-free "WOW! Chips" line, which failed due to digestive side effects.

Retail and department stores

Woolworth's: Faced increasing competition from stores like Walmart and Target, leading to the closure of its U.S. five-and-dime stores in 1997 before the parent company rebranded as Foot Locker.

KB Toys: Went bankrupt and vanished due to competition from big-box retailers and the rise of e-commerce.

Gantos: A women's clothing chain that filed for bankruptcy and liquidated its stores by the end of the decade.

Technology

Compaq: Once the largest PC supplier, it faltered due to product quality issues and an inability to keep up with low-cost competitors like Dell. The company was eventually acquired by Hewlett-Packard in 2002.

Etoys.com: An early online toy store that collapsed when the dot-com bubble burst.

Tiger Electronics: Its "Arzone" portable gaming device failed due to its blurry screen and clunky gameplay.

Food and drink

Frito-Lay WOW! Chips: The "fat-free" chips, made with Olestra, caused severe digestive issues for many consumers, leading to the product's failure.

Zima: This clear, carbonated malt beverage was marketed as a sophisticated alternative to beer but failed to gain traction with consumers.

Other

Blockbuster Video: While its collapse occurred in the early 2000s, its failure to adapt to streaming and buy Netflix was rooted in the 1990s, making it a notable example of a 90s-era business failing to look ahead

Several major US businesses failed in the 2000s due to issues like accounting scandals, failure to adapt to new technology, and a lack of innovation. Prominent examples include Enron and WorldCom (accounting fraud), Blockbuster and Polaroid (failure to adapt to digital streaming and photography, respectively), and the dot-com bubble failures like Pets.com and Webvan.

Failed due to accounting scandals

Enron: Once a leading energy company, its collapse in 2001 was one of the largest accounting scandals in history, says the FBI.

WorldCom: The telecommunications giant also collapsed due to a massive accounting scandal in 2002.

During the 2010s, many long-standing US businesses failed due to a combination of new technology, shifting consumer behavior, and heavy debt. The "retail apocalypse" was a primary driver, as e-commerce giants like Amazon displaced traditional brick-and-mortar stores.

Prominent failures in the 2010s

Retail

Toys "R" Us: Filed for bankruptcy in 2017 and closed all US stores in 2018. It struggled to compete with Amazon and Walmart and was burdened with massive debt from a leveraged buyout in 2005. The brand later attempted a comeback with a smaller footprint.

Sears Holdings Corp: The parent company of Sears and Kmart filed for bankruptcy in 2018. The iconic department store chain suffered a slow decline from intense competition from big-box and online retailers.

Borders: The bookstore giant filed for bankruptcy in 2011 and liquidated its remaining stores. It failed to adapt to the shift to online bookselling and e-readers, leaving its customers and website to its competitor, Barnes & Noble.

Payless ShoeSource: The discount shoe retailer filed for bankruptcy in 2017 and 2019, closing all 4,400 stores across 30 countries. It was unable to compete with online retailers and other discount stores.

RadioShack: Known for electronics and batteries, RadioShack filed for bankruptcy twice during the decade (2015 and 2017). It was a victim of changing tech trends and fierce online competition.

The Bon-Ton: The regional department store chain, which operated stores like Carson's and Younkers, filed for bankruptcy in 2018 and liquidated after not turning a profit since 2010.

American Apparel: The clothing retailer filed for bankruptcy in 2015 and 2016, weighed down by debt and sales declines. The brand now operates as an online-only business.

Entertainment

Blockbuster: The video rental chain, which once had over 9,000 stores, filed for bankruptcy in 2010. The company failed to adapt to the new competitive landscape of Netflix, Redbox kiosks, and streaming services.

Movie Gallery: This competitor to Blockbuster and parent of Hollywood Video filed for bankruptcy in 2010, resulting in the closure of all its 2,400 US locations.

Technology and others

Theranos: The blood-testing startup, founded by Elizabeth Holmes, was one of the most high-profile tech failures of the decade. The company, which was valued at $9 billion at its peak, dissolved in 2018 after it was exposed as fraudulent.

Eastman Kodak Co.: The film photography giant filed for Chapter 11 bankruptcy in 2012. The company, which invented the first digital camera, failed to capitalize on the digital revolution and was a "corporate America poster child" for a company that resisted transition.

BlackBerry: Once a leader in mobile devices, BlackBerry's popularity waned in the 2010s due to its slow adoption of touchscreen technology and app ecosystems. The company exited the smartphone business in 2016 to focus on cybersecurity.

Hummer: The SUV brand was discontinued in 2010 after parent company General Motors filed for bankruptcy the year before. The brand fell out of favor following the 2008 oil price spike and a shift toward fuel-efficient vehicles

Many US businesses failed in the 2020s, especially during the initial COVID-19 pandemic, including retailers like J.C. Penney, Neiman Marcus, J. Crew, and Brooks Brothers. Other significant failures included Bed Bath & Beyond, which went bankrupt in 2023, and Pier 1 Imports, Modell's Sporting Goods, and Art Van Furniture, which all filed for bankruptcy in 2020. Financial institutions like First Republic Bancorp and SVB Financial Group also failed.

Major retail bankruptcies in the 2020s

Bed Bath & Beyond: Filed for bankruptcy in 2023.

J.C. Penney: Filed for bankruptcy in 2020.

Neiman Marcus: Filed for bankruptcy in 2020.

J. Crew: Filed for bankruptcy in 2020.

Pier 1 Imports: Closed all stores after filing for bankruptcy in 2020.

Modell's Sporting Goods: Filed for bankruptcy in 2020.

Art Van Furniture: Filed for bankruptcy in 2020.

Brooks Brothers: Filed for bankruptcy in 2020.

Tuesday Morning: Filed for bankruptcy in 2020.

Sur La Table: Closed many stores during its 2020 bankruptcy process.

Lord & Taylor: Filed for bankruptcy in 2020.

Financial sector failures

First Republic Bancorp: Failed during the banking turmoil in 2023.

SVB Financial Group: Failed during the banking turmoil in 2023

#44 Re: Not So Free Chat » Politics » 2025-10-28 17:01:36

There is another part of the picture and that is the businesses that failed.

Notable American businesses that failed in the 1960s include the Studebaker Corporation, the Lehigh and New England Railroad, and early ventures by American Motors (AMC). These failures highlight how quickly a company's fortunes could change due to new competition, changing consumer tastes, and poor management.

Studebaker Corporation

For over a century, Studebaker was a household name that produced wagons, cars, and trucks. But intense competition and insufficient resources eventually led to its downfall.

The rise of compact cars: In the late 1950s, Studebaker's compact Lark model had a sales bump. But its advantage disappeared in the 1960s when the "Big Three" (General Motors, Ford, and Chrysler) introduced their own compacts.

Lack of capital: Studebaker lacked the funds to invest in the frequent redesigns needed to compete with larger automakers. This led to cost-cutting measures, including closing its main factory in South Bend, Indiana, in 1963.

High-risk gamble: In a final effort to boost sales, Studebaker released the innovative Avanti sports coupe in 1963. However, production problems and a costly labor strike doomed the project. The company ceased all automotive production in 1966.

American Motors Corporation (AMC)

While AMC survived the 1960s, its missteps during this decade paved the way for its later collapse. After early success with compact, economical cars, management decided to chase trends instead of building on its niche.

Failed strategy: In the mid-1960s, AMC's strategy was to compete directly with the Big Three by creating trendy, larger, and more powerful vehicles.

Disastrous model: A prime example of this failure was the 1965 Marlin, a large and ungainly "pony car" meant to compete with the wildly successful Ford Mustang.

Lost momentum: By abandoning its unique focus on smaller, efficient cars, AMC lost its edge. When the larger automakers began making more economical vehicles in the 1970s, AMC could not keep up due to its limited resources.

Lehigh and New England Railroad (LNE)

Many American railroad companies struggled in the 1960s, a trend that accelerated in the following decade. The LNE was a major early casualty.

Dependence on coal: The LNE's fortunes were tied to the anthracite coal industry in Pennsylvania. As the demand for coal rapidly declined, the railroad's future became untenable.

Preemptive shutdown: Even while still turning a profit, the LNE's board saw the writing on the wall and decided to cease all railroad operations in October 1961, liquidating while they still had assets.

Pan American World Airways (Pan Am)

Though the company did not go bankrupt until 1991, the roots of its decline can be found in the 1960s. After being the world leader in international travel, the airline began to face significant challenges.

Overextension: Under CEO Juan Trippe, Pan Am became overextended with a sprawling route system that was costly to maintain.

Large investment: The company made a massive investment in a fleet of Boeing 747 jumbo jets in the mid-1960s. This proved to be a risky move, as an economic downturn and rising fuel prices in the following decade made the jets much more costly to operate.

Growing competition: The 1960s saw intense competition from both foreign and domestic airlines. Without a strong domestic route network, Pan Am was left vulnerable

Several notable US businesses failed in the 1970s due to various factors like changing consumer preferences, technological advancements, and economic downturns, including department store chains like Bonwit Teller and W.T. Grant, and the Franklin National Bank. The decline of large manufacturing employers also had a devastating impact on regional economies, as seen with the "Boeing Bust" in Seattle.

Retail

W.T. Grant: A large department store chain that went bankrupt in 1976.

Bonwit Teller: An upscale department store that eventually lost its prestige and was demolished.

S. S. Kresge: In 1977, this company sold its original stores and renamed the Kmart stores to Kmart.

E. J. Korvette: Another large retail chain that is no longer in business.

Bonwit Teller: An upscale department store that lost its prestige and was eventually demolished.

Banking

Franklin National Bank: A large bank that failed in 1974 due to issues in its foreign exchange portfolio and was eventually acquired by European-American Bank & Trust Company.

Technology

Sony Betamax: While a 1975 invention, the Betamax format ultimately lost the "format war" to VHS, largely because rival companies adopted the competing VHS format and Sony kept its format proprietary.

Manufacturing

Boeing: The cancellation of the SST program in 1971 led to massive layoffs and a significant economic downtown in the Seattle area, a period known as the "Boeing Bust".

Other sectors

Pan American World Airways (Pan Am): The airline, once a symbol of American innovation in air travel, failed to withstand economic pressures and turbulent times, collapsing in 1991

Several major US businesses failed in the 1980s due to various factors like market shifts, failed product launches, and the Savings and Loan crisis. Examples include KCO, a video game and toy company that went bankrupt after an overextension into computers, and the failure of RJ Reynolds' "Premier" smokeless cigarettes. The steel industry also began its major decline in the late 1980s, with Bethlehem Steel starting its decline during that period, and the Savings and Loan crisis led to the failure of many financial institutions.

KCO: The company, known for Cabbage Patch Kids, went bankrupt in the mid-1980s after launching the unsuccessful Atom computer and failing to compete with Nintendo's NES.

RJ Reynolds: Introduced a failed smokeless cigarette called "Premier" in 1989, which was pulled after only five months due to poor consumer reception and a high cost of over $300 million.

Bethlehem Steel: Began its significant decline in the late 1980s as the US transitioned away from industrial manufacturing, although it didn't fully close until 1998.

Savings and Loan institutions: The Savings and Loan crisis of the 1980s and early 1990s resulted in the failure of many banks, with 1,617 FDIC-insured commercial and savings banks closing or receiving financial assistance during that period

#45 Re: Meta New Mars » Housekeeping » 2025-10-28 16:48:58

The attacks are most likely due to the azure site. Then the software which we are making use of the phpbb3.

The newmars site allows me to see all of the ip's that come in for a user and also ip stats of those that tickle the forum.

#46 Re: Not So Free Chat » Huricane season 2025 » 2025-10-27 17:35:41

There has been quite a few but none coming close to hitting the US.

Hurricane Melissa live updates: Jamaica braces for Category 5 storm with 'catastrophic and life-threatening' winds and flooding

with 175 mph winds

#47 Re: Not So Free Chat » Politics » 2025-10-27 17:10:08

Since 2020, the U.S. has experienced a historic surge in new business applications, with record-breaking numbers filed in 2021 and 2023. This sustained period of high business creation is a significant shift from previous decades and was primarily driven by pandemic-induced disruptions and a changing labor market.

New business applications per year

Data based on information from the U.S. Census Bureau.

Year Business Applications Change vs. Prior Year Notes

2020 4.4 million +24.5% A sharp increase during the first year of the pandemic, with applications soaring 51% higher than the 2010–2019 average.

2021 5.4 million +23.5% A new annual record for business applications, largely influenced by pandemic-era economic and labor shifts.

2022 5.0 million -6.0% A slight dip from the 2021 peak, but applications remained well above pre-pandemic levels.

2023 5.5 million +8.1% The highest number of new business applications ever recorded in a calendar year.

2024 5.21 million -4.77% A moderation from the 2023 peak, though still a period of robust entrepreneurship.

2025 Projected millions +3.15% (partial data) As of August 2025, over 3.5 million applications had been submitted, indicating that a high level of business formation is continuing.

Key drivers and characteristics of the boom

Pandemic as a catalyst: The COVID-19 pandemic fueled entrepreneurship by necessity, as many people who lost their jobs started their own businesses.

Shift in work: The rise of remote work and the gig economy gave people more flexibility to pursue entrepreneurial ventures.

Growth in specific sectors: Initial growth was most significant in sectors that supported the "home-based economy," such as e-commerce (retail trade), transportation, and personal services.

Increased diversity: New entrepreneurs in the 2020s have been more diverse than in the past, with women, Black, Asian, and Hispanic shares of self-employed Americans near all-time highs.

Mix of high and low-propensity businesses: The surge included both "high-propensity" businesses, which are likely to hire employees, and a large number of sole proprietorships and ventures less likely to have a payroll.

Long-term outlook

This era of heightened business creation marks a new, higher "plateau" for entrepreneurship in the United States. The surge has proven to be more than a temporary blip, representing a lasting shift in the country's economic landscape

So the shift of job types is clear.

#48 Re: Not So Free Chat » Politics » 2025-10-27 17:08:27

The 1990s saw the rise of new businesses in both the retail and tech sectors, driven by the advent of the internet and the growth of large-scale retail. Prominent examples include the expansion of big-box stores like Walmart and Target and the founding of online pioneers such as Amazon and eBay. The tech industry also saw the emergence of companies like AOL and Yahoo!.

Tech and e-commerce

Amazon and eBay: Founded in the 1990s, these companies were early pioneers of e-commerce, providing online alternatives to traditional brick-and-mortar stores.

AOL and Yahoo!: The 1990s saw the massive growth of the internet, and companies like AOL, with its dial-up service, and Yahoo!, a search engine and web portal, became household names.

Palm: This company was a leader in the early personal digital assistant (PDA) market before the rise of modern smartphones.

Retail

Big-box retailers: Companies like Walmart and Target expanded significantly in the 1990s, offering a wide variety of products at low prices and changing the retail landscape.

Blockbuster: The video rental giant was at its peak in the 1990s before the advent of streaming services.

Einstein Bros. Bagels: This coffee and bagel chain was established in 1995.

Other sectors

Alamo Drafthouse Cinema: A unique cinema-and-restaurant concept, the Alamo Drafthouse was founded in 1997.

Align Technology: This company, founded in 1997, is the maker of the Invisalign clear aligners.

Energy Transfer: This company, founded in 1995, is a major player in the midstream energy sector

The 2000s saw a rise in new businesses across various sectors, particularly in technology, with notable examples including Alarm.com, 2U, and 5-hour Energy. The decade also witnessed the founding of companies focused on areas like e-commerce, with Ocado launching in 2000, and the emergence of businesses in fields that would grow to include telemedicine and clean beauty by the end of the decade and into the next.

Technology and internet companies

Alarm.com: A company specializing in the smart home and security sector, founded in 2000.

2U: An online education platform that was established in 2008.

ActiveCampaign: A marketing automation and email marketing software company, founded in 2003.

51 Minds Entertainment: An entertainment production company that began in 2004.

Consumer goods and food

5-hour Energy: The popular energy shot brand was created in 2004.

AG Jeans: A denim and apparel company established in 2000.

4moms: A company that produces innovative children's products, founded in 2005.

Other notable companies

Ocado: Although based in the UK, this e-commerce grocery company launched in 2000 with a tech-focused approach to home delivery.

Acceleron Pharma: A biopharmaceutical company that started in 2003

he 2010s saw the rise of many new US businesses, particularly in technology, such as the mobile app economy giants like Uber, Spotify, and Snapchat. While the decade had a lower overall entrepreneurship rate compared to previous eras, it was marked by a surge in highly influential tech startups that grew rapidly through digital platforms and venture capital. Notable examples include Square, Airbnb, and Pinterest, as well as The Real Real in the luxury resale market.

Examples of new businesses from the 2010s

Technology and Apps:

Uber: Founded in 2009, the ride-sharing service grew exponentially throughout the 2010s to become a global mobility giant.

Square: Launched in 2010, this company revolutionized small business payments by creating a simple credit card reader for mobile devices.

Spotify: After launching in Europe in 2008, it entered the US in 2011, shifting the music industry from ownership to a streaming subscription model.

Snap Inc.: The parent company of the Snapchat app, which launched in 2011, became a major player in the social media landscape.

Pinterest: This visual discovery engine launched in 2010 and became a leading platform for inspiration and e-commerce.

E-commerce and Services:

The Real Real: Founded in 2011, this online luxury resale retailer grew rapidly, eventually opening its first brick-and-mortar store in 2017.

Airbnb: While founded in 2008, the short-term rental platform saw its most significant growth in the 2010s.

Beyond Meat: This plant-based meat company was founded in 2009 but gained significant traction in the 2010s before its major IPO in 2019.

Other industries:

Instant Pot: This multi-cooker became a household name after its 2010 release, supported by a massive social media community.

GoFundMe: The online fundraising platform was founded in 2010, providing a new way for individuals and organizations to raise money.

Entrepreneurship trends in the 2010s

Lower Entrepreneurship Rate: The decade was marked by one of the lowest rates of new business creation in recent US history.

Slow Job Growth: New firms hired fewer workers in 2019 than they did in 1982, despite the larger overall workforce.

Growth of the Mobile App Economy: The mobile app store ecosystem provided a new, low-capital way for many startups to reach a massive scale very quickly

#49 Re: Not So Free Chat » Politics » 2025-10-27 17:06:16

The 1960s saw the rise of new businesses in various sectors, including fast food franchises like Domino's Pizza and the first discount retailers such as Kmart, Walmart, and Target. The decade was also characterized by the growth of large conglomerates, the development of shopping centers, and the establishment of tech and service companies like Medtronic, Dolby Laboratories, and Instinet.

Retail and consumer goods

Discount Retailers: Kmart was the first, opening in 1962, followed by Walmart and Target in the same year, which introduced a new model of bulk purchasing to offer lower prices.

Franchises: The franchise boom was in full swing, with chains like Domino's Pizza, McDonald's, and Holiday Inn expanding rapidly.

Shopping Centers: More than 8,000 shopping centers were built during the decade, changing how and where people shopped.

Technology and services

Tech and Manufacturing: Companies like Medtronic, Teradyne, and Dolby Laboratories were founded.

Financial Services: NationsBank, Duane Reade, and Jackson Hewitt were among the new financial and service businesses.

Logistics and communication: Sea-Land Service pioneered containerized shipping, and Instinet launched an electronic system for institutional investors.

Conglomerates and hospitality

Conglomerates: A wave of business acquisitions led to the formation of large, diversified conglomerates like ITT Corp. and Litton Industries.

Hospitality: New hotels were built to accommodate the growing population, and new restaurant chains emerged, such as the Playboy Club

he 1970s saw the establishment of many new US businesses, particularly in the tech sector with the rise of semiconductors and venture capital firms like Sequoia Capital and Kleiner Perkins. Other notable companies started in this decade include retail giants like Days Inn, Chili's, and Chi-Chi's; technology and software companies such as Atari and Microsoft; and others like Intel and Acadian Ambulance. The business landscape also reflected broader societal changes, with the emergence of niche stores catering to specific subcultures, such as record stores and boutiques.

Technology and computing

Intel: A major player in the semiconductor industry, which saw significant growth in memory products like the Intel 1103 DRAM.

Microsoft: Founded in 1975 by Bill Gates and Paul Allen.

Atari, Inc.: Founded in 1972, it became a major force in the video game industry.

Venture capital firms: The decade saw the founding of Silicon Valley's top venture capital firms, such as Sequoia Capital and Kleiner Perkins Caufield & Byers, both established in 1972.

Retail and services

Days Inn: A hotel chain that began in the 1970s.

Chili's and Chi-Chi's: Two popular restaurant chains that were established during this period.

Apple Computers: Though not a business startup in the 1970s, the company was founded in 1976.

Specialty stores: A rise in niche stores, including record stores and boutiques, reflected the segmentation of the market and counterculture movements.

American Home Shield: A company that was established in 1971.

Other notable businesses

Amdahl Corporation: A computer company established in the 1970s.

Acadian Ambulance: A company that was established in 1971.

DeLorean Motor Company: A car company established in 1975

The 1980s saw the establishment of many new US businesses, spanning various sectors like technology, retail, and direct sales. Notable tech companies founded during this decade include Adobe Inc. and Synnex. Retail and service-based companies like The UPS Store and ShowBiz Pizza Place also emerged. The direct selling industry experienced significant growth, with companies like Herbalife and The Pampered Chef being founded in the 1980s.

Technology and software

Adobe Inc.: A company that would become a giant in the software industry.

Synnex: A technology services company.

Access Software: A video game developer.

Symbolics: A computer company specializing in Lisp machines.

Retail and food service

ShowBiz Pizza Place: A family entertainment center and restaurant chain.

The UPS Store: A retail franchise focused on packing and shipping services.

Amy's Kitchen: A company that prepares and sells frozen organic meals.

Sierra Nevada Brewing Co.: A craft brewery.

Direct sales

Herbalife: A company that sells nutrition, weight management, and skincare products.

The Pampered Chef: A company specializing in kitchen tools.

Nu Skin: A company in the beauty and wellness sector.

Stampin' Up!: A company focused on paper crafting supplies.

Other sectors

Aéropostale: An American lifestyle clothing company.

Airgas: A distributor of industrial gases.

American Graphics Institute: A company providing design and technology training

#50 Re: Not So Free Chat » Politics » 2025-10-27 15:11:44

Since the start of the 2020s, numerous US businesses have either gone bankrupt or significantly downsized, with the COVID-19 pandemic serving as a major catalyst for existing financial troubles. Many of these were retailers and restaurant chains that struggled with lockdowns, reduced foot traffic, and shifts in consumer behavior.

Some of the most prominent businesses that went under or dramatically downsized since 2020 include:

Retailers

Bed Bath & Beyond: The home goods retailer, a "recent COVID-19 failure" according to U.S. News, officially filed for bankruptcy in 2023.

Lord & Taylor: After filing for bankruptcy in 2020, the department store chain closed all of its remaining locations in 2021.

J.C. Penney: The long-standing department store filed for bankruptcy in 2020. It was eventually purchased by mall owners Simon Property Group and Brookfield Asset Management, which led to a smaller footprint.

Neiman Marcus: The luxury department store filed for bankruptcy in 2020 and emerged with a reduced debt load.

Pier 1 Imports: The home goods retailer filed for bankruptcy in 2020 and liquidated all of its stores. Its brand name was later relaunched as an online-only store.

Tailored Brands: The parent company of Men's Wearhouse and JoS. A. Bank, filed for bankruptcy in 2020 due to decreased demand for professional wear. It closed hundreds of stores and emerged with less debt.

GNC: The nutrition and supplement retailer filed for bankruptcy in 2020 and closed a significant number of its stores.

Stein Mart: The discount retail chain filed for Chapter 11 bankruptcy in 2020 and liquidated its stores.

Papyrus: The stationery and card company went out of business in early 2020, closing all of its stores.

Century 21: The off-price retailer filed for bankruptcy in 2020 and shuttered its physical stores.

Brooks Brothers: The menswear retailer, which had struggled as business attire became more casual, filed for bankruptcy in 2020 but was later purchased and saved from total shutdown.

Restaurants and entertainment

Friendly's: The family-friendly restaurant chain filed for Chapter 11 bankruptcy in 2020.

Sizzler: The restaurant chain filed for bankruptcy in 2020, blaming the pandemic for indoor dining closures.

Souplantation / Sweet Tomatoes: The parent company of these buffet restaurants announced the permanent closure of all 97 US locations in 2020.

Chuck E. Cheese: The parent company of the family entertainment chain filed for bankruptcy in 2020.

Cirque du Soleil: The entertainment company filed for bankruptcy in 2020 after the pandemic halted its productions.

Le Pain Quotidien: The cafe and bakery chain filed for bankruptcy in 2020 and sold all of its US locations.

Other sectors

Hertz: The car rental company filed for bankruptcy in 2020 as travel came to a halt during the pandemic.

Remington Arms: The gun manufacturer filed for bankruptcy in 2020.

24 Hour Fitness: The gym chain filed for bankruptcy in 2020 after pandemic-related closures.

Gold's Gym: The fitness chain filed for bankruptcy in 2020 but planned to keep hundreds of locations open.

Intelsat: The satellite operator filed for bankruptcy in 2020 but continued operations

While jobs are being filled the issue is old businesses have comeback after leaving.

Sure new business have stated

Data from the US Census Bureau shows a record-breaking 5,481,437 new businesses were started in 2023. The onset of the pandemic in 2020 has driven a surge in new business creation, so the number of new businesses is trending up. On average, there are 4.7 million businesses started every year.